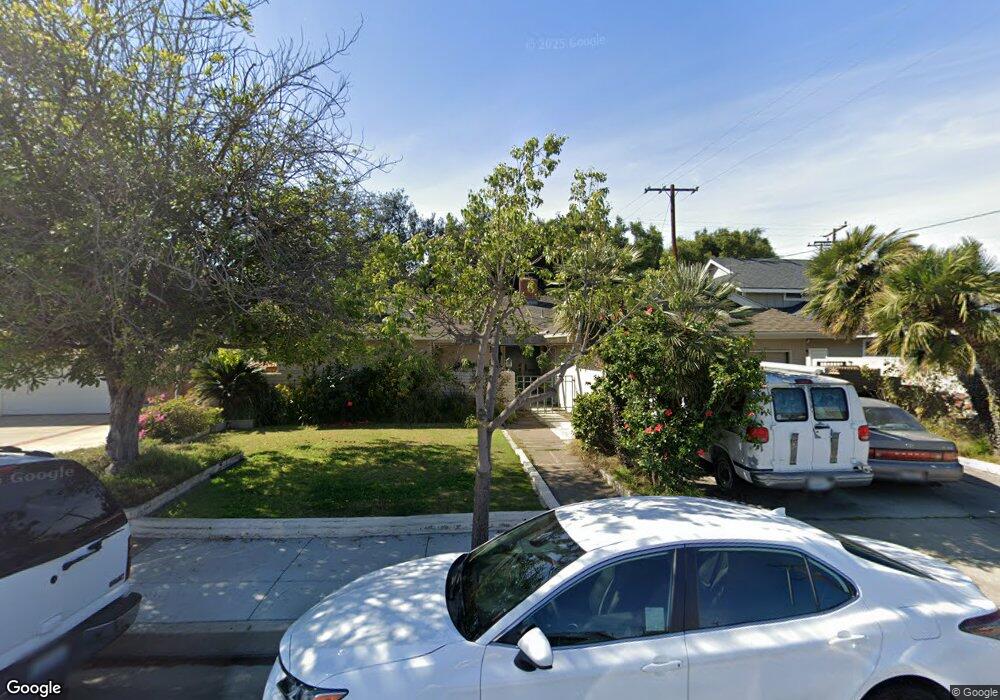

9465 Fernbury St Cypress, CA 90630

Estimated Value: $1,083,124 - $1,268,000

3

Beds

3

Baths

1,744

Sq Ft

$668/Sq Ft

Est. Value

About This Home

This home is located at 9465 Fernbury St, Cypress, CA 90630 and is currently estimated at $1,165,031, approximately $668 per square foot. 9465 Fernbury St is a home located in Orange County with nearby schools including A.E. Arnold Elementary School, Margaret Landell Elementary School, and Lexington Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 19, 2010

Sold by

Ramirez Leo and Ramirez Jennifer

Bought by

Ramirez Leo and Ramirez Jennifer A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$294,604

Outstanding Balance

$194,098

Interest Rate

4.94%

Mortgage Type

New Conventional

Estimated Equity

$970,933

Purchase Details

Closed on

Jan 31, 2003

Sold by

Walko Donald G and Walko Judith

Bought by

Ramirez Leo and Purcell Jennifer

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$322,700

Interest Rate

5.85%

Purchase Details

Closed on

Jul 16, 2002

Sold by

Walko Judith

Bought by

Walko Donald G and Walko Judith

Purchase Details

Closed on

Mar 25, 1997

Sold by

Forkos Bernice

Bought by

Forkos Bernice

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ramirez Leo | -- | Security Union Title Insuran | |

| Ramirez Leo | $420,000 | First American Title Co | |

| Walko Donald G | -- | -- | |

| Forkos Bernice | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ramirez Leo | $294,604 | |

| Closed | Ramirez Leo | $322,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,790 | $608,145 | $493,167 | $114,978 |

| 2024 | $6,790 | $596,221 | $483,497 | $112,724 |

| 2023 | $6,634 | $584,531 | $474,017 | $110,514 |

| 2022 | $6,557 | $573,070 | $464,722 | $108,348 |

| 2021 | $6,470 | $561,834 | $455,610 | $106,224 |

| 2020 | $6,445 | $556,074 | $450,939 | $105,135 |

| 2019 | $6,262 | $545,171 | $442,097 | $103,074 |

| 2018 | $6,177 | $534,482 | $433,429 | $101,053 |

| 2017 | $5,963 | $524,002 | $424,930 | $99,072 |

| 2016 | $5,912 | $513,728 | $416,598 | $97,130 |

| 2015 | $5,869 | $506,012 | $410,340 | $95,672 |

| 2014 | $5,555 | $496,100 | $402,302 | $93,798 |

Source: Public Records

Map

Nearby Homes

- 4741 Newman Ave

- 4644 Portofino Cir

- 9211 Julie Beth St

- 4819 Fieldbrook Ln

- 4615 Alekona Ct

- 4823 Fieldbrook Ln Unit 24

- 4223 Paseo de Plata

- 5000 Clementine Ln

- 7002 Citron Ln

- 4617 Alekona Ct

- 6007 Clementine Ln Unit 21

- Plan B1 at Citrus Square - Cerise

- Plan A2 at Citrus Square - Cerise

- Plan A1 at Citrus Square - Cerise

- Plan B1X at Citrus Square - Cerise

- 9080 Bloomfield Ave Unit 79

- 9080 Bloomfield Ave Unit 11

- 9080 Bloomfield Ave Unit 77

- 9080 Bloomfield Ave Unit 167

- 9080 Bloomfield Ave Unit 33

- 9455 Fernbury St

- 9475 Fernbury St

- 9445 Fernbury St

- 4641 Ashbury Ave

- 4622 Ashbury Ave

- 9456 Fernbury St

- 4588 Lemon Cir

- 4632 Ashbury Ave

- 9435 Fernbury St

- 4568 Lemon Cir

- 9446 Fernbury St

- 4661 Ashbury Ave

- 4642 Ashbury Ave

- 4558 Lemon Cir

- 9436 Fernbury St

- 4662 Ashbury Ave

- 9457 Danbury St

- 4671 Ashbury Ave

- 9447 Danbury St

- 4548 Lemon Cir