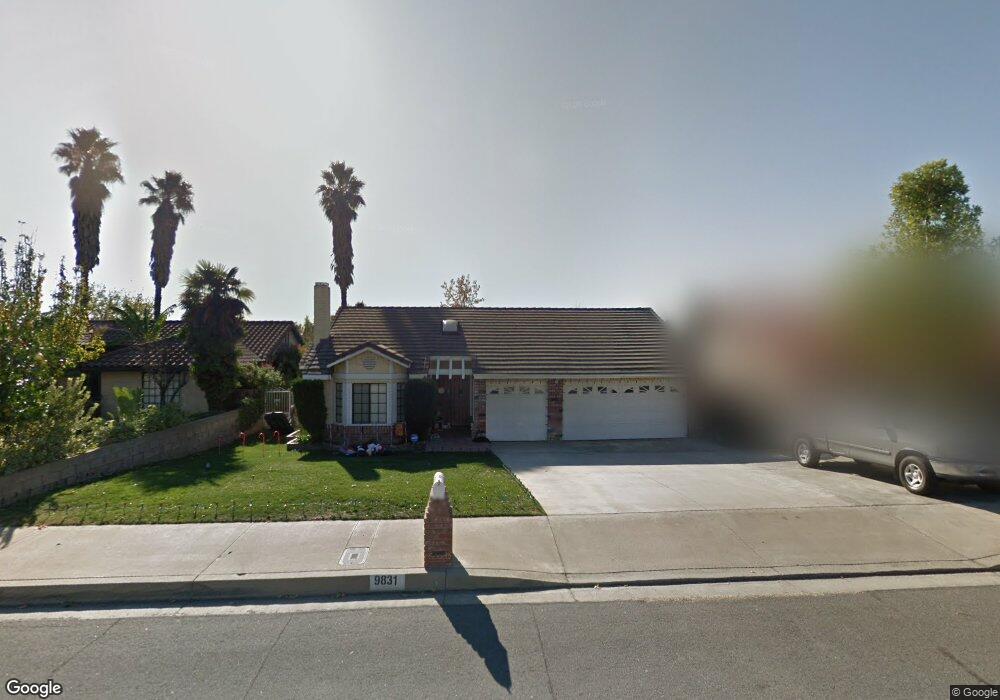

9831 Golden Arrow Ln Rancho Cucamonga, CA 91701

Estimated Value: $718,000 - $775,543

3

Beds

2

Baths

1,361

Sq Ft

$546/Sq Ft

Est. Value

About This Home

This home is located at 9831 Golden Arrow Ln, Rancho Cucamonga, CA 91701 and is currently estimated at $743,136, approximately $546 per square foot. 9831 Golden Arrow Ln is a home located in San Bernardino County with nearby schools including Alta Loma Elementary, Alta Loma Junior High, and Alta Loma High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 10, 1999

Sold by

Albrecht Julie C

Bought by

Besnyl Glenn and Besnyl Jolene

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,000

Outstanding Balance

$40,263

Interest Rate

7.66%

Estimated Equity

$702,873

Purchase Details

Closed on

May 25, 1994

Sold by

Hurtado John Raymond and Hurtado Dana Louise

Bought by

Albrecht Julie C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,000

Interest Rate

4.9%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Besnyl Glenn | $175,000 | Chicago Title Co | |

| Albrecht Julie C | $160,000 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Besnyl Glenn | $140,000 | |

| Previous Owner | Albrecht Julie C | $128,000 | |

| Closed | Besnyl Glenn | $35,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,013 | $268,976 | $67,245 | $201,731 |

| 2024 | $3,013 | $263,701 | $65,926 | $197,775 |

| 2023 | $2,947 | $258,530 | $64,633 | $193,897 |

| 2022 | $2,939 | $253,461 | $63,366 | $190,095 |

| 2021 | $2,936 | $248,492 | $62,124 | $186,368 |

| 2020 | $2,822 | $245,944 | $61,487 | $184,457 |

| 2019 | $2,850 | $241,121 | $60,281 | $180,840 |

| 2018 | $2,789 | $236,393 | $59,099 | $177,294 |

| 2017 | $2,668 | $231,758 | $57,940 | $173,818 |

| 2016 | $2,599 | $227,214 | $56,804 | $170,410 |

| 2015 | $2,582 | $223,801 | $55,951 | $167,850 |

| 2014 | $2,512 | $219,417 | $54,855 | $164,562 |

Source: Public Records

Map

Nearby Homes

- 6949 Laguna Place Unit B1

- 7018 Princeton Place

- 6931 Berkshire Ave

- 6946 Archibald Ave

- 6880 Archibald Ave Unit 114

- 6880 Archibald Ave Unit 27

- 6880 Archibald Ave Unit 40

- 9740 Woodleaf Dr

- 6740 London Ave

- 9800 Baseline Rd Unit 76

- 9800 Baseline Rd Unit 71

- 9800 Baseline Rd Unit 62

- 6765 Jadeite Ave

- 10040 Jonquil Dr

- 10088 Goldenrod Ct

- 9800 Base Line Rd Unit 79

- 7285 Teak Way

- 10210 Baseline Rd Unit 62

- 10210 Baseline Rd Unit 115

- 10210 Baseline Rd Unit 289

- 9841 Golden Arrow Ln

- 9821 Golden Arrow Ln

- 9832 Chesapeake Dr

- 9838 Chesapeake Dr

- 9826 Chesapeake Dr

- 9844 Chesapeake Dr

- 9851 Golden Arrow Ln

- 9820 Chesapeake Dr

- 9850 Chesapeake Dr

- 9856 Chesapeake Dr

- 9814 Chesapeake Dr

- 9830 Golden Arrow Ln

- 9840 Golden Arrow Ln

- 9820 Golden Arrow Ln

- 9862 Chesapeake Dr

- 6944 London Ave

- 9863 Golden Arrow Ln

- 6934 London Ave

- 9810 Chesapeake Dr

- 9850 Golden Arrow Ln