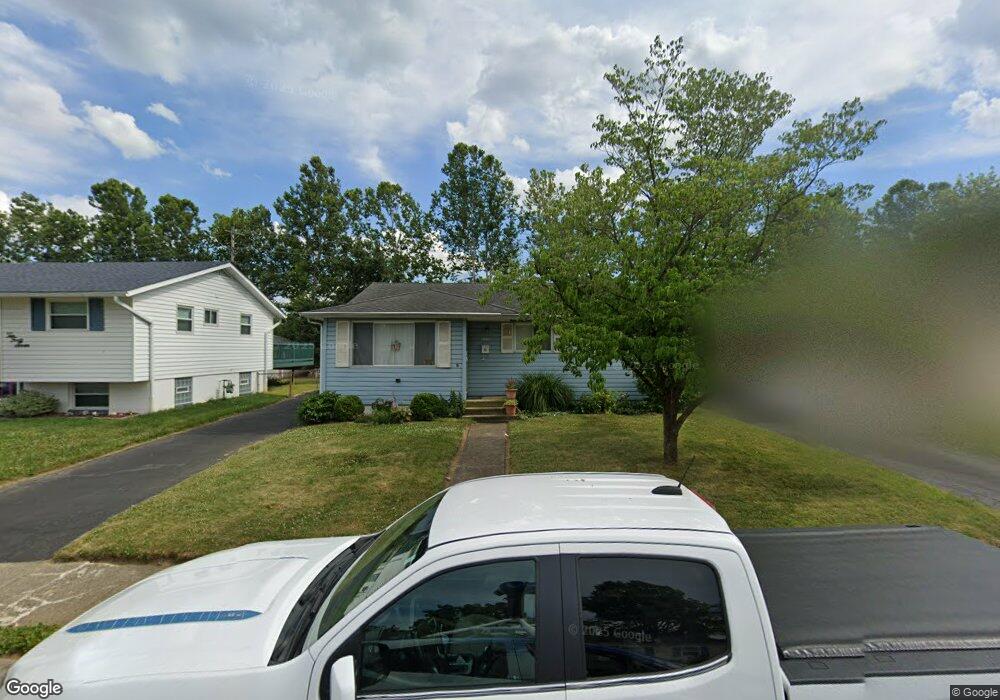

1041 Strimple Ave Columbus, OH 43229

Salem Village NeighborhoodEstimated Value: $237,315 - $247,000

3

Beds

1

Bath

976

Sq Ft

$247/Sq Ft

Est. Value

About This Home

This home is located at 1041 Strimple Ave, Columbus, OH 43229 and is currently estimated at $241,079, approximately $247 per square foot. 1041 Strimple Ave is a home located in Franklin County with nearby schools including Salem Elementary School, Dominion Middle School, and Whetstone High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 15, 2010

Sold by

Bui Phong Q

Bought by

Bui Cynthia S

Current Estimated Value

Purchase Details

Closed on

Sep 7, 2005

Sold by

Rice Kenneth R and Rice Mary Ann

Bought by

Bui Cynthia S and Rice Cynthia S

Purchase Details

Closed on

Aug 31, 1999

Sold by

Maase Karen L and Bylsma Karen L

Bought by

Rice Cynthia S and Rice Kenneth R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,600

Interest Rate

7.5%

Purchase Details

Closed on

Feb 28, 1994

Bought by

Maase Karen L

Purchase Details

Closed on

Oct 1, 1980

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bui Cynthia S | -- | Attorney | |

| Bui Cynthia S | -- | -- | |

| Rice Cynthia S | $90,700 | Title First Agency Inc | |

| Maase Karen L | $67,900 | -- | |

| -- | $44,600 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rice Cynthia S | $80,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,315 | $73,860 | $19,500 | $54,360 |

| 2023 | $3,272 | $73,850 | $19,495 | $54,355 |

| 2022 | $2,445 | $47,150 | $11,590 | $35,560 |

| 2021 | $2,450 | $47,150 | $11,590 | $35,560 |

| 2020 | $2,453 | $47,150 | $11,590 | $35,560 |

| 2019 | $2,212 | $36,470 | $8,890 | $27,580 |

| 2018 | $2,080 | $36,470 | $8,890 | $27,580 |

| 2017 | $2,180 | $36,470 | $8,890 | $27,580 |

| 2016 | $2,150 | $32,450 | $8,120 | $24,330 |

| 2015 | $1,951 | $32,450 | $8,120 | $24,330 |

| 2014 | $1,956 | $32,450 | $8,120 | $24,330 |

| 2013 | $1,016 | $34,160 | $8,540 | $25,620 |

Source: Public Records

Map

Nearby Homes

- 964 Strimple Ave

- 5318 Eisenhower Rd

- 4983 Almont Dr

- 5415 Vinewood Ct

- 5462 Roche Dr

- 4904 Almont Dr

- 5480 Rockwood Ct Unit R1

- 1116 Tulsa Dr

- 5475 Worthington Forest Pl E Unit 5475

- 734 Worthington Forest Place Unit 734

- 1385 Thurell Rd

- 4840 Almont Dr

- 5548 Roche Dr

- 5579 Norcross Rd

- 627 S Selby Blvd

- 582 E Lincoln Ave

- 569 Chase Rd

- 1414 Alvina Dr

- 4827 Glendon Rd

- 1469 Sandalwood Place

- 1047 Strimple Ave

- 1035 Strimple Ave

- 1055 Strimple Ave

- 1027 Strimple Ave

- 1061 Strimple Ave

- 1021 Strimple Ave

- 1036 Strimple Ave

- 1042 Strimple Ave

- 1028 Strimple Ave

- 1069 Strimple Ave

- 1015 Strimple Ave

- 1048 Strimple Ave

- 1022 Strimple Ave

- 1054 Strimple Ave

- 1016 Strimple Ave

- 1075 Strimple Ave

- 1007 Strimple Ave

- 1062 Strimple Ave

- 1008 Strimple Ave

- 1035 Minerva Ave