Estimated Value: $1,131,000 - $1,704,571

6

Beds

4

Baths

3,978

Sq Ft

$348/Sq Ft

Est. Value

About This Home

This home is located at 9503 S Orton Rd, Salem, UT 84653 and is currently estimated at $1,386,143, approximately $348 per square foot. 9503 S Orton Rd is a home located in Utah County with nearby schools including Salem Elementary, Valley View Middle School, and Salem Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 9, 2025

Sold by

Pqrst Trust and Jones Phyllis

Bought by

Pqrst Trust and Jones

Current Estimated Value

Purchase Details

Closed on

May 27, 2009

Sold by

Jones Phyllis and Pqrst Trust

Bought by

Jones Phyllis M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$85,000

Interest Rate

4.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 25, 1999

Sold by

Jones Phillis

Bought by

Jones Phyllis

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$89,618

Interest Rate

6.63%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pqrst Trust | -- | Utah First Title | |

| Jones Phyllis M | -- | Pro Title & Escrow Inc | |

| Jones Phyllis | -- | Pro Title & Escrow Inc | |

| Jones Phyllis M | -- | Pro Title & Escrow Inc | |

| Jones Phyllis | -- | Provo Land Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Jones Phyllis M | $85,000 | |

| Previous Owner | Jones Phyllis M | $50,000 | |

| Previous Owner | Jones Phyllis | $89,618 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,504 | $1,646,800 | $677,100 | $969,700 |

| 2024 | $10,504 | $1,050,015 | $0 | $0 |

| 2023 | $10,372 | $1,037,585 | $0 | $0 |

| 2022 | $9,416 | $1,304,900 | $687,600 | $617,300 |

| 2021 | $6,812 | $856,500 | $392,400 | $464,100 |

| 2020 | $6,533 | $804,800 | $340,700 | $464,100 |

| 2019 | $5,886 | $750,400 | $286,300 | $464,100 |

| 2018 | $5,668 | $679,900 | $276,300 | $403,600 |

| 2017 | $5,830 | $453,280 | $0 | $0 |

| 2016 | $4,702 | $354,440 | $0 | $0 |

| 2015 | $4,564 | $341,185 | $0 | $0 |

| 2014 | $4,562 | $341,185 | $0 | $0 |

Source: Public Records

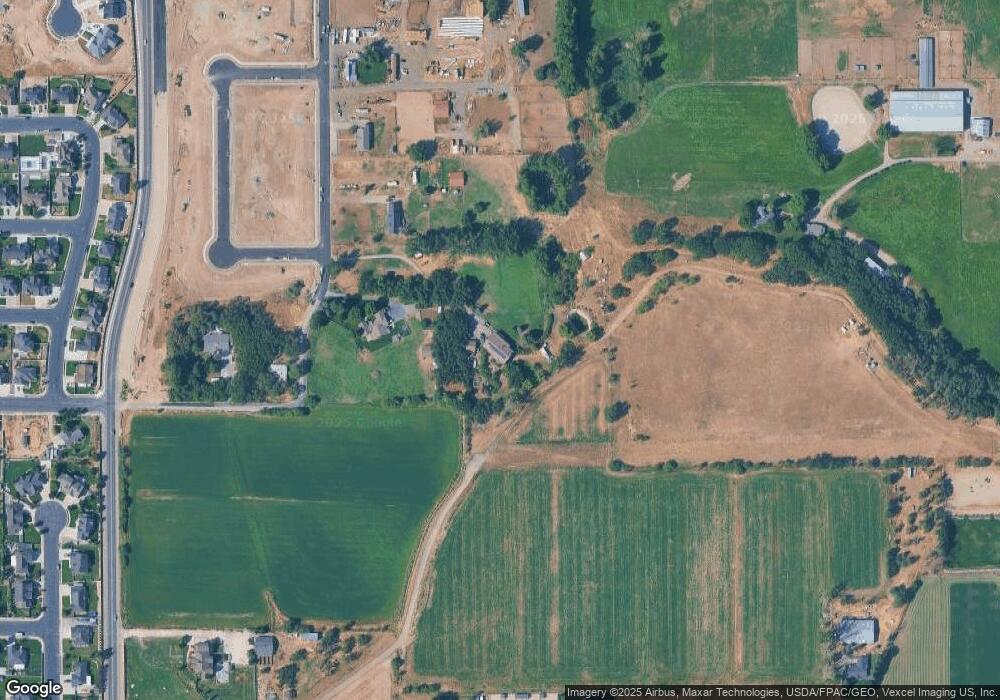

Map

Nearby Homes

- Washington Bonus Plan at Broad Hollow Estates

- Washington Plan at Broad Hollow Estates

- Graham Plan at Broad Hollow Estates

- Konlee Plan at Broad Hollow Estates

- Jenni Plan at Broad Hollow Estates

- Jamie Plan at Broad Hollow Estates

- Alydia Plan at Broad Hollow Estates

- Lyla Plan at Broad Hollow Estates

- Alexa Plan at Broad Hollow Estates

- Aaron Plan at Broad Hollow Estates

- Hailey Plan at Broad Hollow Estates

- Owen Plan at Broad Hollow Estates

- Dakota Plan at Broad Hollow Estates

- Nora Plan at Broad Hollow Estates

- Lennon Plan at Broad Hollow Estates

- Andrew Plan at Broad Hollow Estates

- Amie Plan at Broad Hollow Estates

- Jacqueline Bonus Plan at Broad Hollow Estates

- Stockton Plan at Broad Hollow Estates

- Addison Plan at Broad Hollow Estates

- 9521 S Orton Rd

- 9845 Orton Rd

- 9485 S Orton Rd Unit 36451020

- 9485 S Orton Rd Unit 36469424

- 9485 S Orton Rd Unit 36480897

- 9485 S Orton Rd Unit 36433235

- 9447 S Orton Rd

- 9447 S 50 E

- 25 E 9550 S

- 9415 S Orton Rd

- 155 E 9800 S

- 258 N 900 E Unit 19

- 244 N 900 E

- 278 N 900 E Unit 18

- 278 N 900 E

- 228 N 900 E

- 228 N 900 E Unit 21

- 212 N 900 E Unit 22

- 212 N 900 E

- 292 N 900 E Unit 17