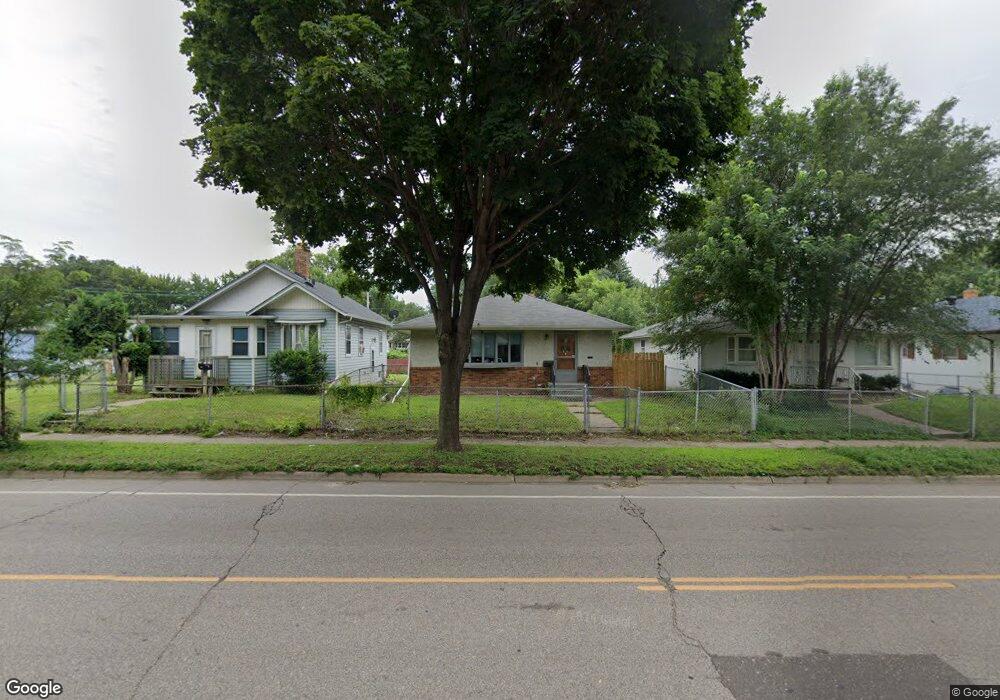

1010 Maryland Ave E Saint Paul, MN 55106

Payne-Phalen NeighborhoodEstimated Value: $284,101 - $299,000

4

Beds

2

Baths

1,176

Sq Ft

$250/Sq Ft

Est. Value

About This Home

This home is located at 1010 Maryland Ave E, Saint Paul, MN 55106 and is currently estimated at $293,775, approximately $249 per square foot. 1010 Maryland Ave E is a home located in Ramsey County with nearby schools including Frost Lake Elementary School, Txuj Ci HMong Language and Culture Upper Campus, and Johnson Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 22, 2020

Sold by

Vang Amy

Bought by

Hooper Walter and Hooper Patricia

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$218,889

Outstanding Balance

$193,966

Interest Rate

3.3%

Mortgage Type

FHA

Estimated Equity

$99,809

Purchase Details

Closed on

Jan 21, 2004

Sold by

Her Pao and Yang Yia Shaine

Bought by

Yang Joe and Yang Shia

Purchase Details

Closed on

Oct 10, 2002

Sold by

Old Treasure Real Estate Development Llc

Bought by

Her Pao

Purchase Details

Closed on

Aug 8, 2002

Sold by

Blanchard Richard E and Brown Richard E

Bought by

Old Treasure Real Estate

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hooper Walter | $223,000 | Arden Title Llc | |

| Yang Joe | $180,000 | -- | |

| Her Pao | $137,000 | -- | |

| Old Treasure Real Estate | $116,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hooper Walter | $218,889 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,604 | $271,700 | $25,000 | $246,700 |

| 2023 | $5,604 | $252,500 | $20,000 | $232,500 |

| 2022 | $4,704 | $252,400 | $20,000 | $232,400 |

| 2021 | $2,584 | $210,000 | $17,800 | $192,200 |

| 2020 | $2,578 | $169,800 | $8,900 | $160,900 |

| 2019 | $2,354 | $169,700 | $8,900 | $160,800 |

| 2018 | $1,922 | $154,900 | $8,900 | $146,000 |

| 2017 | $1,622 | $134,900 | $8,900 | $126,000 |

| 2016 | $1,784 | $0 | $0 | $0 |

| 2015 | $1,552 | $127,400 | $8,900 | $118,500 |

| 2014 | $1,722 | $0 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 992 Orange Ave E

- 915 Rose Ave E

- 968 Hyacinth Ave E

- 904 Rose Ave E

- 904 Jessamine Ave E

- 892 Lawson Ave E

- 1635 Maryland Ave E

- 808 Hyacinth Ave E

- 976 Forest St

- 864 Lawson Ave E

- 1114 Lane Place

- 1144 Jenks Ave

- 941 Cypress St

- 938 Cypress St

- 843 Jenks Ave

- 756 Rose Ave E

- 935 Duchess St

- 792 Cook Ave E

- 911 Sims Ave

- 740 Orange Ave E

- 1006 Maryland Ave E

- 1014 Maryland Ave E

- 1196 Cypress St

- 1196 1196 Cypress-Street-

- 1022 Maryland Ave E

- 1011 Rose Ave E

- 1003 Rose Ave E

- 1026 1026 Maryland-Avenue-e

- 1026 Maryland Ave E

- 1017 Rose Ave E

- 1021 Rose Ave E

- 1021 1021 Rose-Avenue-e

- 1021 1021 Rose Ave E

- 1011 Maryland Ave E

- 996 Maryland Ave E

- 1015 Maryland Ave E

- 1005 Maryland Ave E

- 1030 Maryland Ave E

- 1017 Maryland Ave E

- 1001 Maryland Ave E