9322 Silverbush Dr Unit end Henrico, VA 23228

Laurel NeighborhoodEstimated Value: $296,000 - $311,000

3

Beds

3

Baths

1,376

Sq Ft

$220/Sq Ft

Est. Value

About This Home

This home is located at 9322 Silverbush Dr Unit end, Henrico, VA 23228 and is currently estimated at $302,634, approximately $219 per square foot. 9322 Silverbush Dr Unit end is a home located in Henrico County with nearby schools including Maude Trevvett Elementary School, Brookland Middle School, and Hermitage High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 20, 2018

Sold by

Gilbreath Allison P and Gilbreath Ryan E

Bought by

Draper Robert D and Houchins Aimee

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$174,600

Outstanding Balance

$151,948

Interest Rate

4.5%

Mortgage Type

New Conventional

Estimated Equity

$150,686

Purchase Details

Closed on

Jun 24, 2013

Sold by

Miller John D

Bought by

Perry Allison K and Gilbreath Ryan E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,000

Interest Rate

3.51%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 21, 2002

Sold by

Foreman Robert L

Bought by

Miller John D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,000

Interest Rate

6.57%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 3, 1997

Bought by

Foreman Robert L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,550

Interest Rate

7.36%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Draper Robert D | $180,000 | Aurora Title Llc | |

| Perry Allison K | $168,000 | -- | |

| Miller John D | $135,000 | -- | |

| Foreman Robert L | $106,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Draper Robert D | $174,600 | |

| Previous Owner | Perry Allison K | $168,000 | |

| Previous Owner | Foreman Robert L | $108,000 | |

| Previous Owner | Foreman Robert L | $108,550 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,431 | $261,000 | $57,700 | $203,300 |

| 2024 | $2,431 | $240,700 | $51,500 | $189,200 |

| 2023 | $2,046 | $240,700 | $51,500 | $189,200 |

| 2022 | $1,833 | $215,700 | $45,300 | $170,400 |

| 2021 | $1,651 | $184,700 | $40,200 | $144,500 |

| 2020 | $1,607 | $184,700 | $40,200 | $144,500 |

| 2019 | $1,573 | $180,800 | $39,100 | $141,700 |

| 2018 | $1,482 | $170,300 | $38,100 | $132,200 |

| 2017 | $1,441 | $165,600 | $37,600 | $128,000 |

| 2016 | $1,389 | $159,600 | $33,000 | $126,600 |

| 2015 | $1,315 | $159,600 | $33,000 | $126,600 |

| 2014 | $1,315 | $151,100 | $33,000 | $118,100 |

Source: Public Records

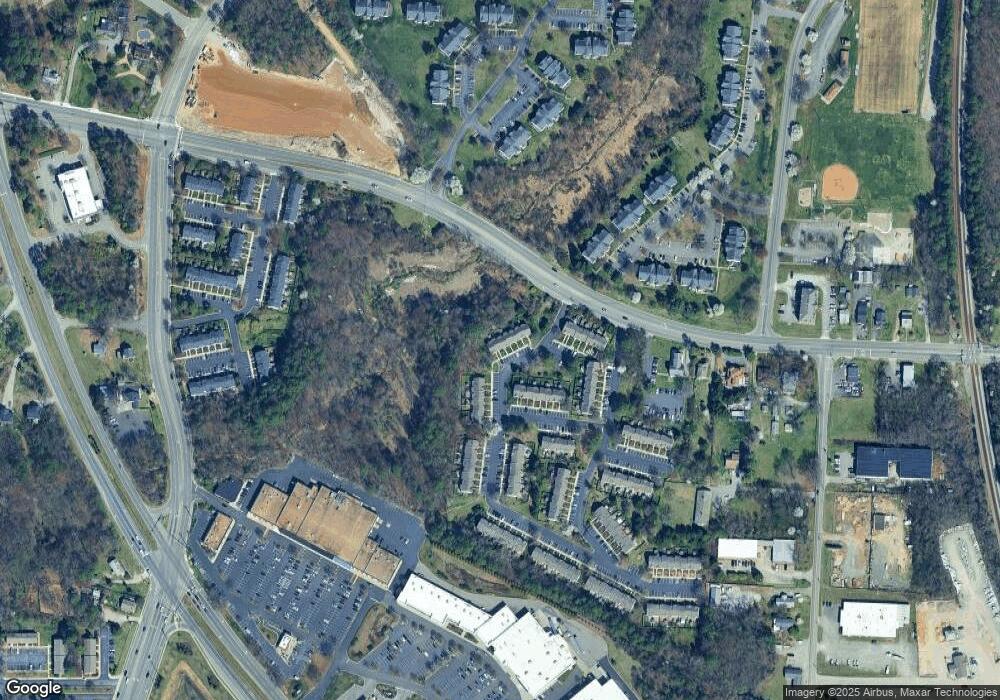

Map

Nearby Homes

- 9200 Silverbush Dr

- 10218 Wolfe Manor Ct Unit 308

- 9351 Kempton Manor Ct Unit 1905

- 8042 Lake Laurel Ln Unit B

- 9484 Tracey Lynne Cir

- 8758 Springwater Dr

- 7416 Willow Ridge Terrace

- 10011 Laurel Lakes Dr

- 2904 Sara Jean Terrace

- 9709 Drexel Ln

- 2600 Hungary Rd

- 5625 Knockadoon Ct

- 5641 Knockadoon Ct

- 10300 Attems Way

- 2707 Tanager Rd

- 7604 Portadown Ct Unit 2712

- 7604 Roscommon Ct Unit 2403

- 7701 Okeith Ct Unit 1601

- 2411 Agra Dr

- 10100 Kexby Rd

- 9320 Silverbush Dr

- 9322 Silverbush Dr

- 9322 Silverbush Dr

- 9324 Silverbush Dr

- 9324 Silverbush Dr Unit INTERIOR

- 9326 Silverbush Dr

- 9328 Silverbush Dr

- 9330 Silverbush Dr

- 9312 Silverbush Dr

- 9312 Silverbush Dr Unit end

- 9312 Silverbush Dr Unit n/a

- 9312 Silverbush Dr

- 9332 Silverbush Dr

- 9310 Silverbush Dr

- 9310 Silverbush Dr Unit 9310

- 9308 Silverbush Dr

- 9308 Silverbush Dr Unit 9308

- 3014 Forest Cove Dr

- 3012 Forest Cove Dr

- 9306 Silverbush Dr