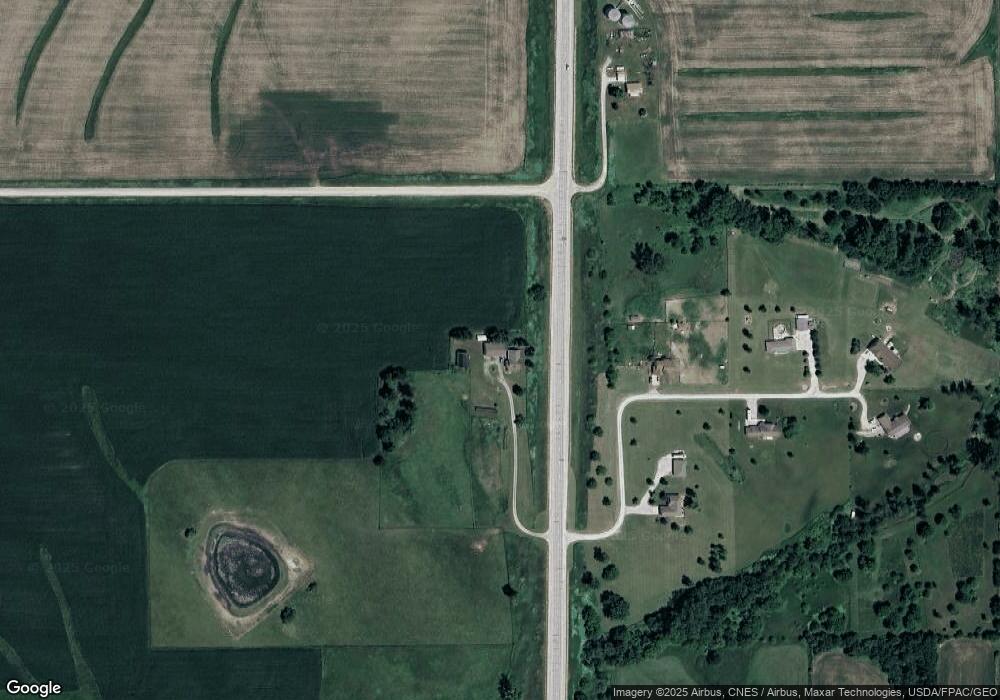

9676 Highway 14 S Monroe, IA 50170

Estimated Value: $240,000 - $447,000

2

Beds

2

Baths

1,231

Sq Ft

$293/Sq Ft

Est. Value

About This Home

This home is located at 9676 Highway 14 S, Monroe, IA 50170 and is currently estimated at $360,088, approximately $292 per square foot. 9676 Highway 14 S is a home located in Jasper County with nearby schools including PCM High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 3, 2017

Sold by

Mardesen Matthew T and Mardesen Joni L

Bought by

Vanzee Sharon L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$224,800

Outstanding Balance

$188,372

Interest Rate

3.85%

Mortgage Type

New Conventional

Estimated Equity

$171,716

Purchase Details

Closed on

Nov 20, 2012

Sold by

Lautenbach C John and Lautenbach Esther L

Bought by

Mardesen Mattew T and Mardesen Joni L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$98,800

Interest Rate

3.37%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 3, 2009

Sold by

Dille Ronald Lee

Bought by

Dille Kenda Kay

Purchase Details

Closed on

Jun 13, 2006

Sold by

Thomas Alan S and Thomas Terri A

Bought by

Dille Ronald L and Dille Kenda Kay

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$117,000

Interest Rate

9.6%

Mortgage Type

Adjustable Rate Mortgage/ARM

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vanzee Sharon L | $281,000 | None Available | |

| Mardesen Mattew T | $104,000 | None Available | |

| Dille Kenda Kay | -- | None Available | |

| Dille Ronald L | $130,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vanzee Sharon L | $224,800 | |

| Previous Owner | Mardesen Mattew T | $98,800 | |

| Previous Owner | Dille Ronald L | $117,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,106 | $397,380 | $85,600 | $311,780 |

| 2024 | $4,106 | $342,310 | $64,080 | $278,230 |

| 2023 | $3,986 | $342,310 | $64,080 | $278,230 |

| 2022 | $3,472 | $283,110 | $64,080 | $219,030 |

| 2021 | $3,576 | $255,000 | $64,080 | $190,920 |

| 2020 | $3,576 | $229,980 | $48,760 | $181,220 |

| 2019 | $2,978 | $177,970 | $0 | $0 |

| 2018 | $2,978 | $151,720 | $0 | $0 |

| 2017 | $2,192 | $130,260 | $0 | $0 |

| 2016 | $2,192 | $130,260 | $0 | $0 |

| 2015 | $2,056 | $108,460 | $0 | $0 |

| 2014 | $1,640 | $94,910 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 601 N Commerce St

- 213 W Lincoln St

- 307 E Lincoln St

- 411 N Virginia St

- 413 N Buchanan St

- 410 E Washington St

- 6719 S 104th Ave W

- 701 W Washington St

- 301 W Sherman St

- 606 W South St

- 11950 W 8th St S

- 734 Taylor St

- 730 Taylor St

- 728 Taylor St

- 726 Taylor St

- 724 Taylor St

- 722 Taylor St

- 720 Taylor St

- 718 Taylor St

- 716 Taylor St

- 9676 Highway 14 S

- 9556 Highway 14 S

- 9556 Highway 14 S

- 9752 Highway 14 S Unit 60

- 9752 Highway 14 S

- 9752 Highway 14 S Unit 20

- 9752 Highway 14 S Unit 50

- 9752 Highway 14 S Unit 30

- 9752 Highway 14 S Unit 10

- 9901 Highway 14 S

- 9976 Highway 14 S

- 9305 Highway 14 S

- 3167 Highway F62 W

- 9103 Iowa 14

- 10253 Highway 14 S

- 9103 Highway 14 S

- 2825 Highway F62 W

- 2936 Highway F62 W

- 9875 W 24th St S

- 2713 Highway F62 W