945 S Clovis Ave Unit B Fresno, CA 93727

Sunnyside NeighborhoodEstimated Value: $248,113 - $275,000

2

Beds

2

Baths

1,548

Sq Ft

$170/Sq Ft

Est. Value

About This Home

This home is located at 945 S Clovis Ave Unit B, Fresno, CA 93727 and is currently estimated at $263,778, approximately $170 per square foot. 945 S Clovis Ave Unit B is a home located in Fresno County with nearby schools including Ayer Elementary School, Elizabeth Terronez Middle School, and Sunnyside High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 7, 2021

Sold by

Wade George J and Wade George J

Bought by

Montano Fernando and Montano Georgiann Audra

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$6,000

Outstanding Balance

$5,454

Interest Rate

3.02%

Mortgage Type

New Conventional

Estimated Equity

$258,324

Purchase Details

Closed on

Mar 26, 2014

Sold by

Wade George J and Wade Barbara J

Bought by

George J Wade Jr & Barbara J Wade Living

Purchase Details

Closed on

Oct 28, 2002

Sold by

Ashworth Elaine Covert and Ashworth Robert L

Bought by

Wade George J and Wade Barbara J

Purchase Details

Closed on

Feb 25, 1997

Sold by

Ashworth Robert

Bought by

Covert Elaine

Purchase Details

Closed on

Feb 24, 1997

Sold by

Kious Peggy Gene and Kious Bradley E

Bought by

Covert Elaine

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Montano Fernando | $200,000 | Old Republic Title Company | |

| George J Wade Jr & Barbara J Wade Living | -- | None Available | |

| Wade George J | $99,000 | Chicago Title Company | |

| Covert Elaine | -- | Central Title Company | |

| Covert Elaine | $97,500 | Central Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Montano Fernando | $6,000 | |

| Open | Montano Fernando | $194,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,651 | $215,942 | $53,578 | $162,364 |

| 2023 | $2,497 | $207,559 | $51,499 | $156,060 |

| 2022 | $2,462 | $203,490 | $50,490 | $153,000 |

| 2021 | $1,636 | $131,109 | $33,442 | $97,667 |

| 2020 | $1,629 | $129,766 | $33,100 | $96,666 |

| 2019 | $1,566 | $127,222 | $32,451 | $94,771 |

| 2018 | $1,532 | $124,728 | $31,815 | $92,913 |

| 2017 | $1,506 | $122,284 | $31,192 | $91,092 |

| 2016 | $1,456 | $119,887 | $30,581 | $89,306 |

| 2015 | $1,434 | $118,087 | $30,122 | $87,965 |

| 2014 | $1,408 | $115,774 | $29,532 | $86,242 |

Source: Public Records

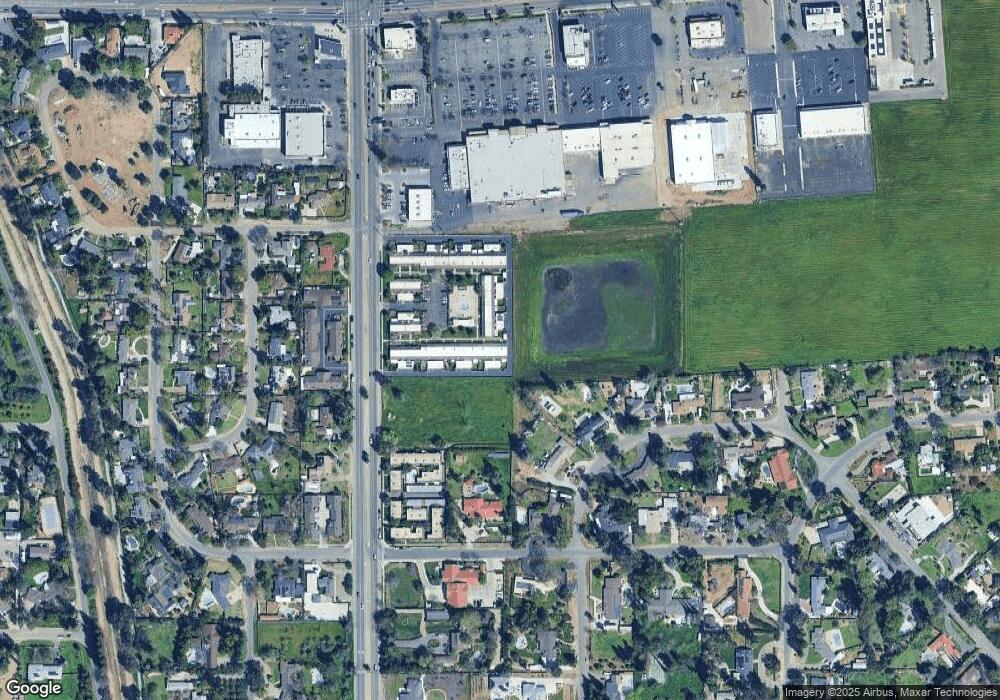

Map

Nearby Homes

- 945 S Clovis Ave Unit H

- 945 S Clovis Ave Unit V

- 935 S Park Circle Dr

- 930 S Park Circle Dr

- 1112 S Sunnyside Ave

- 5526 E Inyo St

- 5812 E Midwick Ln

- 540 S Argyle Ave Unit 101

- 5478 E Butler Ave

- 1771 S Waverly Ln

- 5431 E Liberty Ave

- 5454 E Butler Ave

- 372 S Argyle Ave Unit 102

- 350 S Argyle Ave Unit 103

- 350 S Argyle Ave Unit 101

- 925 S Purdue Ave

- 5869 E Mono St

- 833 S Stanford Ave

- 5865 E Beck Ave

- 5867 E Club View Dr

- 945 S Clovis Ave Unit K

- 945 S Clovis Ave Unit G

- 945 S Clovis Ave Unit Z

- 945 S Clovis Ave Unit Q

- 945 S Clovis Ave Unit D

- 945 S Clovis Ave Unit S

- 945 S Clovis Ave Unit A

- 945 S Clovis Ave Unit E

- 945 S Clovis Ave Unit X

- 945 S Clovis Ave Unit F

- 945 S Clovis Ave Unit Y

- 945 S Clovis Ave Unit J

- 945 S Clovis Ave Unit R

- 945 S Clovis Ave Unit L

- 945 S Clovis Ave Unit P

- 945 S Clovis Ave Unit N

- 945 S Clovis Ave Unit C

- 945 S Clovis Ave Unit U

- 945 S Clovis Ave Unit W

- 945 S Clovis Ave Unit T