934 Courtyard Ln Unit 15 Centerville, UT 84014

Estimated Value: $375,000 - $392,004

2

Beds

2

Baths

1,578

Sq Ft

$242/Sq Ft

Est. Value

About This Home

This home is located at 934 Courtyard Ln Unit 15, Centerville, UT 84014 and is currently estimated at $381,751, approximately $241 per square foot. 934 Courtyard Ln Unit 15 is a home located in Davis County with nearby schools including J A Taylor Elementary School, Centerville Jr High, and Viewmont High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 11, 2014

Sold by

Carter Shauna and Carter Kent Christine

Bought by

Oak And Canyon Properties Llc

Current Estimated Value

Purchase Details

Closed on

Jun 2, 2014

Sold by

Kent Richard A

Bought by

Carter Shauna and Carter Kent Christine

Purchase Details

Closed on

Apr 7, 2003

Sold by

Carter Shauna and Kent Richard A

Bought by

Carter Shauna and Kent Richard A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$124,000

Interest Rate

5.78%

Purchase Details

Closed on

Jul 28, 1999

Sold by

The Courtyard At Pages Lane Lc

Bought by

Jones Jamison C and Jones Melissa C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$116,667

Interest Rate

7.12%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Oak And Canyon Properties Llc | -- | First American Title | |

| Carter Shauna | -- | First American Title | |

| Carter Shauna | -- | First American Title Co | |

| Carter Shauna | -- | First American Title Co | |

| Jones Jamison C | -- | Merrill Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Carter Shauna | $124,000 | |

| Previous Owner | Jones Jamison C | $116,667 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,995 | $190,850 | $72,050 | $118,800 |

| 2024 | $2,018 | $196,350 | $55,000 | $141,350 |

| 2023 | $2,008 | $194,150 | $53,900 | $140,250 |

| 2022 | $2,040 | $359,000 | $96,000 | $263,000 |

| 2021 | $1,751 | $264,000 | $69,000 | $195,000 |

| 2020 | $1,545 | $233,000 | $64,500 | $168,500 |

| 2019 | $1,589 | $234,000 | $70,000 | $164,000 |

| 2018 | $1,464 | $213,000 | $70,000 | $143,000 |

| 2016 | $1,242 | $100,430 | $17,050 | $83,380 |

| 2015 | $1,161 | $88,550 | $17,050 | $71,500 |

| 2014 | $1,282 | $100,062 | $18,333 | $81,729 |

| 2013 | -- | $89,761 | $17,875 | $71,886 |

Source: Public Records

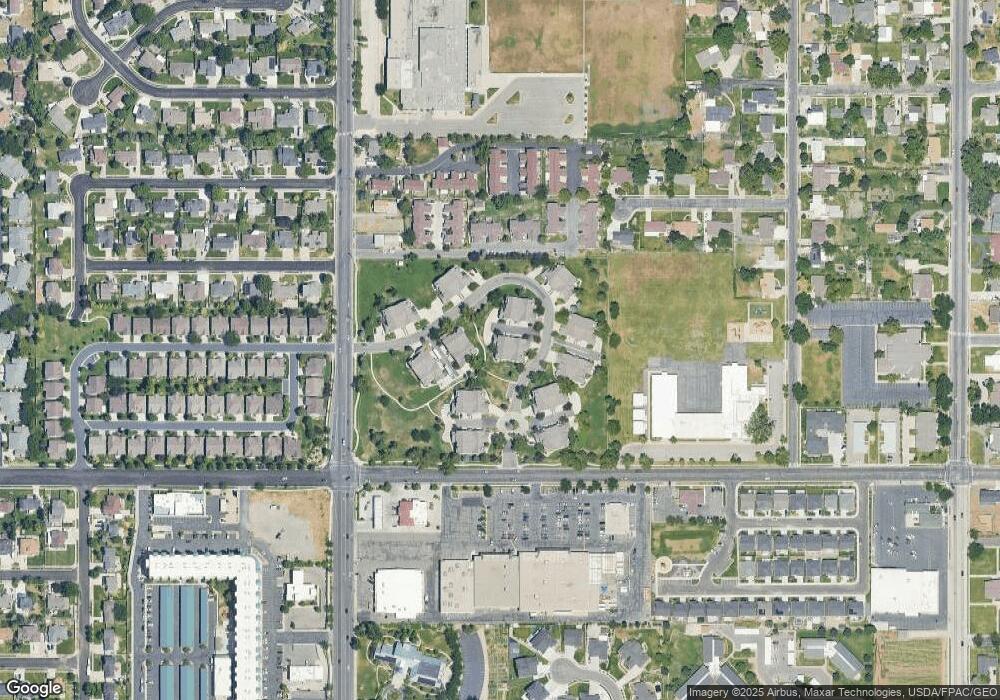

Map

Nearby Homes

- 967 S Courtyard Ln

- 96 Village Square Rd

- 951 Centerville Commons Way

- 1420 N Main St

- 345 E 600 S

- 610 E Pages Ln

- 204 Lyman Ln

- 495 E 475 S

- 1260 N 200 W

- 328 W Pages Ln

- 235 W 1400 N

- 330 W Paradiso Ln

- 88 W 50 S Unit A4

- 88 W 50 S Unit C-3

- 88 W 50 S Unit B5

- 1130 N 200 W

- 328 E 1100 S

- 610 S 800 E

- 360 E Center St

- 324 S 600 W

- 938 Courtyard Ln Unit 14

- 930 Courtyard Ln Unit 13

- 932 Courtyard Ln Unit 16

- 936 Courtyard Ln Unit 18

- 940 Courtyard Ln Unit 17

- 61 Courtyard Ln Unit 26

- 59 Courtyard Ln Unit 27

- 908 Courtyard Ln Unit 22

- 904 Courtyard Ln Unit 24

- 904 Courtyard Ln Unit 24

- 910 Courtyard Ln Unit 19

- 900 Courtyard Ln Unit 23

- 53 Courtyard Ln Unit 25

- 57 Courtyard Ln Unit 29

- 906 Courtyard Ln Unit 21

- 51 Courtyard Ln Unit 28

- 902 Courtyard Ln Unit 20

- 902 E Courtyard Ln Unit 20

- 55 Courtyard Ln Unit 30

- 962 Courtyard Ln Unit 8

Your Personal Tour Guide

Ask me questions while you tour the home.