1051 Grass Valley Rd Unit 2 Chula Vista, CA 91913

Otay Ranch Village NeighborhoodEstimated Value: $813,661 - $885,000

3

Beds

3

Baths

1,605

Sq Ft

$533/Sq Ft

Est. Value

About This Home

This home is located at 1051 Grass Valley Rd Unit 2, Chula Vista, CA 91913 and is currently estimated at $854,915, approximately $532 per square foot. 1051 Grass Valley Rd Unit 2 is a home located in San Diego County with nearby schools including Corky McMillin Elementary School, Rancho Del Rey Middle School, and Olympian High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 15, 2002

Sold by

Lugo Albert and Lugo Claudia P

Bought by

Taneo Erich A and Taneo Vanessa Christina

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$247,200

Interest Rate

6.5%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

Feb 3, 2000

Sold by

Otay Ranch V Llc

Bought by

Lugo Albert and Lugo Claudia P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,200

Interest Rate

7.87%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Taneo Erich A | $309,000 | First American Title | |

| Lugo Albert | $215,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Taneo Erich A | $247,200 | |

| Previous Owner | Lugo Albert | $171,200 | |

| Closed | Taneo Erich A | $61,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,692 | $456,470 | $169,849 | $286,621 |

| 2024 | $7,692 | $447,520 | $166,519 | $281,001 |

| 2023 | $7,564 | $438,746 | $163,254 | $275,492 |

| 2022 | $7,356 | $430,144 | $160,053 | $270,091 |

| 2021 | $7,214 | $421,711 | $156,915 | $264,796 |

| 2020 | $7,058 | $417,388 | $155,307 | $262,081 |

| 2019 | $6,893 | $409,205 | $152,262 | $256,943 |

| 2018 | $6,782 | $401,182 | $149,277 | $251,905 |

| 2017 | $6,663 | $393,316 | $146,350 | $246,966 |

| 2016 | $6,451 | $385,605 | $143,481 | $242,124 |

| 2015 | $6,312 | $379,814 | $141,326 | $238,488 |

| 2014 | $6,271 | $372,375 | $138,558 | $233,817 |

Source: Public Records

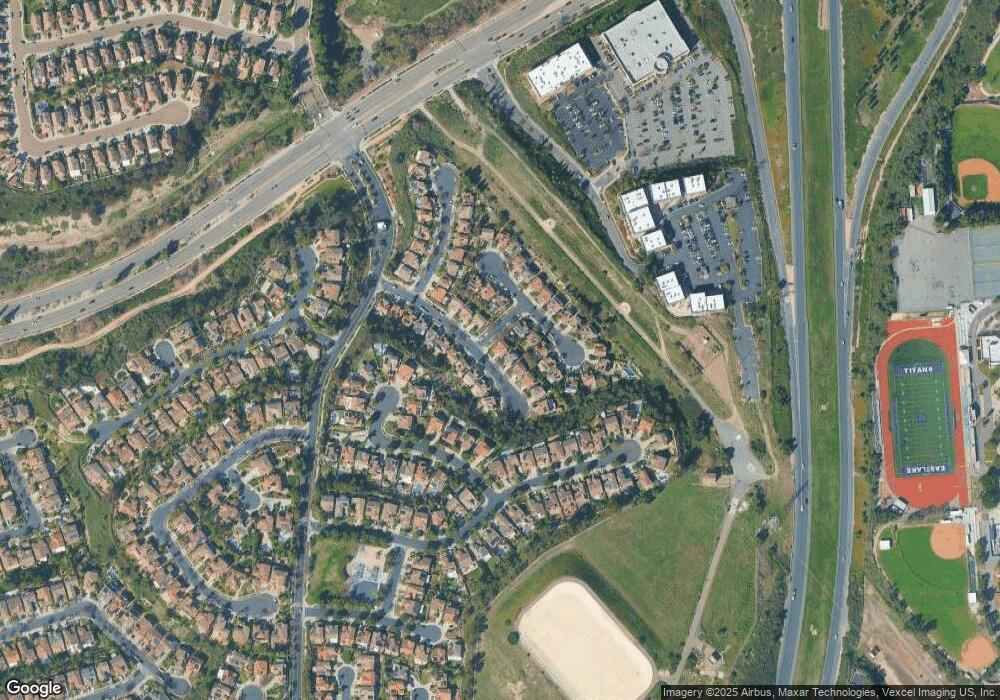

Map

Nearby Homes

- 1054 Forest Hill Place

- 1908 Petaluma Dr

- 1925 Otay Lakes Rd Unit 39

- 1925 Otay Lakes Rd Unit 69

- 1925 Otay Lakes Rd Unit 43

- 1925 Otay Lakes Rd Unit 167

- 845 Ridgewater Dr

- 1020 Baywood Cir Unit E

- 1930 Parker Mountain Rd

- 2083 Lakeridge Cir Unit 104

- 1306 Mill Valley Rd

- 761 Brookstone Rd Unit 203

- 773 Brookstone Rd Unit 304

- 1279 Fools Gold Way Unit 2

- 731 Brookstone Rd Unit 103

- 1280 Haglar Way Unit 2

- 1873 Fargo Ln Unit 4

- 749 Brookstone Rd Unit 101

- 2300 Palomira Ct

- 775 Eastshore Terrace Unit 225

- 1055 Grass Valley Rd

- 1042 Forest Hill Place

- 1059 Grass Valley Rd Unit 2

- 1046 Forest Hill Place

- 1045 Grass Valley Rd

- 1050 Forest Hill Place

- 1063 Grass Valley Rd

- 1030 Forest Hill Place

- 1041 Grass Valley Rd

- 1044 Grass Valley Rd

- 1048 Grass Valley Rd

- 1067 Grass Valley Rd

- 1026 Forest Hill Place

- 1056 Grass Valley Rd

- 1052 Grass Valley Rd

- 1058 Forest Hill Place

- 1037 Grass Valley Rd

- 1060 Grass Valley Rd

- 1040 Grass Valley Rd

- 1022 Forest Hill Place