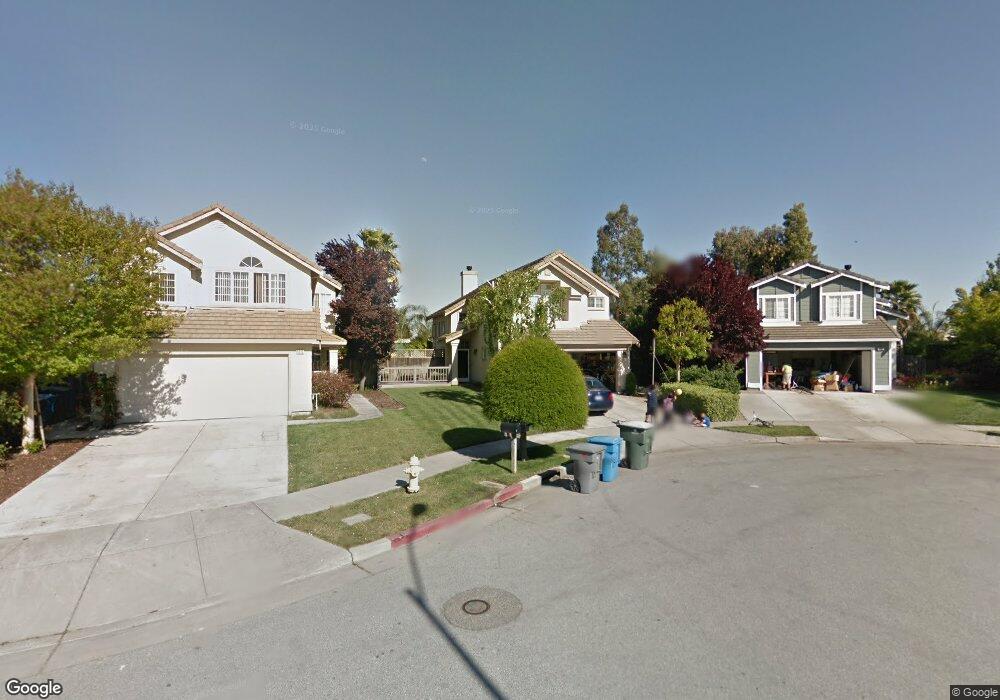

9300 Benbow Dr Gilroy, CA 95020

Las Animas NeighborhoodEstimated Value: $906,000 - $1,008,000

3

Beds

3

Baths

1,397

Sq Ft

$681/Sq Ft

Est. Value

About This Home

This home is located at 9300 Benbow Dr, Gilroy, CA 95020 and is currently estimated at $951,502, approximately $681 per square foot. 9300 Benbow Dr is a home located in Santa Clara County with nearby schools including Luigi Aprea Elementary School, Brownell Middle School, and Solorsano Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 10, 2019

Sold by

Oogjen Cory Cory and Oogjen Michelle

Bought by

Oogjen Cory William and Oogjen Michelle Kimberly

Current Estimated Value

Purchase Details

Closed on

Dec 3, 2002

Sold by

Kim Kyung Hee and Jang Jung Hee

Bought by

Oogjen Cory and Oogjen Michelle

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$312,000

Interest Rate

5.75%

Purchase Details

Closed on

Jan 16, 2001

Sold by

Meyer Anthony S and Meyer Jacquelynne A

Bought by

Kim Kyung Hee and Jang Jung Hee

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$287,000

Interest Rate

7.37%

Purchase Details

Closed on

Jan 2, 1997

Sold by

Maxxum Management Company

Bought by

Meyer Anthony S and Meyer Jacquelynne Amanda

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$216,863

Interest Rate

7.16%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Oogjen Cory William | -- | None Available | |

| Oogjen Cory | $390,000 | Chicago Title | |

| Kim Kyung Hee | $410,000 | Old Republic Title Company | |

| Meyer Anthony S | $228,500 | Golden California Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Oogjen Cory | $312,000 | |

| Previous Owner | Kim Kyung Hee | $287,000 | |

| Previous Owner | Meyer Anthony S | $216,863 | |

| Closed | Oogjen Cory | $78,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,122 | $589,346 | $246,204 | $343,142 |

| 2024 | $7,122 | $577,791 | $241,377 | $336,414 |

| 2023 | $7,079 | $566,463 | $236,645 | $329,818 |

| 2022 | $6,961 | $555,356 | $232,005 | $323,351 |

| 2021 | $6,929 | $544,467 | $227,456 | $317,011 |

| 2020 | $6,852 | $538,885 | $225,124 | $313,761 |

| 2019 | $6,787 | $528,319 | $220,710 | $307,609 |

| 2018 | $6,336 | $517,961 | $216,383 | $301,578 |

| 2017 | $6,468 | $507,806 | $212,141 | $295,665 |

| 2016 | $6,336 | $497,850 | $207,982 | $289,868 |

| 2015 | $5,977 | $490,372 | $204,858 | $285,514 |

| 2014 | $5,698 | $461,300 | $192,700 | $268,600 |

Source: Public Records

Map

Nearby Homes

- 9400 Benbow Dr

- 946 Martiri Ct

- 1165 Lerma Ln

- 803 Sunrise Dr

- 1080 Sunrise Dr

- 1320 Heritage Way

- 735 Painter Ct

- 1206 Sycamore Ct

- 1404 Casablanca Cir

- 9465 Eagle View Way

- 1437 Briarberry Ln

- 9130 Rancho Hills Dr

- 1501 Welburn Ave

- 119 Farrell Ave

- 103 Farrell Ave

- 111 Farrell Ave

- 8980 Acorn Way

- 8940 Acorn Way

- 170 Sturla Way

- 1008 Primrose Ln

- 9310 Benbow Dr

- 980 Sage Hill Dr

- 9320 Benbow Dr

- 990 Sage Hill Dr

- 9330 Benbow Dr

- 1010 Sage Hill Dr

- 995 Sage Hill Dr

- 9340 Benbow Dr

- 975 Summerhill Cir

- 1020 Sage Hill Dr

- 955 Summerhill Cir

- 985 Summerhill Cir

- 1005 Sage Hill Dr

- 9350 Benbow Dr

- 935 Summerhill Cir

- 9333 Benbow Dr

- 1040 Sage Hill Dr

- 1025 Sage Hill Dr

- 991 Woodcreek Way

- 9343 Benbow Dr

Your Personal Tour Guide

Ask me questions while you tour the home.