956 E 6795 S Midvale, UT 84047

Estimated Value: $450,000 - $470,001

3

Beds

3

Baths

1,544

Sq Ft

$297/Sq Ft

Est. Value

About This Home

This home is located at 956 E 6795 S, Midvale, UT 84047 and is currently estimated at $458,750, approximately $297 per square foot. 956 E 6795 S is a home located in Salt Lake County with nearby schools including Ridgecrest School, Hillcrest High School, and Midvale Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 13, 2024

Sold by

Adair Susan P

Bought by

Susan Adair Trust and Adair

Current Estimated Value

Purchase Details

Closed on

Jun 29, 2017

Sold by

Union Park Townshomes Llc

Bought by

Miller Jeff V and Jones Chelsea Rose

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$196,000

Interest Rate

4.02%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 4, 2004

Sold by

Rrk Investment Llc

Bought by

Adair Susan P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$142,580

Interest Rate

5.69%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Susan Adair Trust | -- | None Listed On Document | |

| Miller Jeff V | -- | First American Title | |

| Adair Susan P | -- | Surety Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Miller Jeff V | $196,000 | |

| Previous Owner | Adair Susan P | $142,580 | |

| Closed | Adair Susan P | $35,600 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,526 | $448,900 | $57,000 | $391,900 |

| 2024 | $2,526 | $424,300 | $53,300 | $371,000 |

| 2023 | $2,488 | $414,600 | $50,700 | $363,900 |

| 2022 | $2,593 | $424,300 | $49,700 | $374,600 |

| 2021 | $2,154 | $302,300 | $43,200 | $259,100 |

| 2020 | $2,060 | $273,700 | $38,000 | $235,700 |

| 2019 | $2,105 | $273,000 | $38,000 | $235,000 |

| 2016 | $1,826 | $224,600 | $53,000 | $171,600 |

Source: Public Records

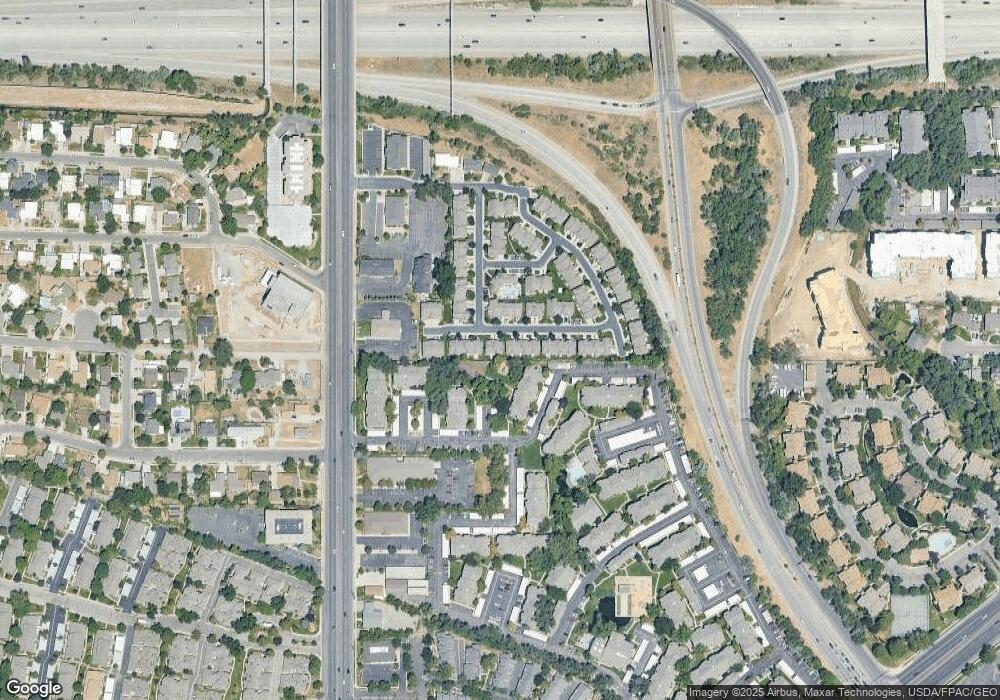

Map

Nearby Homes

- 970 Tuscan Park Ln

- 6779 S Sienna Park Ln

- 937 Essex Court Way Unit 3

- 805 E Grenoble Dr

- 6960 S 900 E

- 6948 S 855 E

- 6907 S 800 E

- 6969 S 855 E

- 6824 Creekcove Way

- 1205 E Privet Dr Unit 1-107

- 1205 Privet Dr Unit 101

- 1205 Privet Dr Unit 102

- 1180 E 6600 S Unit 3

- 1245 E Privet Dr Unit 429

- 6934 S 745 E Unit C

- 6965 S 700 E

- 761 E Gables Ln

- 6888 S 670 E Unit 16

- 734 E Bogart Ln Unit 108

- 6886 S 670 E