1054 Lost Valley Ct Chula Vista, CA 91913

Otay Ranch Village NeighborhoodEstimated Value: $966,875 - $1,051,000

5

Beds

3

Baths

2,148

Sq Ft

$470/Sq Ft

Est. Value

About This Home

This home is located at 1054 Lost Valley Ct, Chula Vista, CA 91913 and is currently estimated at $1,010,469, approximately $470 per square foot. 1054 Lost Valley Ct is a home located in San Diego County with nearby schools including Corky McMillin Elementary School, Rancho Del Rey Middle School, and Olympian High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 19, 2005

Sold by

Reyes Genciano G

Bought by

Reyes Genciano and Reyes Elsie Fernando

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$597,550

Outstanding Balance

$221,129

Interest Rate

1%

Mortgage Type

Negative Amortization

Estimated Equity

$789,340

Purchase Details

Closed on

Aug 26, 2002

Sold by

Reyes Genciano Guevarra and Reyes Elsie Fernando

Bought by

Reyes Genciano and Reyes Elsie Fernando

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$284,000

Interest Rate

6.29%

Mortgage Type

Balloon

Purchase Details

Closed on

May 3, 2001

Sold by

Otay Ranch V 2 Llc

Bought by

Reyes Genciano Guevara and Reyes Elsie Fernando

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,000

Interest Rate

7.09%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Reyes Genciano | -- | -- | |

| Reyes Genciano G | -- | Southland Title Of San Diego | |

| Reyes Genciano | -- | Commonwealth Land Title | |

| Reyes Genciano Guevara | $300,000 | Commonwealth Land Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Reyes Genciano G | $597,550 | |

| Closed | Reyes Genciano | $284,000 | |

| Previous Owner | Reyes Genciano Guevara | $240,000 | |

| Closed | Reyes Genciano Guevara | $45,000 | |

| Closed | Reyes Genciano | $53,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,105 | $443,167 | $169,878 | $273,289 |

| 2024 | $8,105 | $434,479 | $166,548 | $267,931 |

| 2023 | $7,971 | $425,961 | $163,283 | $262,678 |

| 2022 | $7,758 | $417,610 | $160,082 | $257,528 |

| 2021 | $7,617 | $409,423 | $156,944 | $252,479 |

| 2020 | $7,457 | $405,226 | $155,335 | $249,891 |

| 2019 | $7,286 | $397,282 | $152,290 | $244,992 |

| 2018 | $7,168 | $389,493 | $149,304 | $240,189 |

| 2017 | $7,039 | $381,857 | $146,377 | $235,480 |

| 2016 | $6,808 | $374,370 | $143,507 | $230,863 |

| 2015 | $6,645 | $368,748 | $141,352 | $227,396 |

| 2014 | -- | $361,526 | $138,584 | $222,942 |

Source: Public Records

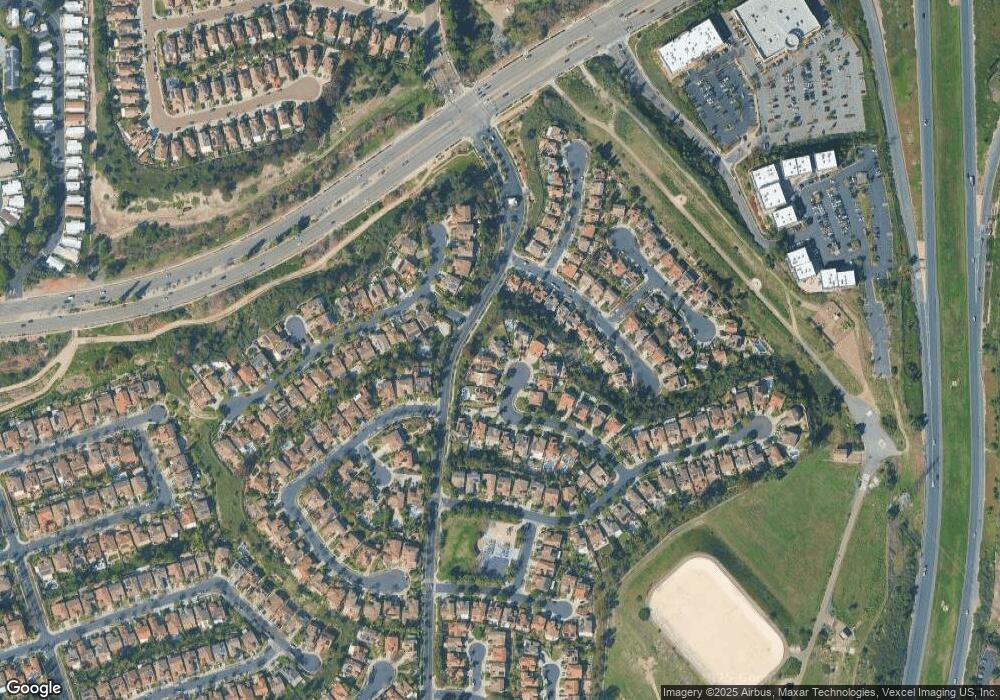

Map

Nearby Homes

- 1054 Forest Hill Place

- 1908 Petaluma Dr

- 1925 Otay Lakes Rd Unit 39

- 1925 Otay Lakes Rd Unit 69

- 1925 Otay Lakes Rd Unit 43

- 1925 Otay Lakes Rd Unit 167

- 1930 Parker Mountain Rd

- 845 Ridgewater Dr

- 1306 Mill Valley Rd

- 1279 Fools Gold Way Unit 2

- 1280 Haglar Way Unit 2

- 1873 Fargo Ln Unit 4

- 1020 Baywood Cir Unit E

- 2083 Lakeridge Cir Unit 104

- 1285 Fools Gold Way Unit 2

- 1295 Haglar Way Unit 1

- 1761 Harvard St

- 761 Brookstone Rd Unit 203

- 773 Brookstone Rd Unit 304

- 731 Brookstone Rd Unit 103

- 1050 Lost Valley Ct

- 1058 Lost Valley Ct

- 1062 Lost Valley Ct

- 1051 Lost Valley Ct

- 1066 Lost Valley Ct

- 1028 Grass Valley Rd

- 1055 Lost Valley Ct

- 1024 Grass Valley Rd

- 1032 Grass Valley Rd

- 1059 Lost Valley Ct

- 1036 Grass Valley Rd

- 1020 Grass Valley Rd Unit 1

- 1065 Lost Valley Ct

- 1998 Moss Landing Ave

- 1040 Grass Valley Rd

- 2000 Moss Landing Ave

- 1044 Grass Valley Rd

- 1994 Moss Landing Ave

- 1048 Grass Valley Rd

- 2004 Moss Landing Ave