1053 Los Pinos Ct Chula Vista, CA 91910

Rancho Del Rey NeighborhoodEstimated Value: $678,000 - $738,000

3

Beds

3

Baths

1,650

Sq Ft

$423/Sq Ft

Est. Value

About This Home

This home is located at 1053 Los Pinos Ct, Chula Vista, CA 91910 and is currently estimated at $698,392, approximately $423 per square foot. 1053 Los Pinos Ct is a home located in San Diego County with nearby schools including Chula Vista Hills Elementary School, Bonita Vista Middle School, and Bonita Vista Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 22, 2011

Sold by

Siwek Peter

Bought by

Siwek Peter

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,590

Outstanding Balance

$86,305

Interest Rate

3.94%

Mortgage Type

New Conventional

Estimated Equity

$612,087

Purchase Details

Closed on

Oct 22, 2007

Sold by

Siwek Peter B

Bought by

Siwek Peter

Purchase Details

Closed on

Jul 22, 1998

Sold by

Black James W and Black Lorna

Bought by

Siwek Peter B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$149,350

Interest Rate

6.92%

Mortgage Type

VA

Purchase Details

Closed on

Jul 6, 1989

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Siwek Peter | -- | Equity Title | |

| Siwek Peter | -- | Equity Title Company | |

| Siwek Peter | -- | None Available | |

| Siwek Peter B | $145,000 | Southland Title | |

| -- | $135,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Siwek Peter | $126,590 | |

| Previous Owner | Siwek Peter B | $149,350 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,686 | $227,293 | $52,129 | $175,164 |

| 2024 | $2,686 | $222,837 | $51,107 | $171,730 |

| 2023 | $2,637 | $218,468 | $50,105 | $168,363 |

| 2022 | $2,558 | $214,185 | $49,123 | $165,062 |

| 2021 | $2,497 | $209,986 | $48,160 | $161,826 |

| 2020 | $2,438 | $207,834 | $47,667 | $160,167 |

| 2019 | $2,372 | $203,760 | $46,733 | $157,027 |

| 2018 | $2,330 | $199,766 | $45,817 | $153,949 |

| 2017 | $11 | $195,850 | $44,919 | $150,931 |

| 2016 | $2,222 | $192,011 | $44,039 | $147,972 |

| 2015 | $2,192 | $189,128 | $43,378 | $145,750 |

| 2014 | $2,148 | $185,424 | $42,529 | $142,895 |

Source: Public Records

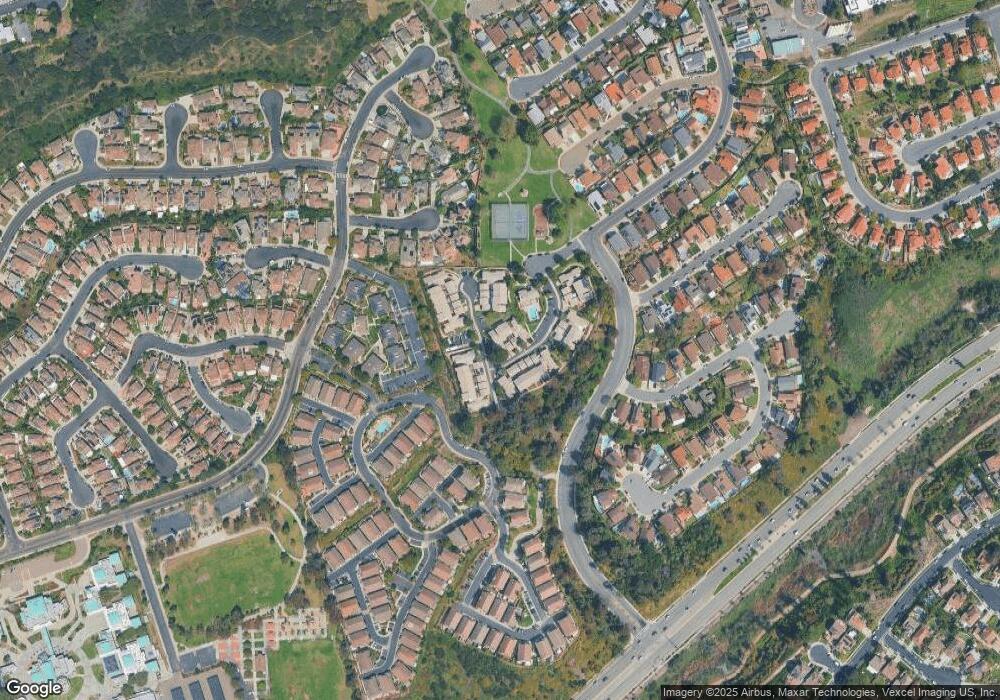

Map

Nearby Homes

- 1181 De Soto Ct Unit 54

- 1236 El Cortez Ct

- 1209 Morgan Hill Dr

- 1402 Antioch Ave

- 1075 Hayuco Plaza

- 1284 Saint Helena Ave

- 1060 Via Sinuoso

- 1236 Bolinas Bay Ct

- 1112 Camino Del Rey

- 1529 Apache Dr Unit A

- 1386 Serena Cir Unit 2

- 1340 Monte Sereno Ave

- 1057 Paseo Del Norte

- 1153 Gustine St

- 1781 Camino Strava Unit 1

- 1711 Avenida Tealing

- 1719 Avenida Tealing Unit 2

- 1415 Summit Dr

- 1129 Pacifica Ave

- 1175 Santa Olivia Rd

- 1055 Los Pinos Ct

- 1057 Los Pinos Ct

- 1051 Los Pinos Ct

- 1059 Los Pinos Ct

- 1076 Las Rosas Ct

- 1074 Las Rosas Ct

- 1078 Las Rosas Ct

- 1080 Las Rosas Ct

- 1320 E Vaquero Ct Unit 1

- 1324 E Vaquero Ct

- 1062 Los Pinos Ct Unit 23

- 1060 Los Pinos Ct Unit 24

- 1056 Los Pinos Ct Unit 26

- 1058 Los Pinos Ct

- 1054 Los Pinos Ct

- 1052 Los Pinos Ct

- 1050 Los Pinos Ct

- 1051 Las Rosas Ct

- 1068 Los Pinos Ct

- 1053 Las Rosas Ct