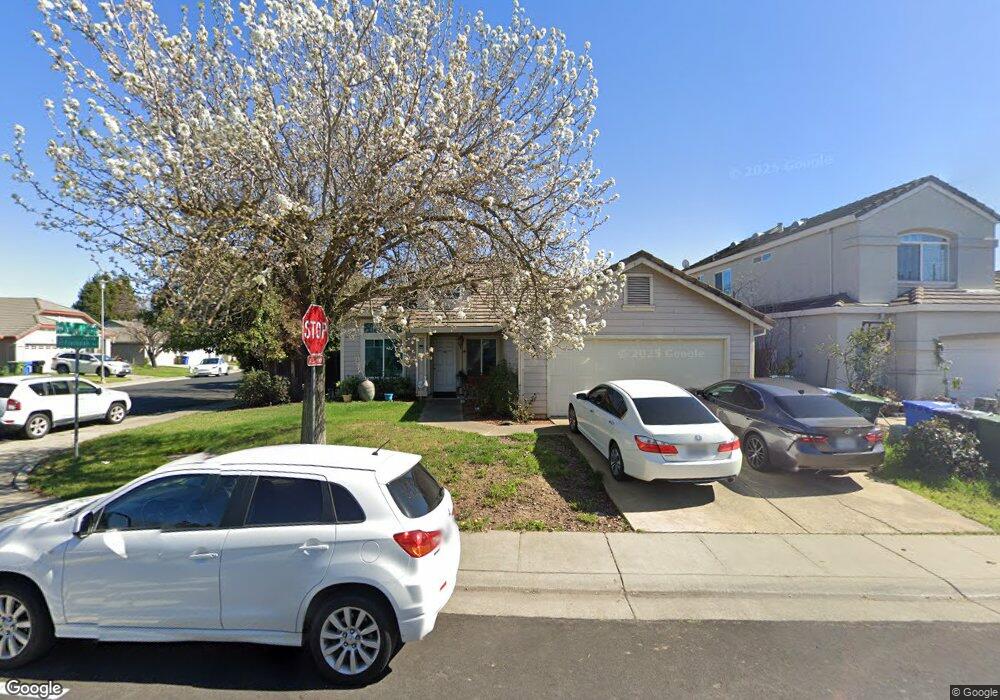

9425 Plainoak Way Elk Grove, CA 95758

North West Elk Grove NeighborhoodEstimated Value: $361,000 - $582,000

3

Beds

2

Baths

1,479

Sq Ft

$348/Sq Ft

Est. Value

About This Home

This home is located at 9425 Plainoak Way, Elk Grove, CA 95758 and is currently estimated at $514,020, approximately $347 per square foot. 9425 Plainoak Way is a home located in Sacramento County with nearby schools including Elitha Donner Elementary School, Elizabeth Pinkerton Middle School, and Cosumnes Oaks High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 6, 2001

Sold by

Townsley Margaret K

Bought by

Habal Amelia

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$193,410

Outstanding Balance

$73,674

Interest Rate

7.14%

Estimated Equity

$440,346

Purchase Details

Closed on

Feb 21, 1996

Sold by

Sarreshteh Kamran

Bought by

Townsley Margaret K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$130,281

Interest Rate

7.04%

Mortgage Type

FHA

Purchase Details

Closed on

Feb 20, 1996

Sold by

Calprop Corp

Bought by

Townsley Margaret K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$130,281

Interest Rate

7.04%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Habal Amelia | $215,000 | Alliance Title Company | |

| Townsley Margaret K | -- | North American Title Co | |

| Townsley Margaret K | $132,500 | North American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Habal Amelia | $193,410 | |

| Previous Owner | Townsley Margaret K | $130,281 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,839 | $323,795 | $75,330 | $248,465 |

| 2024 | $3,839 | $317,447 | $73,853 | $243,594 |

| 2023 | $3,740 | $311,223 | $72,405 | $238,818 |

| 2022 | $3,664 | $305,122 | $70,986 | $234,136 |

| 2021 | $3,603 | $299,141 | $69,595 | $229,546 |

| 2020 | $3,553 | $296,075 | $68,882 | $227,193 |

| 2019 | $3,486 | $290,271 | $67,532 | $222,739 |

| 2018 | $3,393 | $284,580 | $66,208 | $218,372 |

| 2017 | $3,332 | $279,001 | $64,910 | $214,091 |

| 2016 | $3,170 | $273,532 | $63,638 | $209,894 |

| 2015 | $3,113 | $269,425 | $62,683 | $206,742 |

| 2014 | $3,064 | $264,149 | $61,456 | $202,693 |

Source: Public Records

Map

Nearby Homes

- 8200 Burloak Way

- 8288 Primoak Way

- 8286 Caribou Peak Way

- 8464 Crystal Walk Cir

- 9510 Village Tree Dr

- 9578 Dominion Wood Ln

- 9550 Village Tree Dr

- 8397 Crystal Walk Cir

- 7905 Baldur Ct

- 8392 Red Fox Way

- 9357 Hoyleton Way

- 7801 Melfort Way

- 9252 Faraway Place

- 8340 La Cruz Way

- 9733 Enviro Way

- 9455 E Stockton Blvd

- 9728 Philta Way

- 9217 Trenholm Dr

- 9508 Delburns Ct

- 9713 Allen Ranch Way

- 9429 Plainoak Way

- 9433 Plainoak Way

- 8299 Primoak Way

- 8293 Primoak Way

- 9328 Village Tree Dr

- 9424 Plainoak Way

- 9324 Village Tree Dr

- 8289 Primoak Way

- 9428 Plainoak Way

- 9437 Plainoak Way

- 9432 Plainoak Way

- 9320 Village Tree Dr

- 8285 Primoak Way

- 9436 Plainoak Way

- 9441 Plainoak Way

- 9316 Village Tree Dr

- 8281 Primoak Way

- 8166 Oakbriar Cir

- 9440 Plainoak Way

- 9482 Winewood Cir