Lot 4 Blk 4 120th St SE Big Lake, MN 55309

Estimated Value: $441,000 - $450,000

2

Beds

2

Baths

1,332

Sq Ft

$334/Sq Ft

Est. Value

About This Home

This home is located at Lot 4 Blk 4 120th St SE, Big Lake, MN 55309 and is currently estimated at $445,374, approximately $334 per square foot. Lot 4 Blk 4 120th St SE is a home located in Sherburne County with nearby schools including Liberty Elementary School, Independence Elementary School, and Big Lake Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 18, 2025

Sold by

Vickstrom Deanna Lynn

Bought by

Olson Matthew Dean and Bares Samantha

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$198,225

Outstanding Balance

$197,539

Interest Rate

5.92%

Mortgage Type

New Conventional

Estimated Equity

$247,835

Purchase Details

Closed on

Mar 17, 2023

Sold by

Cardinal Financial

Bought by

Vickstrom Deanna

Purchase Details

Closed on

May 10, 2019

Sold by

Anderson Jennifer and Anderson Steven

Bought by

Obrzut Jeramey and Obrzut Debra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$294,467

Interest Rate

5.75%

Mortgage Type

FHA

Purchase Details

Closed on

Feb 4, 2016

Purchase Details

Closed on

Mar 30, 2015

Sold by

Riverwood Bank

Bought by

Sherburne Land Company Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Olson Matthew Dean | $440,500 | All American Title Company | |

| Vickstrom Deanna | $300,202 | -- | |

| Obrzut Jeramey | $299,900 | None Available | |

| -- | $24,900 | -- | |

| Sherburne Land Company Llc | $368,000 | Preferred Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Olson Matthew Dean | $198,225 | |

| Previous Owner | Obrzut Jeramey | $294,467 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,938 | $391,100 | $154,200 | $236,900 |

| 2024 | $3,850 | $385,400 | $146,000 | $239,400 |

| 2023 | $3,648 | $378,800 | $146,000 | $232,800 |

| 2022 | $3,374 | $358,600 | $123,300 | $235,300 |

| 2020 | $3,200 | $275,000 | $73,300 | $201,700 |

| 2019 | $2,952 | $261,600 | $68,000 | $193,600 |

| 2018 | $2,734 | $245,800 | $65,100 | $180,700 |

| 2017 | $2,628 | $223,200 | $59,600 | $163,600 |

| 2016 | $450 | $208,700 | $55,200 | $153,500 |

| 2015 | $332 | $27,300 | $27,300 | $0 |

| 2014 | $352 | $21,000 | $21,000 | $0 |

| 2013 | -- | $21,000 | $21,000 | $0 |

Source: Public Records

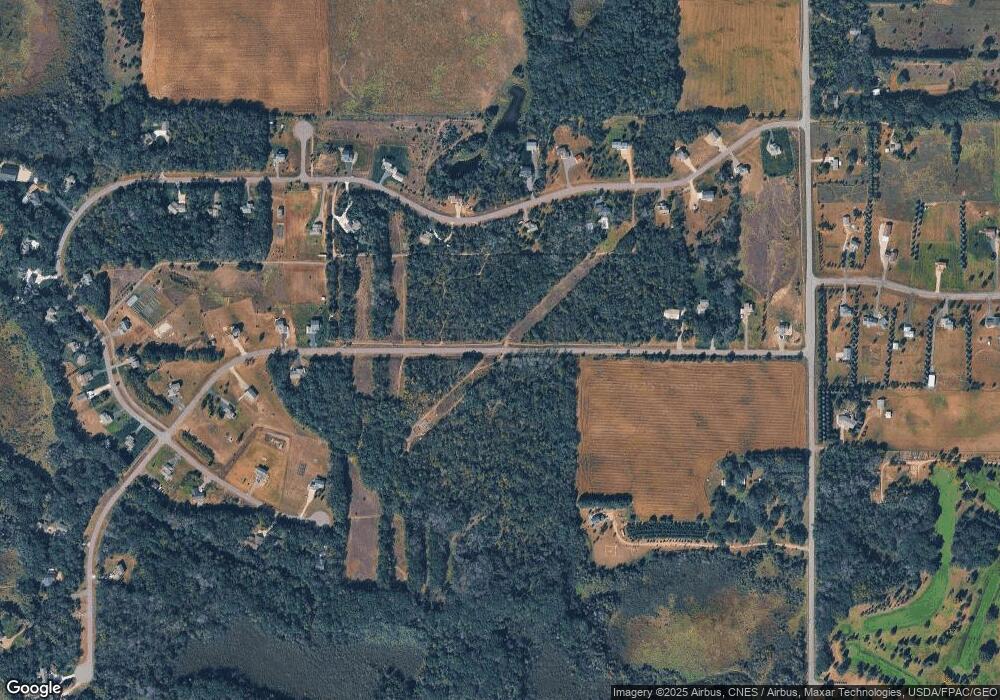

Map

Nearby Homes

- 23218 188th St NW

- 24051 187th St NW

- 18950 243rd Ave NW

- 23976 187th St NW

- L3 B5 121st St SE

- The Madison Plan at Shores of Eagle Lake

- The Brookview Plan at Shores of Eagle Lake

- The Augusta Plan at Shores of Eagle Lake

- The Stonewood Plan at Shores of Eagle Lake

- The Edgewater Plan at Shores of Eagle Lake

- The Highland Plan at Shores of Eagle Lake

- The Summit Plan at Shores of Eagle Lake

- The Sedona Plan at Shores of Eagle Lake

- The Somerset Plan at Shores of Eagle Lake

- 24069 187th St NW

- 24661 187th St NW

- 16819 102nd St SE

- xxxxx 185th St NW

- 9466 191st Ave SE

- L10,Blk1 177th St NW

- 18454 120th St SE

- Lot 3 Blk 4 120th St SE

- 18545 18545 119th-Street-se

- 18545 119th St SE

- 18550 119th St SE

- 18627 119th St SE

- 18443 118th St SE

- Lot 2 Blk 3 118th St

- Lot 2 Blk 3 118th St SE

- 18407 118th St SE

- Lot 3 Blk 3 118th St SE

- XXXX (Lot 1) 118th St

- XXXX (Lot 1) 118th St SE

- 18495 118th St SE

- 18442 120th St SE

- 18632 119th St SE

- 18632 119th St SE

- 18709 119th St SE

- 18385 118th St SE

- Lot 4, Blk 3 118th St SE