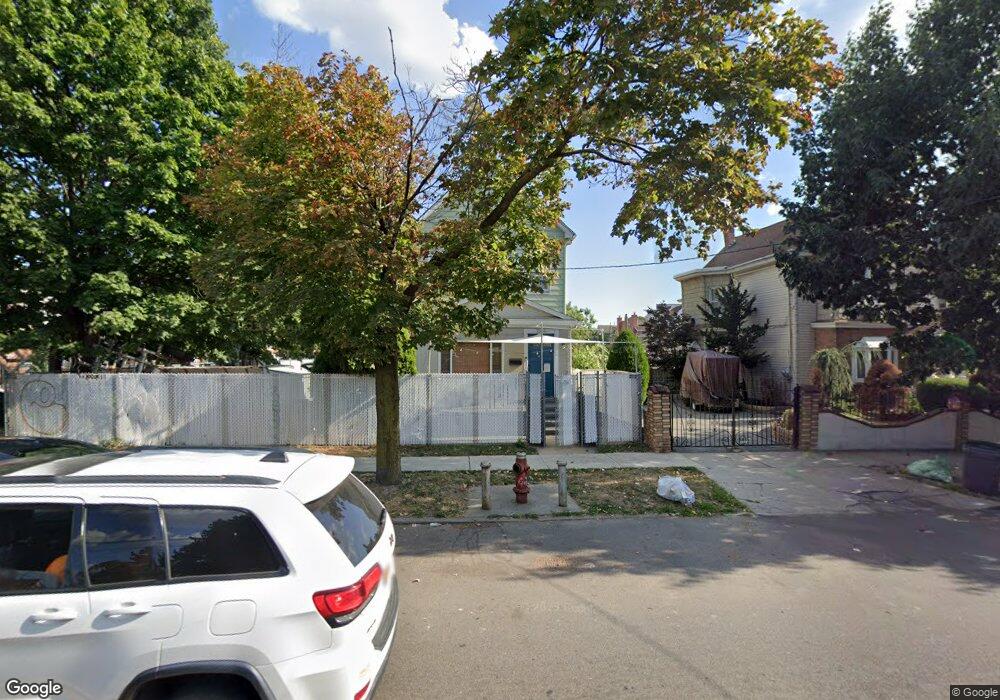

9616 103rd Ave Ozone Park, NY 11417

Ozone Park NeighborhoodEstimated Value: $761,579 - $895,000

--

Bed

--

Bath

1,324

Sq Ft

$612/Sq Ft

Est. Value

About This Home

This home is located at 9616 103rd Ave, Ozone Park, NY 11417 and is currently estimated at $809,895, approximately $611 per square foot. 9616 103rd Ave is a home located in Queens County with nearby schools including P.S. 65 - The Raymond York Elementary School, Robert H. Goddard High School, and Divine Mercy Catholic Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 1, 2013

Sold by

Cuevas Robert

Bought by

Pramanand Diana and Pramanand Narendranauth

Current Estimated Value

Purchase Details

Closed on

Apr 30, 2001

Sold by

Khan Shenaz and Roopchan Chaterau

Bought by

Cuevas Robert and Abud-Cuevas Ramona

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$304,000

Interest Rate

7.03%

Purchase Details

Closed on

Jul 28, 2000

Sold by

Guiliano Angelo and Guiliano Joseph

Bought by

Khan Shenaz and Roopchan Chateram

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$186,300

Interest Rate

8.16%

Purchase Details

Closed on

Jan 22, 1999

Sold by

Commisso Lena

Bought by

Guiliano Angelo and Guiliano Joseph

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pramanand Diana | $505,000 | -- | |

| Cuevas Robert | -- | -- | |

| Khan Shenaz | $207,000 | Regal Title | |

| Guiliano Angelo | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Cuevas Robert | $304,000 | |

| Previous Owner | Khan Shenaz | $186,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,454 | $34,058 | $12,462 | $21,596 |

| 2024 | $6,454 | $32,131 | $11,443 | $20,688 |

| 2023 | $6,088 | $30,313 | $11,706 | $18,607 |

| 2022 | $5,709 | $49,440 | $18,420 | $31,020 |

| 2021 | $6,018 | $43,980 | $18,420 | $25,560 |

| 2020 | $6,008 | $43,140 | $18,420 | $24,720 |

| 2019 | $5,488 | $42,360 | $18,420 | $23,940 |

| 2018 | $5,149 | $25,261 | $13,302 | $11,959 |

| 2017 | $4,858 | $23,832 | $13,599 | $10,233 |

| 2016 | $4,764 | $23,832 | $13,599 | $10,233 |

| 2015 | -- | $23,652 | $11,381 | $12,271 |

| 2014 | -- | $22,314 | $12,895 | $9,419 |

Source: Public Records

Map

Nearby Homes

- 103-47 96th St

- 103-48 96th St

- 10333 Woodhaven Blvd

- 101-46 95th St

- 10330 102nd St

- 93-18 103rd Ave

- 103-50 102nd St

- 101-14 95th St

- 106-38 95th St

- 103-37 102nd St

- 10154 102nd St

- 92-17 Liberty Ave

- 103-18 103rd St

- 10719 96th St

- 92-18 Liberty Ave

- 103-58 103rd St

- 10370 103rd St

- 10723 96th St

- 100-08 101st Ave

- 10152 103rd St

- 9612 103rd Ave

- 10312 97th St

- 9610 103rd Ave

- 103-12 97th St

- 9610 103rd Ave

- 9610 103rd Ave Unit 2

- 97-18 103rd Ave Unit 2

- 10314 97th St

- 10305 97th St

- 9608 103rd Ave

- 9608 103rd Ave

- 10303 97th St

- 9608 103rd Ave

- 10307 97th St

- 103-5 97th St

- 103-7 97th St

- 10316 97th St

- 10311 96th St

- 9706 103rd Ave

- 10311 97th St