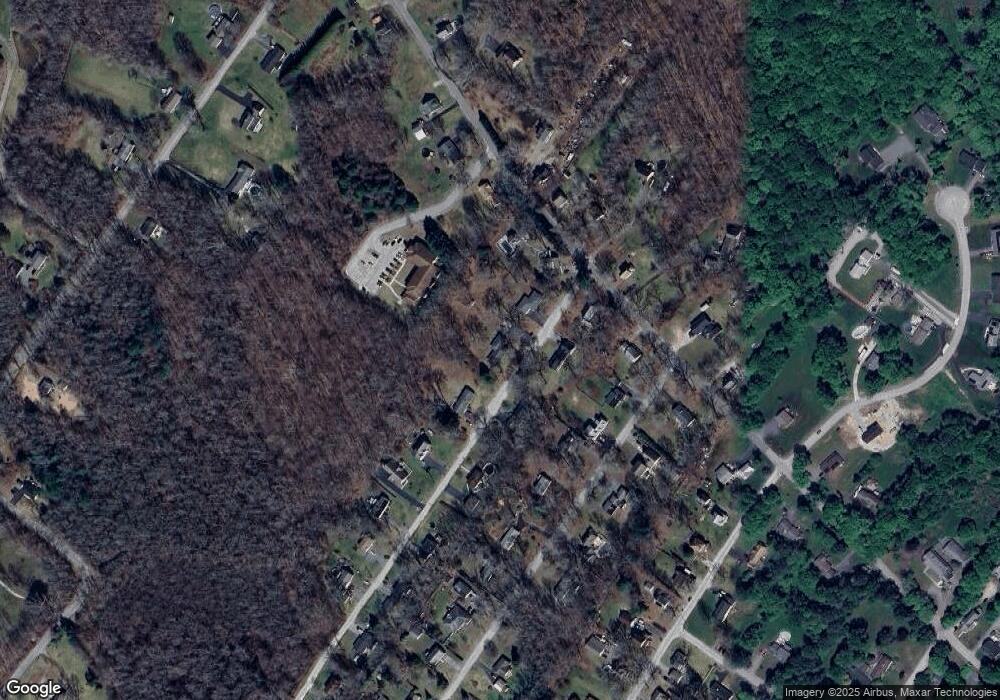

10 Stanley Dr Moosup, CT 06354

Estimated Value: $383,076 - $398,000

3

Beds

3

Baths

1,639

Sq Ft

$239/Sq Ft

Est. Value

About This Home

This home is located at 10 Stanley Dr, Moosup, CT 06354 and is currently estimated at $392,019, approximately $239 per square foot. 10 Stanley Dr is a home located in Windham County with nearby schools including Plainfield Memorial School, Plainfield Central Middle School, and Plainfield High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 3, 2007

Sold by

Dpac Construction Llc

Bought by

Gabriele Ronald C

Current Estimated Value

Purchase Details

Closed on

Aug 14, 2006

Sold by

Zastowsky Ronald G

Bought by

Dpac Construction Llc

Purchase Details

Closed on

Sep 17, 2001

Sold by

Department Of Housing & Urban Dev

Bought by

Zastowsky Ronald G

Purchase Details

Closed on

Aug 18, 1997

Sold by

Roberts Jeffrey J

Bought by

Racine George J and Cyrus Dori Ann M

Purchase Details

Closed on

May 10, 1996

Sold by

Roberts Robin J and Roberts Norma L

Bought by

Roberts Jeffrey J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gabriele Ronald C | $245,000 | -- | |

| Gabriele Ronald C | $245,000 | -- | |

| Dpac Construction Llc | $175,000 | -- | |

| Dpac Construction Llc | $175,000 | -- | |

| Zastowsky Ronald G | $115,000 | -- | |

| Zastowsky Ronald G | $115,000 | -- | |

| Racine George J | $109,000 | -- | |

| Racine George J | $109,000 | -- | |

| Roberts Jeffrey J | $86,000 | -- | |

| Roberts Jeffrey J | $86,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Roberts Jeffrey J | $25,000 | |

| Open | Roberts Jeffrey J | $343,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,052 | $213,970 | $35,270 | $178,700 |

| 2024 | $4,932 | $213,970 | $35,270 | $178,700 |

| 2023 | $4,908 | $213,970 | $35,270 | $178,700 |

| 2022 | $6,928 | $147,670 | $30,520 | $117,150 |

| 2021 | $4,538 | $147,670 | $30,520 | $117,150 |

| 2020 | $4,508 | $147,670 | $30,520 | $117,150 |

| 2019 | $4,508 | $147,670 | $30,520 | $117,150 |

| 2018 | $4,439 | $147,670 | $30,520 | $117,150 |

| 2017 | $4,070 | $127,110 | $27,330 | $99,780 |

| 2016 | $3,934 | $127,110 | $27,330 | $99,780 |

| 2015 | $3,834 | $127,110 | $27,330 | $99,780 |

| 2014 | $3,834 | $127,110 | $27,330 | $99,780 |

Source: Public Records

Map

Nearby Homes

- 100 Squaw Rock Rd

- 11 Stone House Dr

- 58 Milner Ave

- 50 High St

- 130 Church St

- 275 Moosup Pond Rd

- 12 Mechanic St

- 29 Union St

- 6 Ward Ln

- 277 Moosup Pond Rd

- 8 Juniper Ln

- 30 Main St

- 89 Kinney Hill Rd

- 0 Putnam Rd Unit 24147722

- 143 Goshen Rd

- 133 Sachem Dr

- 47 Texas Heights Rd

- 24 Marie St

- 10 School Street Extension

- 181 Snake Meadow Rd