1044 Meadow Way Arroyo Grande, CA 93420

Estimated Value: $252,000 - $627,458

2

Beds

3

Baths

1,220

Sq Ft

$344/Sq Ft

Est. Value

About This Home

This home is located at 1044 Meadow Way, Arroyo Grande, CA 93420 and is currently estimated at $419,115, approximately $343 per square foot. 1044 Meadow Way is a home located in San Luis Obispo County with nearby schools including Ocean View Elementary School, Judkins Middle School, and Arroyo Grande High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 26, 2025

Sold by

Barnes Family Trust and Barnes Michael L

Bought by

Gail P Mandal Revocable Trust and Mandal

Current Estimated Value

Purchase Details

Closed on

Jul 10, 2020

Sold by

Barnes Joyce C

Bought by

Barnes Michael L and Barnes Joyce C

Purchase Details

Closed on

Apr 2, 2012

Sold by

Barnes Joyce

Bought by

Barnes Joyce C

Purchase Details

Closed on

Oct 29, 2007

Sold by

Mandal Gail P

Bought by

Mandal Gail P

Purchase Details

Closed on

Oct 25, 2007

Sold by

Rome Sally

Bought by

Mandal Gail and Barnes Joyce

Purchase Details

Closed on

Oct 17, 2006

Sold by

Rome Salvatore J and Rome Alvera M

Bought by

Mandal Gail and Barnes Joyce

Purchase Details

Closed on

Jan 15, 1998

Sold by

Rome Sal J and Rome Vera M

Bought by

Rome Salvatore J and Rome Alvera M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gail P Mandal Revocable Trust | $250,000 | Fidelity National Title | |

| Barnes Michael L | -- | First American Title | |

| Barnes Joyce C | -- | None Available | |

| Barnes Joyce C | -- | None Available | |

| Mandal Gail P | -- | None Available | |

| Mandal Gail | $95,000 | None Available | |

| Mandal Gail | -- | None Available | |

| Rome Salvatore J | -- | None Available | |

| Rome Salvatore J | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,647 | $255,851 | $98,346 | $157,505 |

| 2024 | $2,616 | $250,835 | $96,418 | $154,417 |

| 2023 | $2,616 | $245,918 | $94,528 | $151,390 |

| 2022 | $2,577 | $241,097 | $92,675 | $148,422 |

| 2021 | $2,572 | $236,370 | $90,858 | $145,512 |

| 2020 | $2,542 | $233,947 | $89,927 | $144,020 |

| 2019 | $2,524 | $229,361 | $88,164 | $141,197 |

| 2018 | $2,494 | $224,865 | $86,436 | $138,429 |

| 2017 | $2,453 | $220,457 | $84,742 | $135,715 |

| 2016 | $2,317 | $216,135 | $83,081 | $133,054 |

| 2015 | $2,298 | $212,890 | $81,834 | $131,056 |

| 2014 | -- | $208,720 | $80,231 | $128,489 |

Source: Public Records

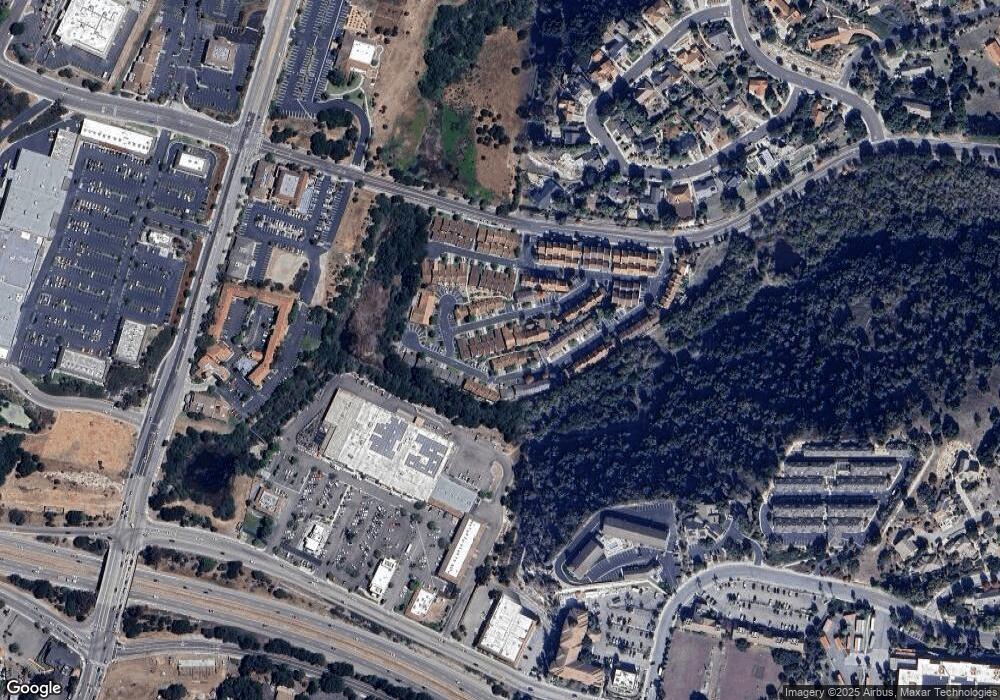

Map

Nearby Homes

- 1057 Meadow Way

- 579 Camino Mercado Unit 305

- 0 N Oak Park Blvd

- 1024 Robin Cir

- 282 Robles Rd Unit 19

- 277 Hillcrest Dr Unit 13

- 117 Village Cir

- 1566 Hillcrest Dr

- 108 Marian Way

- 249 Margo Way

- 910 N 12th St

- 334 Corona Del Terra

- 1950 Newport Ave

- 758 Via Bandolero

- 1773 Newport Ave

- 234 Christine Way

- 280 Chelsea Ct

- 1747 Brighton Ave

- 182 Fair View Dr

- 850 N 12th St

- 1042 Meadow Way

- 1040 Meadow Way

- 1167 Clevenger Dr

- 1169 Clevenger Dr

- 1165 Clevenger Dr

- 1171 Clevenger Dr

- 1038 Meadow Way

- 1163 Clevenger Dr

- 1049 Meadow Way

- 1051 Meadow Way

- 1173 Clevenger Dr

- 1045 Meadow Way

- 1053 Meadow Way

- 1043 Meadow Way

- 1161 Clevenger Dr

- 1175 Clevenger Dr

- 1036 Meadow Way

- 1041 Meadow Way

- 1159 Clevenger Dr