9435 Merryrest Rd Columbia, MD 21045

Oakland Mills NeighborhoodEstimated Value: $341,793 - $374,000

3

Beds

2

Baths

1,106

Sq Ft

$328/Sq Ft

Est. Value

About This Home

This home is located at 9435 Merryrest Rd, Columbia, MD 21045 and is currently estimated at $362,264, approximately $327 per square foot. 9435 Merryrest Rd is a home located in Howard County with nearby schools including Stevens Forest Elementary School, Oakland Mills Middle School, and Oakland Mills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 21, 2010

Sold by

Raphael Donald L

Bought by

Hampton Carl Elliott

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$7,070

Interest Rate

4.82%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Jul 23, 1985

Sold by

Lanier James Taylor

Bought by

Raphael Donald L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$58,500

Interest Rate

11.94%

Purchase Details

Closed on

Dec 17, 1981

Sold by

Stanko Michael Peter and Stanko Wf

Bought by

Lanier James Taylor

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$46,500

Interest Rate

16.94%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hampton Carl Elliott | $205,000 | -- | |

| Raphael Donald L | $63,500 | -- | |

| Lanier James Taylor | $57,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Hampton Carl Elliott | $7,070 | |

| Open | Hampton Carl Elliott | $209,407 | |

| Previous Owner | Raphael Donald L | $58,500 | |

| Previous Owner | Lanier James Taylor | $46,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,940 | $258,833 | $0 | $0 |

| 2024 | $3,940 | $246,167 | $0 | $0 |

| 2023 | $3,721 | $233,500 | $90,000 | $143,500 |

| 2022 | $3,522 | $222,567 | $0 | $0 |

| 2021 | $3,224 | $211,633 | $0 | $0 |

| 2020 | $3,224 | $200,700 | $75,000 | $125,700 |

| 2019 | $3,224 | $200,700 | $75,000 | $125,700 |

| 2018 | $3,014 | $200,700 | $75,000 | $125,700 |

| 2017 | $3,039 | $203,300 | $0 | $0 |

| 2016 | $627 | $195,467 | $0 | $0 |

| 2015 | $627 | $187,633 | $0 | $0 |

| 2014 | $611 | $179,800 | $0 | $0 |

Source: Public Records

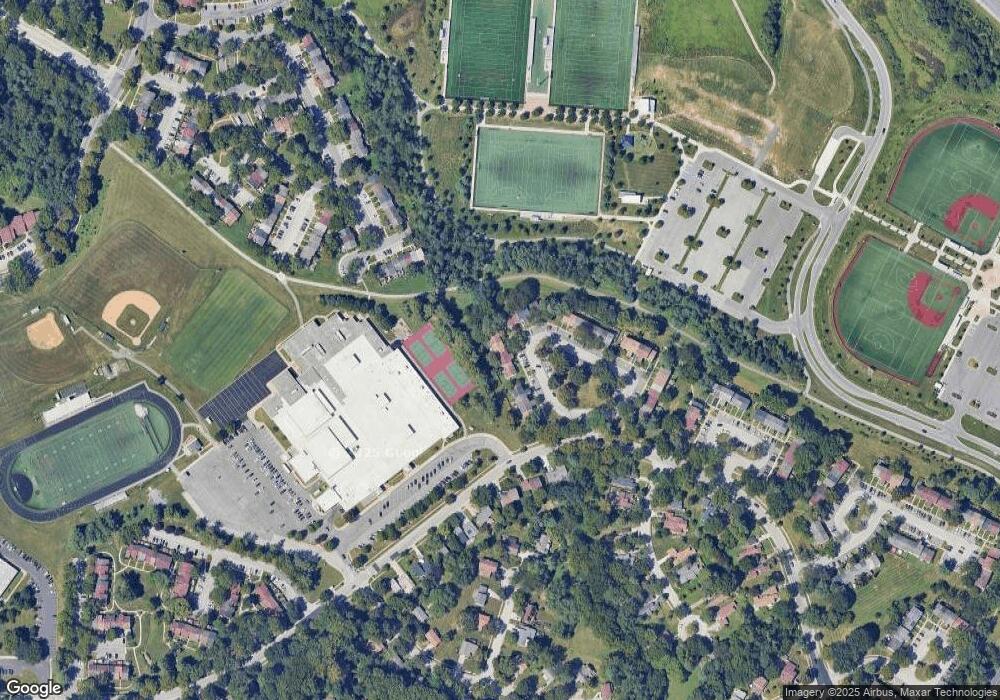

Map

Nearby Homes

- 9453 Pursuit Ct

- 5824 Humblebee Rd

- 5834 Morningbird Ln

- 9487 Timesweep Ln

- 9323 Matador Rd

- 9318 Matador Rd

- 9518 Pamplona Rd

- 9639 Whiteacre Rd Unit B1

- 9627 Whiteacre Rd Unit A1

- 9653 Whiteacre Rd Unit C2

- 9633 White Acre Rd Unit C2

- 6016 Helen Dorsey Way

- 9321 Farewell Rd

- 5645 Thunder Hill Rd

- 9222 Bellfall Ct

- 6122 Campfire

- 9593 Standon Place

- 9429 Farewell Rd

- 6171 Campfire

- 6149 Gate Sill

- 9437 Merryrest Rd

- 9433 Merryrest Rd

- 9439 Merryrest Rd

- 9427 Merryrest Rd

- 9425 Merryrest Rd

- 9441 Merryrest Rd

- 9423 Merryrest Rd

- 9443 Merryrest Rd

- 9445 Merryrest Rd

- 9421 Merryrest Rd

- 9447 Merryrest Rd

- 9419 Merryrest Rd

- 9453 Merryrest Rd

- 9415 Merryrest Rd

- 9415 Merryrest Rd Unit 1A

- 9455 Merryrest Rd

- 9411 Merryrest Rd

- 9457 Merryrest Rd

- 9407 Merryrest Rd

- 9403 Merryrest Rd