9383 Old Post Dr Rancho Cucamonga, CA 91730

Estimated Value: $757,507 - $837,000

4

Beds

3

Baths

1,955

Sq Ft

$404/Sq Ft

Est. Value

About This Home

This home is located at 9383 Old Post Dr, Rancho Cucamonga, CA 91730 and is currently estimated at $789,127, approximately $403 per square foot. 9383 Old Post Dr is a home located in San Bernardino County with nearby schools including Ontario Center School, Rancho Cucamonga Middle, and Colony High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 10, 2020

Sold by

Chiu Ya Chi and Sung Austin Chi

Bought by

Chiu Ya Chi

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$220,000

Outstanding Balance

$195,013

Interest Rate

3.2%

Mortgage Type

New Conventional

Estimated Equity

$594,114

Purchase Details

Closed on

Jul 28, 2011

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Chiu Ya Chi

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,000

Interest Rate

4.46%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 24, 2011

Sold by

Zumer Daniel Robert

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Sep 10, 1999

Sold by

Cornerpointe 257 Llc

Bought by

Zumer Daniel Robert and Zumer Viola

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$206,720

Interest Rate

7.72%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chiu Ya Chi | -- | Stewart Title Of Ca Inc | |

| Chiu Ya Chi | $300,000 | Ticor Title | |

| Federal Home Loan Mortgage Corporation | $310,000 | Lps Default Title & Closing | |

| Zumer Daniel Robert | $218,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Chiu Ya Chi | $220,000 | |

| Closed | Chiu Ya Chi | $240,000 | |

| Previous Owner | Zumer Daniel Robert | $206,720 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,331 | $376,817 | $131,886 | $244,931 |

| 2024 | $5,331 | $369,428 | $129,300 | $240,128 |

| 2023 | $5,209 | $362,185 | $126,765 | $235,420 |

| 2022 | $5,108 | $355,083 | $124,279 | $230,804 |

| 2021 | $5,054 | $348,120 | $121,842 | $226,278 |

| 2020 | $4,966 | $344,551 | $120,593 | $223,958 |

| 2019 | $4,926 | $337,795 | $118,228 | $219,567 |

| 2018 | $4,815 | $331,172 | $115,910 | $215,262 |

| 2017 | $4,593 | $324,678 | $113,637 | $211,041 |

| 2016 | $4,528 | $318,312 | $111,409 | $206,903 |

| 2015 | $4,560 | $313,531 | $109,736 | $203,795 |

| 2014 | $4,447 | $307,389 | $107,586 | $199,803 |

Source: Public Records

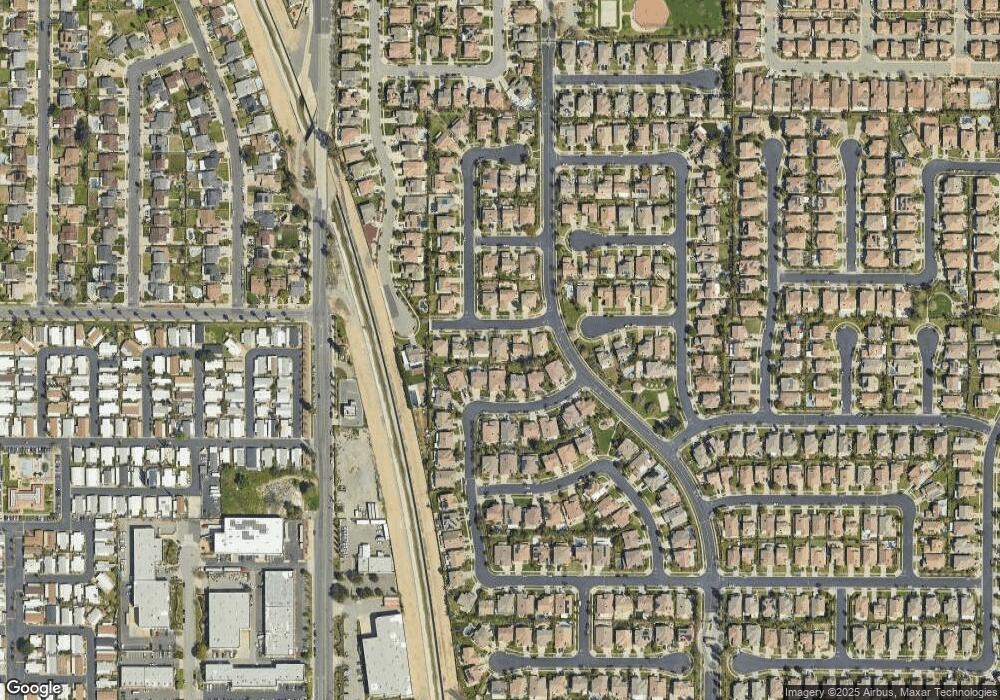

Map

Nearby Homes

- 9403 Old Post Dr

- 9523 Sunglow Ct

- 9593 Brook Dr

- 9550 Springbrook Ct

- 9330 Alderwood Dr

- 9357 Culinary Place

- 9427 Sun Meadow Ct

- 2139 E 4th St #244 St Unit 244

- 2139 E 4th St Unit 230

- 2139 E 4th St Unit 176

- 2139 E 4th St Unit 13

- 2139 E 4th St Unit 135

- 2139 E 4th St Unit 244

- 2139 E 4th St Unit 39

- 2139 E 4th St Unit 142

- 2008 E 5th St

- 1120 N Solano Privado Unit A

- 9175 Jadeite Ave

- 1360 N Placer Ave

- 2927 E Via Terrano

- 9375 Old Post Dr

- 9395 Old Post Dr

- 9384 Homestead Dr

- 9394 Homestead Dr

- 9376 Homestead Dr

- 9365 Old Post Dr

- 9406 Homestead Dr

- 9388 Old Post Dr

- 9376 Old Post Dr

- 9370 Homestead Dr

- 9398 Old Post Dr

- 9418 Homestead Dr

- 9353 Old Post Dr

- 9494 Silver Fern Place

- 9544 Heatherbrook Place

- 9379 Morning Breeze Dr

- 9389 Morning Breeze Dr

- 9387 Homestead Dr

- 9377 Homestead Dr

- 9484 Silver Fern Place