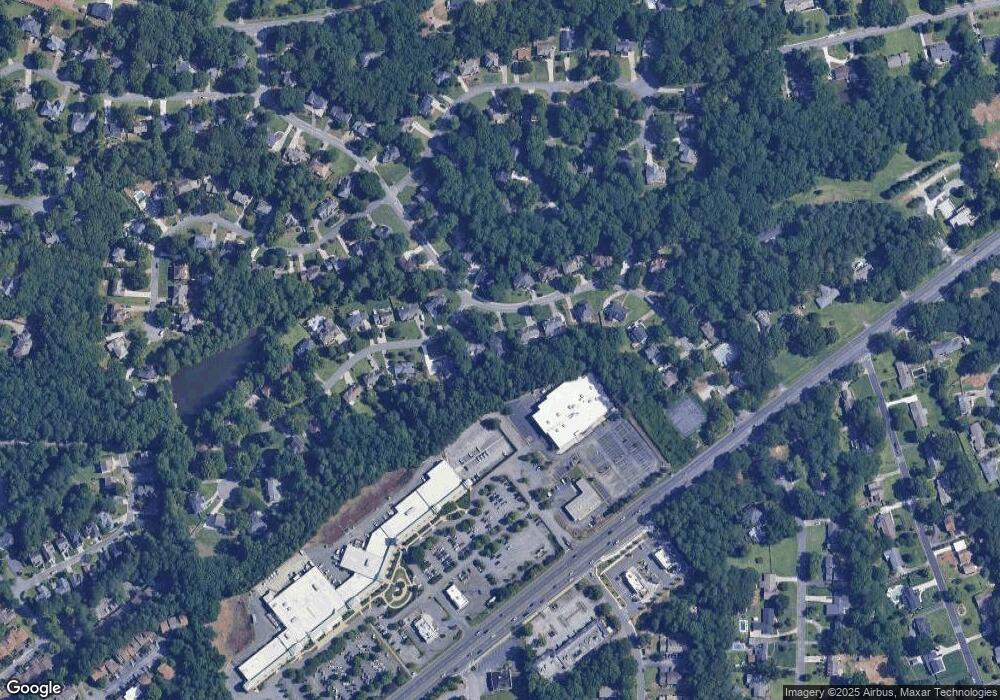

981 Laurel Springs Ln SW Unit 2 Marietta, GA 30064

Southwestern Marietta NeighborhoodEstimated Value: $419,000 - $476,000

4

Beds

2

Baths

3,076

Sq Ft

$145/Sq Ft

Est. Value

About This Home

This home is located at 981 Laurel Springs Ln SW Unit 2, Marietta, GA 30064 and is currently estimated at $446,942, approximately $145 per square foot. 981 Laurel Springs Ln SW Unit 2 is a home located in Cobb County with nearby schools including Hickory Hills Elementary School, Marietta Sixth Grade Academy, and Marietta Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 9, 2017

Sold by

Not Provided

Bought by

Srp Sub Llc

Current Estimated Value

Purchase Details

Closed on

May 7, 2014

Sold by

Secretary Of Housing And U

Bought by

Beauly Llc

Purchase Details

Closed on

Nov 5, 2013

Sold by

Suntrust Mtg Inc

Bought by

Secretary Of Housing And Urban and Conn C O Michaelson

Purchase Details

Closed on

Jul 9, 2008

Sold by

Michaud Jason A

Bought by

Hatchett Ronald

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$252,019

Interest Rate

6.43%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 21, 2002

Sold by

Faglior Harvey L

Bought by

Michaud Jason A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$202,500

Interest Rate

9.75%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Srp Sub Llc | -- | -- | |

| Beauly Llc | $172,300 | -- | |

| Secretary Of Housing And Urban | $262,620 | -- | |

| Suntrust Mtg Inc | $262,620 | -- | |

| Hatchett Ronald | $256,000 | -- | |

| Michaud Jason A | $225,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hatchett Ronald | $252,019 | |

| Previous Owner | Michaud Jason A | $202,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,421 | $168,012 | $52,000 | $116,012 |

| 2024 | $1,421 | $168,012 | $52,000 | $116,012 |

| 2023 | $1,375 | $162,560 | $40,000 | $122,560 |

| 2022 | $1,017 | $120,160 | $32,000 | $88,160 |

| 2021 | $1,032 | $120,160 | $32,000 | $88,160 |

| 2020 | $984 | $114,544 | $32,000 | $82,544 |

| 2019 | $984 | $114,544 | $32,000 | $82,544 |

| 2018 | $820 | $95,452 | $28,000 | $67,452 |

| 2017 | $658 | $95,452 | $28,000 | $67,452 |

| 2016 | $475 | $68,896 | $16,856 | $52,040 |

| 2015 | $517 | $68,896 | $16,856 | $52,040 |

| 2014 | $608 | $78,500 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 644 Laurel Wood Dr SW

- 959 Laurel Springs Ln SW

- 852 Hickory Dr SW

- 1038 Arden Dr SW

- 994 Powder Springs St

- 952 Laurel Springs Ln SW

- 651 Chestnut Hill Rd SW

- 840 Hickory Dr SW

- 836 Lake Hollow Blvd SW Unit 38

- 766 Reeves Lake Dr SW

- 893 Lake Hollow Blvd SW

- 841 Lake Hollow Blvd SW Unit 9

- 803 Chestnut Hill Rd SW

- 730 Reeves Lake Dr SW

- 1230 Arden Dr SW

- 963 Bolingbrook Dr SW

- 701 Springhollow Ln SW

- 745 Cedar Pointe Ct SW

- 981 Laurel Springs Ln SW Unit 981

- 981 Laurel Springs Ln SW

- 981 Laurel Springs Ln SW

- 705 Laurel Chase SW

- 987 Laurel Springs Ln SW Unit 2

- 980 Laurel Springs Ln SW

- 984 Laurel Springs Ln SW

- 700 Laurel Chase SW Unit 2

- 0 Laurel Springs Ln SW Unit 7398350

- 0 Laurel Springs Ln SW Unit 7240540

- 0 Laurel Springs Ln SW Unit 7156627

- 0 Laurel Springs Ln SW Unit 3277273

- 0 Laurel Springs Ln SW Unit 3283980

- 991 Laurel Springs Ln SW

- 986 Laurel Springs Ln SW Unit 2

- 707 Laurel Chase SW

- 978 Laurel Springs Ln SW

- 704 Laurel Chase SW

- 973 Laurel Springs Ln SW

- 990 Laurel Springs Ln SW Unit II