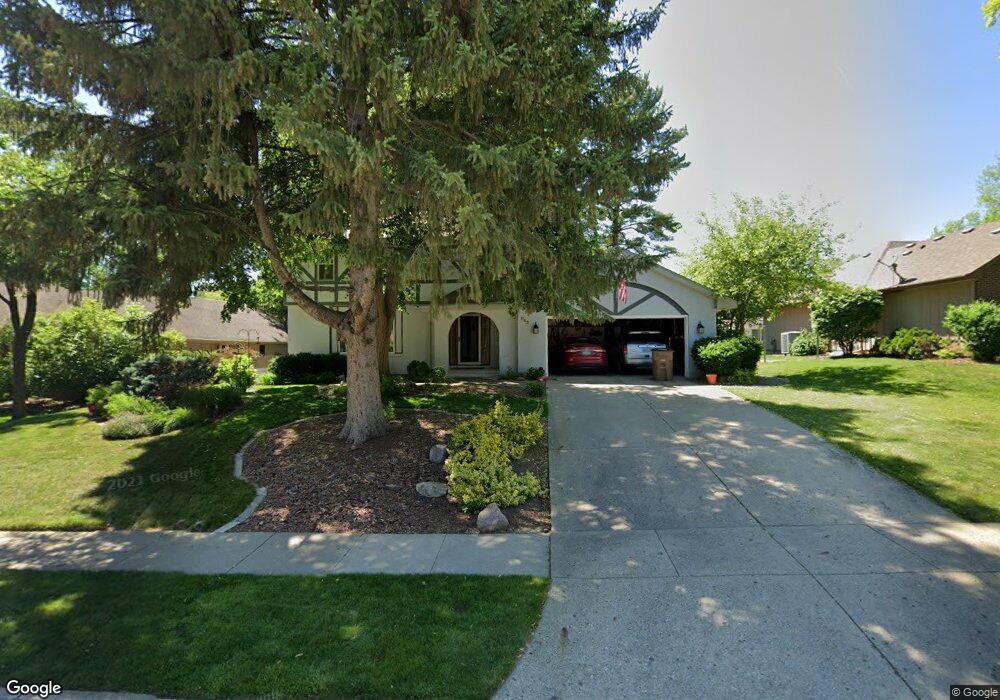

942 44th St West Des Moines, IA 50265

Estimated Value: $361,249 - $433,000

4

Beds

3

Baths

2,424

Sq Ft

$160/Sq Ft

Est. Value

About This Home

This home is located at 942 44th St, West Des Moines, IA 50265 and is currently estimated at $388,062, approximately $160 per square foot. 942 44th St is a home located in Polk County with nearby schools including Western Hills Elementary School, Stilwell Junior High School, and Valley Southwoods Freshman High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 24, 2019

Sold by

Hoye Patrick James and Baker Hoye Dianna J

Bought by

Hoye Patrick J and Baker Dianna J

Current Estimated Value

Purchase Details

Closed on

Jan 27, 2001

Sold by

Meyer Forrest T and Wurth Marilyn L

Bought by

Hoye Patrick James and Baker Hoye Dianna J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$183,780

Outstanding Balance

$67,267

Interest Rate

7.43%

Estimated Equity

$320,795

Purchase Details

Closed on

Jan 19, 1998

Sold by

Wanna Leila D

Bought by

Meyer Forrest T and Wurth Marilyn L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$156,000

Interest Rate

7.24%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hoye Patrick J | -- | None Available | |

| Hoye Patrick James | $199,500 | -- | |

| Meyer Forrest T | $194,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hoye Patrick James | $183,780 | |

| Previous Owner | Meyer Forrest T | $156,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,726 | $355,800 | $70,400 | $285,400 |

| 2024 | $4,726 | $315,600 | $61,600 | $254,000 |

| 2023 | $4,866 | $315,600 | $61,600 | $254,000 |

| 2022 | $4,808 | $260,900 | $52,600 | $208,300 |

| 2021 | $4,734 | $260,900 | $52,600 | $208,300 |

| 2020 | $4,660 | $244,700 | $49,200 | $195,500 |

| 2019 | $4,438 | $244,700 | $49,200 | $195,500 |

| 2018 | $4,444 | $225,200 | $43,800 | $181,400 |

| 2017 | $4,120 | $225,200 | $43,800 | $181,400 |

| 2016 | $4,026 | $203,400 | $38,900 | $164,500 |

| 2015 | $4,026 | $203,400 | $38,900 | $164,500 |

| 2014 | $4,318 | $221,800 | $35,800 | $186,000 |

Source: Public Records

Map

Nearby Homes

- 942 42nd St

- 4300 Pommel Place

- 4600 Aspen Dr

- 1035 Belle Mar Dr

- 1007 Marcourt Ln

- 636 47th St

- 1019 Maplenol Dr

- 4830 Cedar Dr Unit 86

- 3931 Ashworth Rd

- 4817 Westbrooke Place

- 4609 Woodland Ave Unit 5

- 909 39th St

- 1112 49th St Unit 2

- 4533 Woodland Ave Unit 2

- 4906 W Park Dr Unit J2

- 4918 W Park Dr Unit G3

- 5005 Colt Dr

- 3905 Francrest Dr

- 4549 Woodland Ave Unit 4

- 4917 Westbrooke Place