1047 Garrido Ct Camarillo, CA 93010

Estimated Value: $1,529,642 - $1,591,000

4

Beds

3

Baths

2,860

Sq Ft

$545/Sq Ft

Est. Value

About This Home

This home is located at 1047 Garrido Ct, Camarillo, CA 93010 and is currently estimated at $1,558,911, approximately $545 per square foot. 1047 Garrido Ct is a home located in Ventura County with nearby schools including Mesa Union School, Rio Mesa High School, and Camarillo Academy of Progressive Education.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 16, 2021

Sold by

Delanerolle Primal and De Lanerolle Judith

Bought by

Delanerolle Primal and De Lanerolle Judith

Current Estimated Value

Purchase Details

Closed on

Jun 4, 2001

Sold by

Amantia Phillip E and Amantia Valerie P

Bought by

Delanerolle Primal and Delanerolle Judith Sandra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Interest Rate

3.94%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 8, 1996

Sold by

Pohle Budd T and Pohle Marie R

Bought by

Pohle Budd T and Pohle Marie R

Purchase Details

Closed on

Jan 18, 1994

Sold by

Pohle Marie R

Bought by

Pohle Budd T

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Delanerolle Primal | -- | None Available | |

| Delanerolle Primal | $1,179,000 | Chicago Title Co | |

| Pohle Budd T | -- | -- | |

| Pohle Budd T | -- | United Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Delanerolle Primal | $80,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $15,009 | $1,341,496 | $872,145 | $469,351 |

| 2024 | $15,009 | $1,315,193 | $855,044 | $460,149 |

| 2023 | $14,561 | $1,289,405 | $838,278 | $451,127 |

| 2022 | $14,424 | $1,264,123 | $821,841 | $442,282 |

| 2021 | $14,095 | $1,239,337 | $805,727 | $433,610 |

| 2020 | $13,915 | $1,226,631 | $797,466 | $429,165 |

| 2019 | $13,904 | $1,202,580 | $781,830 | $420,750 |

| 2018 | $13,243 | $1,179,000 | $766,500 | $412,500 |

| 2017 | $9,583 | $867,000 | $563,550 | $303,450 |

| 2016 | $3,846 | $354,015 | $86,075 | $267,940 |

| 2015 | $3,784 | $348,699 | $84,783 | $263,916 |

| 2014 | -- | $341,871 | $83,123 | $258,748 |

Source: Public Records

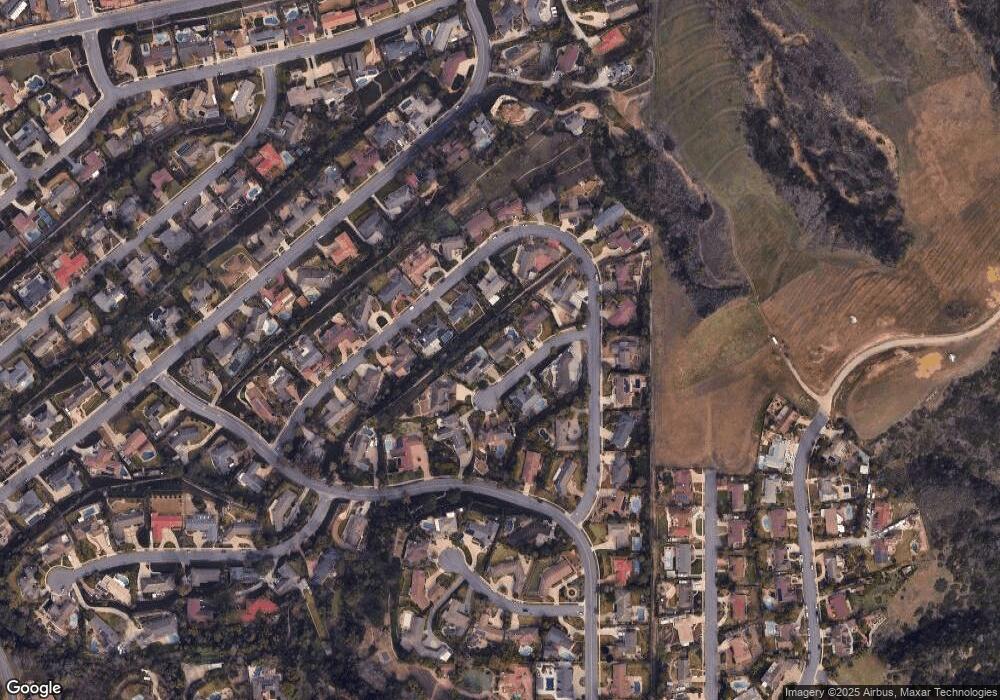

Map

Nearby Homes

- 1065 Garrido Dr

- 3181 Goldenspur Dr

- 880 Grada Ave

- 3130 Old Coach Dr

- 3118 Old Coach Dr

- 58 Altamont Way

- 35 Estaban Dr

- 375 W Highland Dr

- 250 W Highland Dr

- 9 Altamont Way

- 244 W Highland Dr

- 894 W Highland Dr

- 67 Santa Cruz Way

- 22 Santa Cruz Way

- 1361 Calle Aurora

- 2048 Sierra Mesa Dr

- 1525 Ramona Dr

- 520 Marissa Ln

- 999 San Clemente Way

- 1974 Sierra Mesa Dr

- 1073 Garrido Ct

- 1025 Garrido Ct

- 1012 Garrido Dr

- 1026 Garrido Dr

- 1046 Garrido Ct

- 990 Garrido Dr

- 1098 Garrido Ct

- 1078 Garrido Dr

- 1038 Garrido Dr

- 1101 Garrido Ct

- 1024 Garrido Ct

- 988 Garrido Dr

- 1128 Garrido Dr

- 1010 Garrido Ct

- 1013 Garrido Dr

- 1109 Garrido Dr

- 991 Garrido Dr

- 1093 Garrido Dr

- 814 Valley Vista Dr

- 1035 Garrido Dr