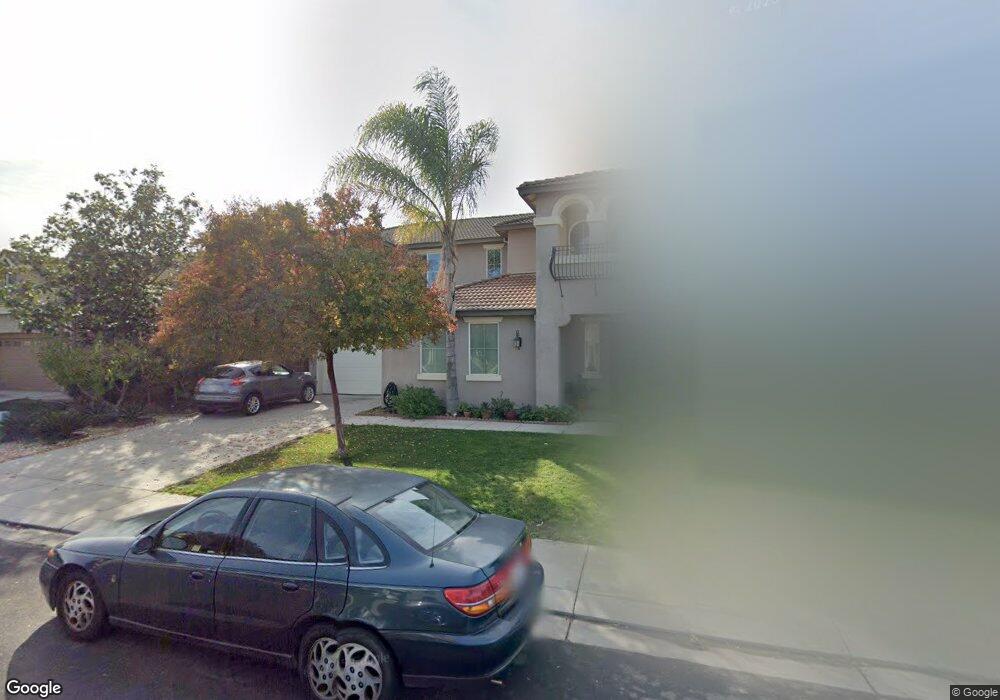

967 Alfonso Ln Manteca, CA 95336

Estimated Value: $637,902 - $727,000

5

Beds

3

Baths

2,639

Sq Ft

$264/Sq Ft

Est. Value

About This Home

This home is located at 967 Alfonso Ln, Manteca, CA 95336 and is currently estimated at $695,476, approximately $263 per square foot. 967 Alfonso Ln is a home located in San Joaquin County with nearby schools including Joshua Cowell Elementary School, Manteca High School, and St. Anthony's Catholic School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 2, 2009

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Torres Juan and Torres Maria

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$245,471

Outstanding Balance

$159,039

Interest Rate

4.77%

Mortgage Type

FHA

Estimated Equity

$536,437

Purchase Details

Closed on

Jun 29, 2009

Sold by

Carbajal Loreta M

Bought by

Federal Home Loan Mortgage Corporation

Purchase Details

Closed on

Aug 16, 2006

Sold by

Western Pacific Housing Inc

Bought by

Carbajal Loreta M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$370,850

Interest Rate

6.36%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Torres Juan | $250,000 | Ticor Title Redlands | |

| Federal Home Loan Mortgage Corporation | $198,489 | Accommodation | |

| Carbajal Loreta M | $464,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Torres Juan | $245,471 | |

| Previous Owner | Carbajal Loreta M | $370,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,260 | $322,687 | $80,025 | $242,662 |

| 2024 | $5,160 | $316,360 | $78,456 | $237,904 |

| 2023 | $5,117 | $310,158 | $76,918 | $233,240 |

| 2022 | $5,065 | $304,077 | $75,410 | $228,667 |

| 2021 | $5,006 | $298,116 | $73,932 | $224,184 |

| 2020 | $4,852 | $295,060 | $73,174 | $221,886 |

| 2019 | $4,789 | $289,276 | $71,740 | $217,536 |

| 2018 | $4,707 | $283,605 | $70,334 | $213,271 |

| 2017 | $4,611 | $278,045 | $68,955 | $209,090 |

| 2016 | $4,567 | $272,595 | $67,604 | $204,991 |

| 2014 | $4,244 | $263,245 | $65,285 | $197,960 |

Source: Public Records

Map

Nearby Homes

- 1003 Alfonso Ln

- 1015 Lucio St

- 1023 Marsh Creek Ln

- 1129 E Alameda St

- 1527 Deerpark Dr

- 521 Emperor Ct

- 938 Buttercup Place

- 1560 Snapdragon Way

- Residence 3 Plan at Dawn at The Collective 55+

- 1292 Laurel Dr

- 1526 Brookside Dr

- 1073 Spring Meadow Dr

- 1361 Marceline Dr

- 743 Larkmont St

- Residence 1 Plan at Origin at The Collective 55+

- Residence 2 Plan at Origin at The Collective 55+

- 1110 Aldwina Ln

- 338 Cottage Ave

- 1849 Holly Oak Ct

- 762 Conrad St