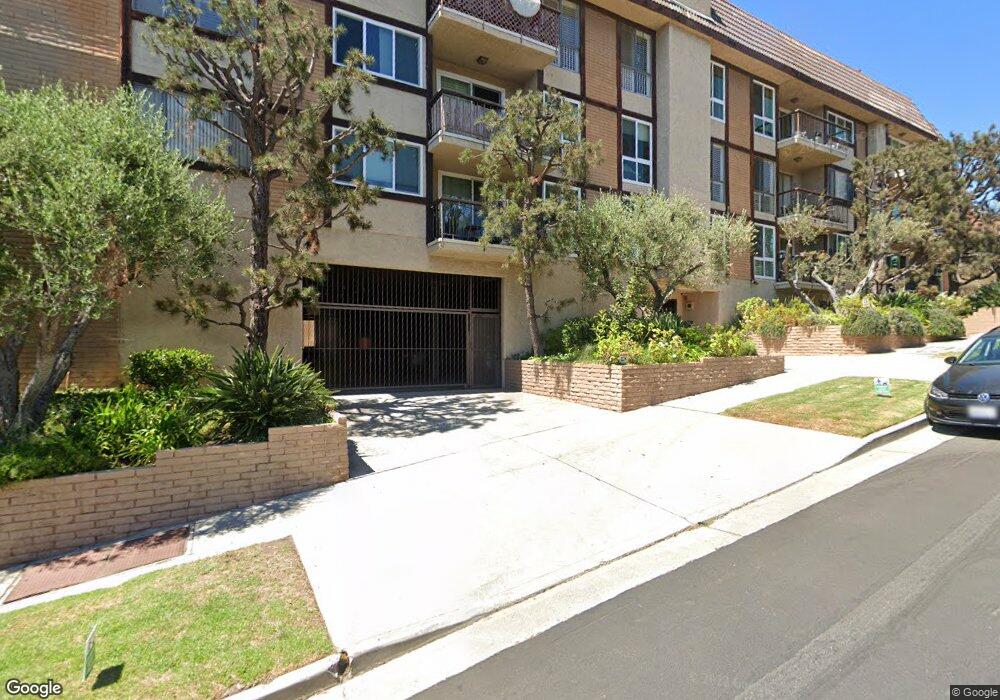

10345 Almayo Ave Unit 302 Los Angeles, CA 90064

Estimated Value: $853,111 - $969,000

2

Beds

2

Baths

1,309

Sq Ft

$690/Sq Ft

Est. Value

About This Home

This home is located at 10345 Almayo Ave Unit 302, Los Angeles, CA 90064 and is currently estimated at $903,028, approximately $689 per square foot. 10345 Almayo Ave Unit 302 is a home located in Los Angeles County with nearby schools including Daniel Webster Middle School, Westwood Charter School, and Ralph Waldo Emerson Community Charter Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 4, 2009

Sold by

Lessing Linda

Bought by

Lessing Linda and Linda Lessing 2009 Trust

Current Estimated Value

Purchase Details

Closed on

Jul 18, 1996

Sold by

Nater Robert A

Bought by

Lessing Linda

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,500

Interest Rate

8.33%

Mortgage Type

Balloon

Purchase Details

Closed on

Jun 4, 1996

Sold by

Nater Robert A and Jean Nater 1986 Survivors Trus

Bought by

Nater Robert A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,500

Interest Rate

8.33%

Mortgage Type

Balloon

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lessing Linda | -- | None Available | |

| Lessing Linda | $188,500 | Southland Title Company | |

| Nater Robert A | -- | Southland Title Company | |

| Nater Robert A | -- | Southland Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Lessing Linda | $138,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,681 | $306,980 | $112,367 | $194,613 |

| 2024 | $3,681 | $300,962 | $110,164 | $190,798 |

| 2023 | $3,613 | $295,061 | $108,004 | $187,057 |

| 2022 | $3,448 | $289,277 | $105,887 | $183,390 |

| 2021 | $3,396 | $283,606 | $103,811 | $179,795 |

| 2019 | $3,292 | $275,196 | $100,733 | $174,463 |

| 2018 | $3,273 | $269,801 | $98,758 | $171,043 |

| 2016 | $3,118 | $259,326 | $94,924 | $164,402 |

| 2015 | $3,072 | $255,432 | $93,499 | $161,933 |

| 2014 | $3,088 | $250,429 | $91,668 | $158,761 |

Source: Public Records

Map

Nearby Homes

- 10336 Almayo Ave Unit 203

- 10364 Almayo Ave Unit 205

- 10365 Ilona Ave

- 10393 Almayo Ave

- 2372 S Beverly Glen Blvd

- 10326 Keswick Ave

- 2318 Fox Hills Dr Unit 102

- 2318 Fox Hills Dr Unit 203

- 10404 Ilona Ave Unit 2

- 2323 S Beverly Glen Blvd Unit 9

- 2240 S Beverly Glen Blvd Unit 103

- 10456 Almayo Ave

- 2175 S Beverly Glen Blvd Unit 403

- 10509 Blythe Ave

- 10517 Blythe Ave

- 2160 Century Park Ln Unit 503

- 2187 Century Woods Way Unit 33

- 2142 Century Park Ln Unit 411

- 2132 Century Park Ln Unit 304

- 2467 Century Hill

- 10345 Almayo Ave Unit 106

- 10345 Almayo Ave Unit 104

- 10345 Almayo Ave Unit 103

- 10345 Almayo Ave Unit 102

- 10345 Almayo Ave Unit 101

- 10345 Almayo Ave Unit 306

- 10345 Almayo Ave Unit 305

- 10345 Almayo Ave Unit 304

- 10345 Almayo Ave Unit 303

- 10345 Almayo Ave Unit 301

- 10345 Almayo Ave Unit 208

- 10345 Almayo Ave Unit 207

- 10345 Almayo Ave Unit 206

- 10345 Almayo Ave Unit 205

- 10345 Almayo Ave Unit 204

- 10345 Almayo Ave Unit 203

- 10345 Almayo Ave Unit 202

- 10345 Almayo Ave Unit 201

- 10345 Almayo Ave Unit 108

- 10345 Almayo Ave Unit 107