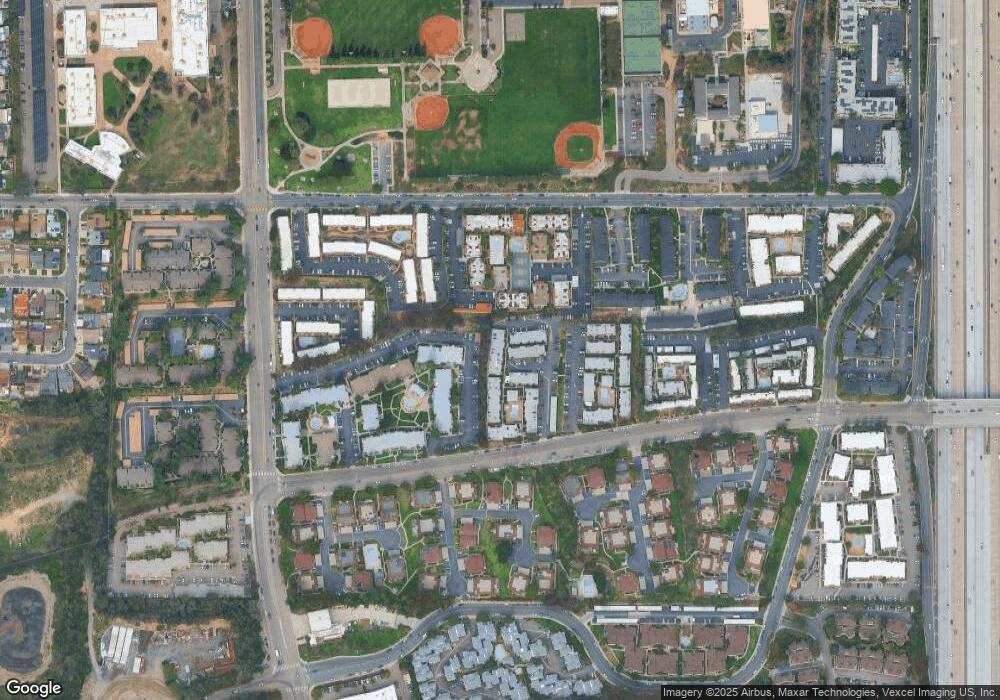

9516 Carroll Canyon Rd Unit 116 San Diego, CA 92126

Mira Mesa NeighborhoodEstimated Value: $455,000 - $500,000

2

Beds

1

Bath

838

Sq Ft

$579/Sq Ft

Est. Value

About This Home

This home is located at 9516 Carroll Canyon Rd Unit 116, San Diego, CA 92126 and is currently estimated at $485,248, approximately $579 per square foot. 9516 Carroll Canyon Rd Unit 116 is a home located in San Diego County with nearby schools including Walker Elementary School, Wangenheim Middle School, and Mira Mesa High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 19, 2014

Sold by

Hall Lincoln

Bought by

Zhuang Mark Shunrui

Current Estimated Value

Purchase Details

Closed on

Dec 8, 1998

Sold by

Wigmore Letty E

Bought by

Hall Lincoln

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$62,800

Interest Rate

2.95%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 4, 1998

Sold by

Va

Bought by

Wigmore Letty E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,300

Interest Rate

7.13%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Mar 5, 1997

Sold by

Union Planters National Bank

Bought by

Va

Purchase Details

Closed on

Feb 28, 1997

Sold by

Obrien Carol Marie

Bought by

Union Planters National Bank

Purchase Details

Closed on

Aug 31, 1990

Purchase Details

Closed on

Aug 5, 1988

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Zhuang Mark Shunrui | $210,000 | Chicago Title Company | |

| Hall Lincoln | $78,500 | Lawyers Title | |

| Wigmore Letty E | $67,000 | Lawyers Title | |

| Va | -- | Benefit Land Title Company | |

| Union Planters National Bank | $51,876 | Benefit Land Title Company | |

| -- | $71,000 | -- | |

| -- | $59,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hall Lincoln | $62,800 | |

| Previous Owner | Wigmore Letty E | $60,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,083 | $252,378 | $84,117 | $168,261 |

| 2024 | $3,083 | $247,430 | $82,468 | $164,962 |

| 2023 | $3,014 | $242,579 | $80,851 | $161,728 |

| 2022 | $2,934 | $237,823 | $79,266 | $158,557 |

| 2021 | $2,914 | $233,161 | $77,712 | $155,449 |

| 2020 | $2,879 | $230,772 | $76,916 | $153,856 |

| 2019 | $2,827 | $226,248 | $75,408 | $150,840 |

| 2018 | $2,645 | $221,813 | $73,930 | $147,883 |

| 2017 | $2,580 | $217,465 | $72,481 | $144,984 |

| 2016 | $2,539 | $213,202 | $71,060 | $142,142 |

| 2015 | $1,155 | $102,382 | $34,124 | $68,258 |

| 2014 | $1,137 | $100,377 | $33,456 | $66,921 |

Source: Public Records

Map

Nearby Homes

- 9504 Carroll Canyon Rd Unit 202

- 10249 Black Mountain Rd Unit Q3

- 10226 Black Mountain Rd Unit 78

- 10112 Caminito Volar

- 10258 Black Mountain Rd Unit 145

- 10296 Black Mountain Rd Unit 220

- 10222 Black Mountain Rd Unit 69

- 10143 Caminito Volar Unit 185

- 10026 Maya Linda Rd Unit 6101

- 10076 Maya Linda Rd Unit 1101

- 10284 Black Mountain Rd Unit 198

- 10224 Maya Linda Rd Unit 17

- 9725 Mesa Springs Way Unit 176

- 9785 Mesa Springs Way Unit 74

- 9755 Mesa Springs Way Unit 126

- 10422 Londonderry Ave

- 10582 Caminito Glenellen

- 10771 Black Mountain Rd Unit 58

- 10770 Black Mountain Rd Unit 220

- 10770 Black Mountain Rd

- 9516 Carroll Canyon Rd

- 9516 Carroll Canyon Rd Unit 211

- 9516 Carroll Canyon Rd Unit 115

- 9516 Carroll Canyon Rd Unit 114

- 9516 Carroll Canyon Rd Unit 112

- 9516 Carroll Canyon Rd Unit 111

- 9516 Carroll Canyon Rd Unit 216

- 9516 Carroll Canyon Rd Unit 215

- 9516 Carroll Canyon Rd Unit 214

- 9516 Carroll Canyon Rd Unit 213

- 9516 Carroll Canyon Rd Unit 212

- 9528 Carroll Canyon Rd

- 9528 Carroll Canyon Rd Unit 126

- 9528 Carroll Canyon Rd Unit 122

- 9528 Carroll Canyon Rd Unit 226

- 9528 Carroll Canyon Rd Unit 225

- 9528 Carroll Canyon Rd Unit 224

- 9528 Carroll Canyon Rd Unit 223

- 9528 Carroll Canyon Rd Unit 222

- 9528 Carroll Canyon Rd Unit 125