10438 Nobleton Rd Apple Valley, CA 92308

High Desert NeighborhoodEstimated Value: $367,701 - $403,000

2

Beds

2

Baths

1,544

Sq Ft

$249/Sq Ft

Est. Value

About This Home

This home is located at 10438 Nobleton Rd, Apple Valley, CA 92308 and is currently estimated at $384,675, approximately $249 per square foot. 10438 Nobleton Rd is a home located in San Bernardino County with nearby schools including Rio Vista School of Applied Learning, Apple Valley High School, and Excelsior Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 9, 2022

Sold by

Andre James M and Andre Tobi L

Bought by

James M And Tobi L Andre Family Trust

Current Estimated Value

Purchase Details

Closed on

Jul 20, 2006

Sold by

Andre James M

Bought by

Andre James M and Andre Tobi

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,000

Interest Rate

6.69%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 13, 2006

Sold by

Pulte Home Corp

Bought by

Andre James M and Andre Tobi

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$220,090

Interest Rate

6.19%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| James M And Tobi L Andre Family Trust | -- | None Listed On Document | |

| Andre James M | -- | Stewart Title Guaranty | |

| Andre James M | $275,500 | First American Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Andre James M | $60,000 | |

| Previous Owner | Andre James M | $220,090 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,471 | $212,079 | $53,019 | $159,060 |

| 2024 | $2,400 | $207,920 | $51,979 | $155,941 |

| 2023 | $2,377 | $203,843 | $50,960 | $152,883 |

| 2022 | $2,339 | $199,846 | $49,961 | $149,885 |

| 2021 | $2,284 | $195,927 | $48,981 | $146,946 |

| 2020 | $2,307 | $193,918 | $48,479 | $145,439 |

| 2019 | $2,264 | $190,115 | $47,528 | $142,587 |

| 2018 | $2,208 | $186,387 | $46,596 | $139,791 |

| 2017 | $2,176 | $182,732 | $45,682 | $137,050 |

| 2016 | $2,080 | $179,149 | $44,786 | $134,363 |

| 2015 | $2,122 | $176,458 | $44,113 | $132,345 |

| 2014 | $2,095 | $173,002 | $43,249 | $129,753 |

Source: Public Records

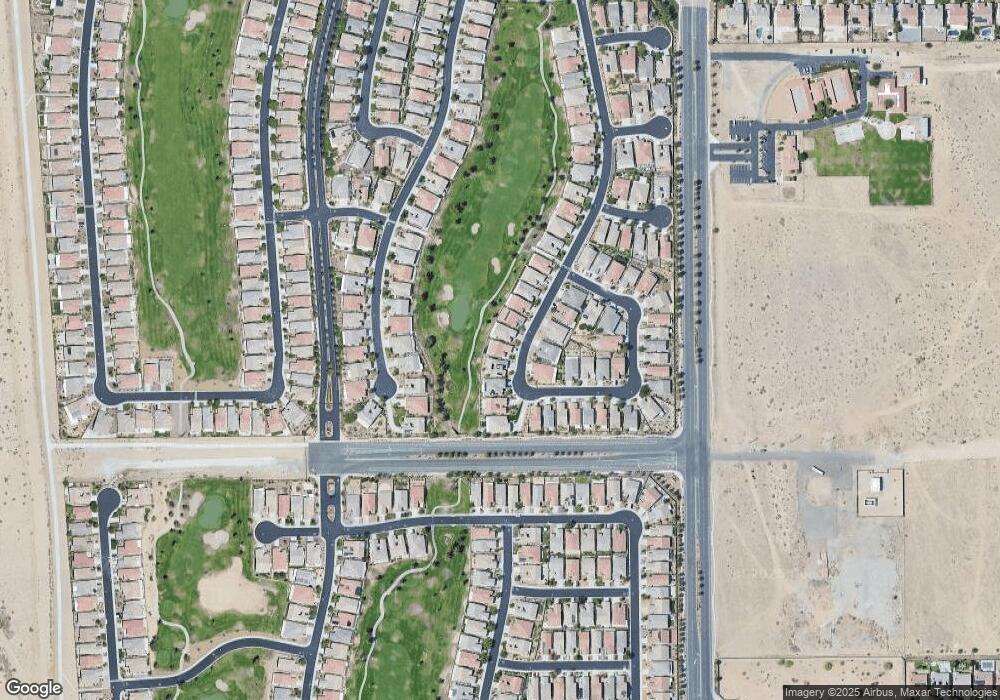

Map

Nearby Homes

- 10446 Bridge Haven Rd

- 10364 Lakeshore Dr

- 10468 Darby Rd

- 10273 Wascana Ln

- 19484 Biltmore Rd

- 10266 Lakeshore Dr

- 19369 Glaslyn Ct

- 10215 Wascana Ln

- 10332 Darby Rd

- 10301 Darby Rd

- 10854 Aster Ln

- 19442 Royal Oaks Rd

- 19422 Royal Oaks Rd

- 10212 Darby Rd

- 10030 El Dorado St

- 10041 Wilmington Ln

- 10939 Rockaway Glen Rd

- 10852 Katepwa St

- 10887 Katepwa St

- 11000 Rockaway Glen Rd

- 10450 Nobleton Rd

- 10426 Nobleton Rd

- 10462 Nobleton Rd

- 10449 Nobleton Rd

- 10474 Nobleton Rd

- 10425 Nobleton Rd

- 10402 Nobleton Rd

- 10486 Nobleton Rd

- 19532 Hanely St

- 10485 Nobleton Rd

- 10400 Nobleton Rd

- 19511 Hanely St

- 10498 Nobleton Rd

- 19519 Hanely St

- 19527 Hanely St

- 19542 Hanely St

- 10499 Nobleton Rd

- 10417 Lanigan Rd