9455 E Acorn Way Unit 927 Heber City, UT 84032

Timber Lakes NeighborhoodEstimated Value: $617,238 - $673,000

2

Beds

1

Bath

1,550

Sq Ft

$412/Sq Ft

Est. Value

About This Home

This home is located at 9455 E Acorn Way Unit 927, Heber City, UT 84032 and is currently estimated at $638,413, approximately $411 per square foot. 9455 E Acorn Way Unit 927 is a home located in Wasatch County with nearby schools including J.R. Smith Elementary School and Wasatch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 31, 2020

Sold by

Perry Deana F

Bought by

Perry Deana Francine and Perry Deanna Francine

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$304,000

Interest Rate

2.9%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 13, 2020

Sold by

Perry Deana Francine and Perry Deana Francine

Bought by

Schlegel Nicholas A and Schlegel Lynsey J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$304,000

Interest Rate

2.9%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 5, 2013

Sold by

Price Kristin E and Roe Karen L

Bought by

Perry Deana F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$209,183

Interest Rate

3.92%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 27, 2006

Sold by

Roe Kristin E and Roe Karen L

Bought by

Price Kristin E and Roe Karen L

Purchase Details

Closed on

Mar 27, 2006

Sold by

Roe Kristin E

Bought by

Roe Kristin E and Roe Karen L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,500

Interest Rate

6.04%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 2, 2006

Sold by

Christiansen Richard D and Christiansen Shauna K

Bought by

Roe Kristin E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,500

Interest Rate

6.04%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Perry Deana Francine | -- | None Available | |

| Schlegel Nicholas A | -- | Metro National Title | |

| Perry Deana F | -- | First American Title Co | |

| Perry Deana F | -- | First American Title Compa | |

| Price Kristin E | -- | None Available | |

| Roe Kristin E | -- | None Available | |

| Roe Kristin E | -- | Integrated Title Insurance S |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Schlegel Nicholas A | $304,000 | |

| Previous Owner | Perry Deana F | $209,183 | |

| Previous Owner | Roe Kristin E | $114,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,924 | $507,050 | $92,500 | $414,550 |

| 2024 | $4,924 | $580,640 | $140,000 | $440,640 |

| 2023 | $4,924 | $475,940 | $132,500 | $343,440 |

| 2022 | $1,159 | $224,957 | $77,597 | $147,360 |

| 2021 | $1,455 | $224,957 | $77,597 | $147,360 |

| 2020 | $1,389 | $208,460 | $61,100 | $147,360 |

| 2019 | $1,870 | $166,198 | $0 | $0 |

| 2018 | $1,870 | $166,198 | $0 | $0 |

| 2017 | $1,602 | $142,578 | $0 | $0 |

| 2016 | $1,152 | $100,519 | $0 | $0 |

| 2015 | $1,085 | $100,519 | $0 | $0 |

| 2014 | $1,008 | $90,251 | $0 | $0 |

Source: Public Records

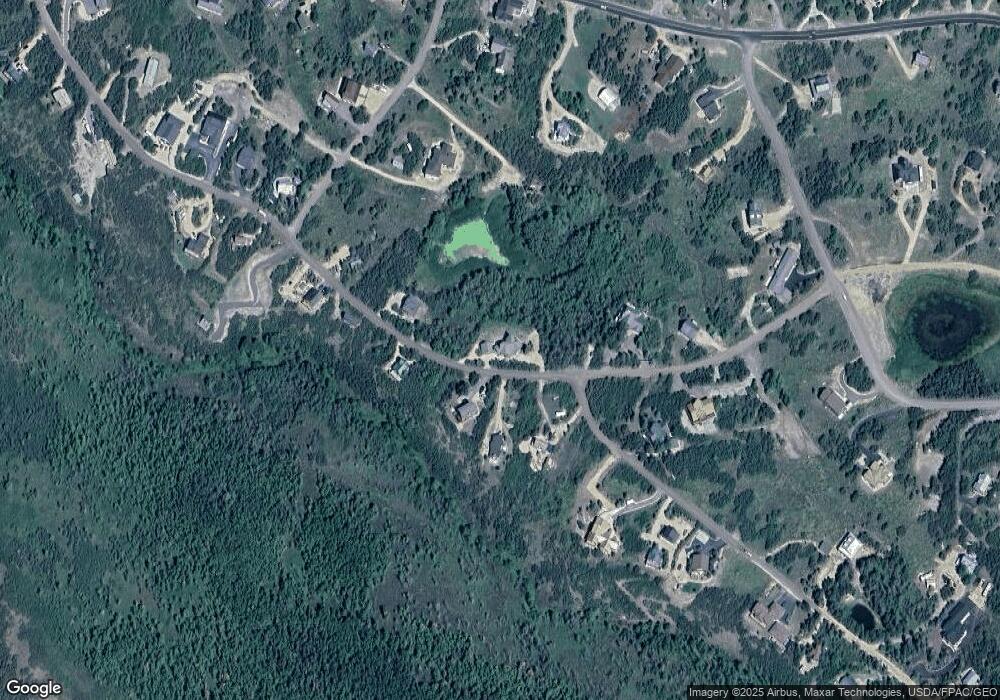

Map

Nearby Homes

- 2204 Timber Lakes Dr Unit 945

- 2230 Timber Lakes Dr Unit 944

- 9906 Lake Pines Dr Unit 1187

- 9906 Lake Pines Dr

- 9393 Deer Creek Dr Unit 970

- 1810 Timber Lakes Dr

- 1810 Timber Lakes Dr Unit 832

- 9406 E Deer Creek Dr

- 9406 E Deer Creek Dr Unit 1074

- 9048 E Acorn Way

- 9048 E Acorn Way Unit 984

- 1950 Timber Lakes Dr Unit 955

- 1950 Timber Lakes Dr

- 1813 S Greenleaf Rd Unit 341

- 1594 Tree Top Ln Unit 825

- 10385 Deer Creek Dr Unit 2

- 10385 Deer Creek Dr

- 9881 Clubhouse Rd Unit 1043

- 9881 E Clubhouse Rd

- 10088 Ridge Pine Dr Unit 1199-C

- 9455 E Acorn Way

- 1693 Timber Lakes Dr

- 2062 Timber Lakes Dr

- 2062 Timber Lakes Dr Unit 949

- 2032 S Timberlakes Dr

- 2032 S Timber Lakes Dr

- 2032 Timberlakes Dr Unit 950

- 9536 E Lake Pines Dr

- 2116 Timber Lakes Dr

- 2016 Timber Lakes Dr

- 2016 Timber Lakes Dr Unit 951

- 917 Lake Pines Dr

- 2148 S Timber Lakes Dr Unit 947

- 2002 S Timber Lakes Dr

- 2002 S Timber Lakes (Lot 952) Dr

- 2002 S Timber Lakes Dr Unit 952

- 2148 Timber Lakes Dr

- 2148 Timber Lakes Dr Unit 947

- 1051 Timber Lakes Dr