951 Private Rd Winnetka, IL 60093

Estimated Value: $2,103,000 - $3,001,000

5

Beds

6

Baths

4,714

Sq Ft

$576/Sq Ft

Est. Value

About This Home

This home is located at 951 Private Rd, Winnetka, IL 60093 and is currently estimated at $2,714,643, approximately $575 per square foot. 951 Private Rd is a home located in Cook County with nearby schools including Hubbard Woods Elementary School, The Skokie School, and The Carleton W. Washburne School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 7, 2000

Sold by

Basse Daniel W and Basse Jean M

Bought by

Basse Jean M and Jean M Basse Trust

Current Estimated Value

Purchase Details

Closed on

Jul 16, 1996

Sold by

Eggers Thomas E and Eggers Lynn M

Bought by

Basse Daniel W and Basse Jean M

Purchase Details

Closed on

Jan 19, 1996

Sold by

Brown H Templeton and Brown Jessie Hosmer

Bought by

Eggers Thomas E and Eggers Lynn M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$900,000

Interest Rate

7.11%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Basse Jean M | -- | -- | |

| Basse Daniel W | $710,000 | Ticor Title Insurance | |

| Eggers Thomas E | $670,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Eggers Thomas E | $900,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $43,412 | $259,000 | $50,512 | $208,488 |

| 2024 | $43,412 | $190,572 | $55,563 | $135,009 |

| 2023 | $43,697 | $203,631 | $55,563 | $148,068 |

| 2022 | $43,697 | $203,631 | $55,563 | $148,068 |

| 2021 | $43,475 | $170,849 | $53,037 | $117,812 |

| 2020 | $42,841 | $170,849 | $53,037 | $117,812 |

| 2019 | $42,040 | $183,709 | $53,037 | $130,672 |

| 2018 | $41,739 | $177,452 | $45,460 | $131,992 |

| 2017 | $41,670 | $182,638 | $45,460 | $137,178 |

| 2016 | $39,883 | $182,638 | $45,460 | $137,178 |

| 2015 | $35,611 | $147,361 | $38,515 | $108,846 |

| 2014 | $39,603 | $167,066 | $38,515 | $128,551 |

| 2013 | $41,346 | $182,683 | $38,515 | $144,168 |

Source: Public Records

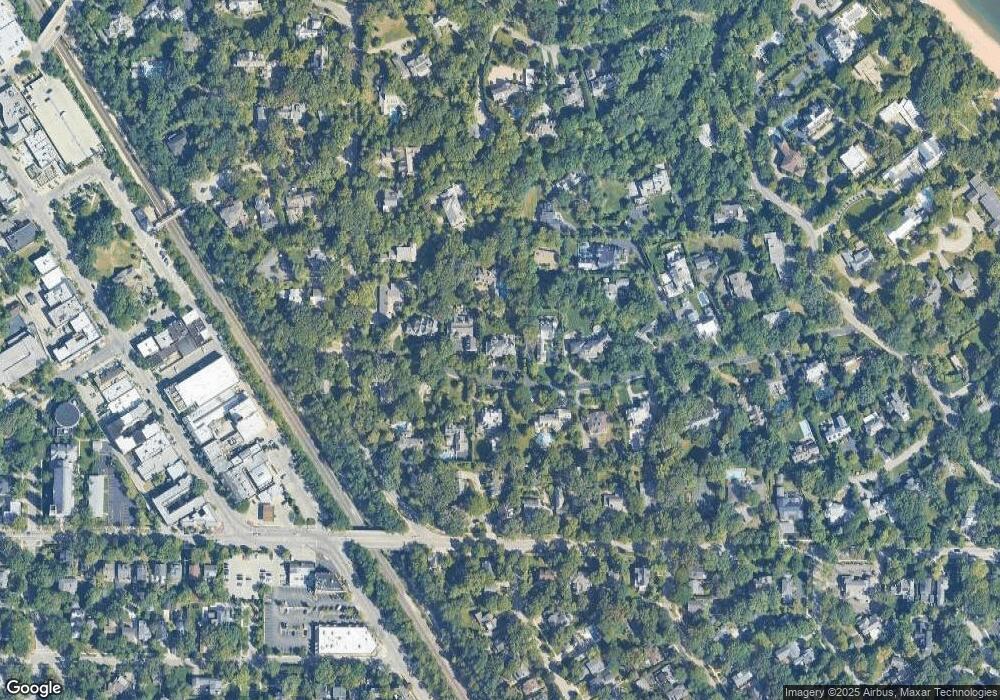

Map

Nearby Homes

- 979 Vine St

- 1070 Fisher Ln

- 1159 Chatfield Rd

- 706 Foxdale Ave

- 124 Linden Ave

- 150 Linden Ave

- 650 Winnetka Mews Unit 310

- 1311 Scott Ave

- 1333 Tower Rd

- 925 Elm St

- 265 Randolph St

- 1215 Spruce St

- 1295 Sunview Ln

- 165 Lapier St

- 916 Oak St

- 285 Vernon Ave

- 1370 Sunview Ln

- 410 Green Bay Rd

- 610 Drexel Ave

- 1492 Asbury Ave

- 945 Private Rd

- 965 Private Rd

- 953 Private Rd

- 960 Private Rd

- 940 Private Rd

- 966 Private Rd

- 935 Private Rd

- 949 Private Rd

- 975 Private Rd

- 976 Private Rd

- 920 Private Rd

- 921 Private Rd

- 945 Old Green Bay Rd

- 901 Private Rd

- 939 Tower Rd

- 959 Tower Manor Dr

- 986 Private Rd

- 933 Tower Rd

- 909 Old Green Bay Rd

- 903 Private Rd