10640 Porto Ct San Diego, CA 92124

Tierrasanta NeighborhoodEstimated Value: $942,069 - $1,009,000

4

Beds

2

Baths

1,532

Sq Ft

$642/Sq Ft

Est. Value

About This Home

This home is located at 10640 Porto Ct, San Diego, CA 92124 and is currently estimated at $984,017, approximately $642 per square foot. 10640 Porto Ct is a home located in San Diego County with nearby schools including Tierrasanta Elementary, Farb Middle School, and De Portola Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 5, 2020

Sold by

Krabbenhoft Kristine M

Bought by

Krabbenhoft Kristine Marie and The Kristine M Krabbenhoft Tru

Current Estimated Value

Purchase Details

Closed on

Jun 21, 2019

Sold by

Belsha John Logan and Belsha Virginia Helen

Bought by

Krabbenhoft Kristine M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$208,000

Outstanding Balance

$182,137

Interest Rate

3.9%

Mortgage Type

New Conventional

Estimated Equity

$801,880

Purchase Details

Closed on

Oct 1, 2015

Sold by

Pabst J Weston

Bought by

Belsha John Logan and Belsha Virginia Helen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$519,599

Interest Rate

3.86%

Mortgage Type

VA

Purchase Details

Closed on

Jan 15, 1987

Purchase Details

Closed on

Nov 1, 1984

Purchase Details

Closed on

Dec 21, 1983

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Krabbenhoft Kristine Marie | -- | None Available | |

| Krabbenhoft Kristine M | $635,000 | Guardian Title Company | |

| Belsha John Logan | $503,000 | Lawyers Title | |

| -- | $127,000 | -- | |

| -- | $119,000 | -- | |

| -- | $113,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Krabbenhoft Kristine M | $208,000 | |

| Previous Owner | Belsha John Logan | $519,599 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,411 | $694,461 | $173,916 | $520,545 |

| 2024 | $8,411 | $680,845 | $170,506 | $510,339 |

| 2023 | $8,221 | $667,496 | $167,163 | $500,333 |

| 2022 | $7,997 | $654,409 | $163,886 | $490,523 |

| 2021 | $7,936 | $641,578 | $160,673 | $480,905 |

| 2020 | $7,839 | $635,000 | $159,026 | $475,974 |

| 2019 | $6,604 | $533,785 | $133,678 | $400,107 |

| 2018 | $6,175 | $523,319 | $131,057 | $392,262 |

| 2017 | $6,027 | $513,059 | $128,488 | $384,571 |

| 2016 | $5,929 | $503,000 | $125,969 | $377,031 |

| 2015 | $2,622 | $214,559 | $53,733 | $160,826 |

| 2014 | $2,582 | $210,357 | $52,681 | $157,676 |

Source: Public Records

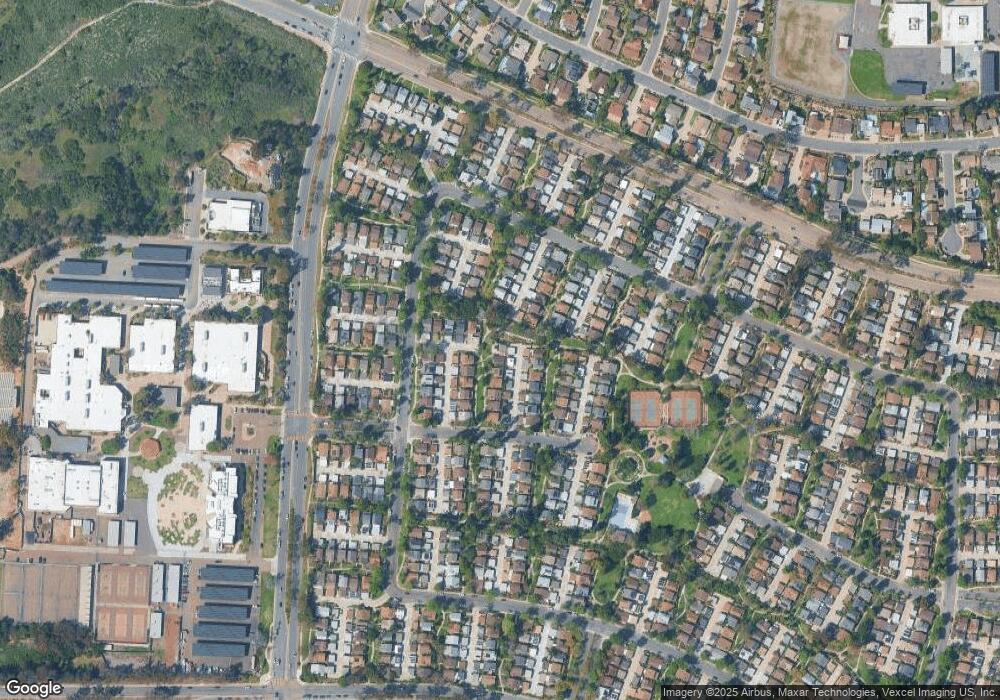

Map

Nearby Homes

- 10690 Esmeraldas Dr

- 10706 Esmeraldas Dr Unit 6

- 10748 Escobar Dr

- 5137 Abuela Dr

- 10812 Lamentin Ct Unit 312

- 10828 Lamentin Ct Unit 313

- 10889 Lamentin Ct

- 10834 Caravelle Place

- 5059 La Cuenta Dr

- 10852 Carbet Place

- 10945 Clairemont Mesa Blvd

- 10853 Valldemosa Ln

- 6140 Calle Mariselda Unit 102

- 5450 Rebolla Ln

- 5449 Escarchosa Ln

- 10140 Gayuba Ln

- 10165 Gayuba Ln Unit 311

- 10437 Hermanos Rd

- 5283 Edge Park Way

- 10966 Baroque Ln

- 10638 Porto Ct

- 10636 Porto Ct Unit 2

- 10642 Porto Ct Unit 2

- 10644 Porto Ct

- 10634 Porto Ct

- 5193 Fino Dr

- 10639 Esmeraldas Dr

- 10646 Porto Ct

- 10616 Porto Ct

- 10637 Esmeraldas Dr

- 10618 Porto Ct

- 10632 Porto Ct

- 5189 Fino Dr

- 10648 Porto Ct

- 10641 Esmeraldas Dr

- 10620 Porto Ct

- 10635 Esmeraldas Dr Unit 5

- 10650 Porto Ct

- 5185 Fino Dr

- 10630 Porto Ct