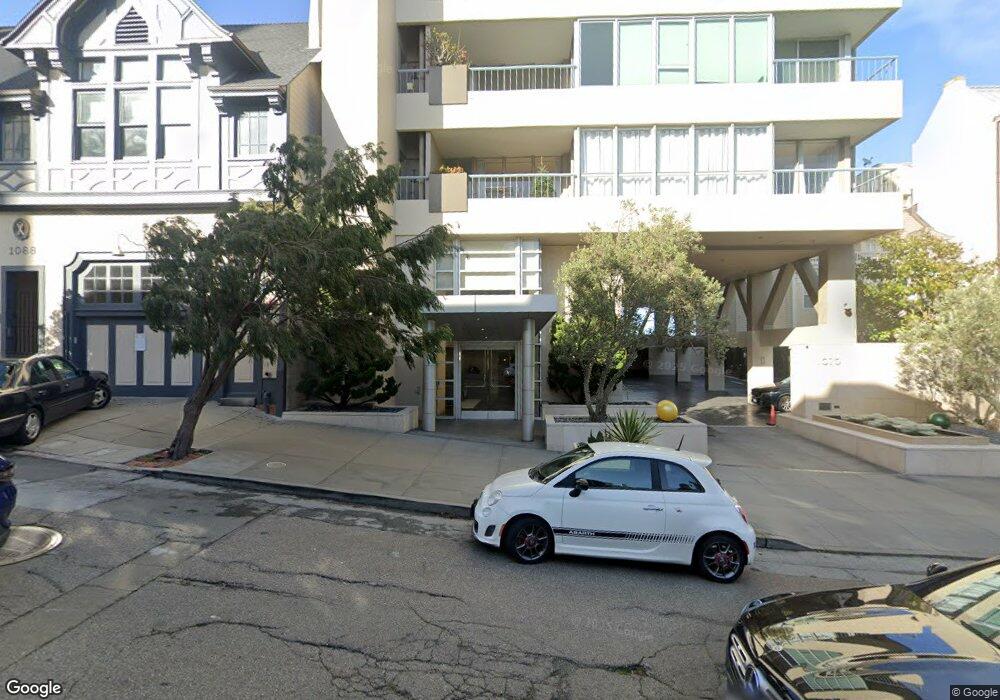

1070 Green St Unit 303 San Francisco, CA 94133

Russian Hill NeighborhoodEstimated Value: $1,181,563 - $1,573,000

1

Bed

1

Bath

1,197

Sq Ft

$1,183/Sq Ft

Est. Value

About This Home

This home is located at 1070 Green St Unit 303, San Francisco, CA 94133 and is currently estimated at $1,416,141, approximately $1,183 per square foot. 1070 Green St Unit 303 is a home located in San Francisco County with nearby schools including Yick Wo Elementary School, Francisco Middle School, and Cathedral School for Boys.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 9, 1998

Sold by

Yee James

Bought by

The James Yee 1998 Living Trust and Yee James

Current Estimated Value

Purchase Details

Closed on

Nov 25, 1997

Sold by

Chuang Carol

Bought by

Yee James

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,000,000

Outstanding Balance

$156,476

Interest Rate

6.75%

Estimated Equity

$1,259,665

Purchase Details

Closed on

Nov 19, 1997

Sold by

Demott George A and Demott Joyceann A

Bought by

Yee James

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,000,000

Outstanding Balance

$156,476

Interest Rate

6.75%

Estimated Equity

$1,259,665

Purchase Details

Closed on

Sep 14, 1995

Sold by

Robco and Roberts Jo Anne E

Bought by

Demott George A and Demott Joyceann A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$160,000

Interest Rate

7.37%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| The James Yee 1998 Living Trust | -- | -- | |

| Yee James | -- | First American Title Co | |

| Yee James | $390,000 | First American Title Co | |

| Demott George A | $310,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Yee James | $1,000,000 | |

| Previous Owner | Demott George A | $160,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,966 | $622,713 | $247,485 | $375,228 |

| 2024 | $7,966 | $610,504 | $242,633 | $367,871 |

| 2023 | $7,829 | $598,534 | $237,876 | $360,658 |

| 2022 | $7,668 | $586,799 | $233,212 | $353,587 |

| 2021 | $7,529 | $575,294 | $228,640 | $346,654 |

| 2020 | $7,577 | $569,396 | $226,296 | $343,100 |

| 2019 | $7,371 | $558,232 | $221,859 | $336,373 |

| 2018 | $7,121 | $547,287 | $217,509 | $329,778 |

| 2017 | $6,739 | $536,557 | $213,245 | $323,312 |

| 2016 | $6,608 | $526,037 | $209,064 | $316,973 |

| 2015 | $6,522 | $518,136 | $205,924 | $312,212 |

| 2014 | $6,352 | $507,988 | $201,891 | $306,097 |

Source: Public Records

Map

Nearby Homes

- 1070 Green St Unit 801

- 1070 Green St Unit 1001

- 1925 Leavenworth St Unit 7

- 999 Green St Unit 1501

- 999 Green St Unit 2001

- 1135 Green St

- 1950 Jones St

- 1145 Green St Unit 3

- 1100 Union St Unit 1100

- 1100 Union St Unit 1000

- 1250 Vallejo St Unit 7

- 1250 Vallejo St Unit 9

- 16 Delgado Place

- 947 Green St Unit 6

- 1281 Vallejo St Unit 4

- 1179 Filbert St

- 1750 Taylor St Unit 2202

- 1750 Taylor St Unit 1901

- 1750 Taylor St Unit 1401

- 1750 Taylor St Unit 1001

- 1070 Green St Unit 1900

- 1070 Green St Unit 1901

- 1070 Green St Unit 1802

- 1070 Green St Unit 1801

- 1070 Green St Unit 1702

- 1070 Green St Unit 1701

- 1070 Green St Unit 1602

- 1070 Green St Unit 1601

- 1070 Green St Unit 1502

- 1070 Green St Unit 1501

- 1070 Green St Unit 1402

- 1070 Green St Unit 1401

- 1070 Green St Unit 1302

- 1070 Green St Unit 1301

- 1070 Green St Unit 1201

- 1070 Green St Unit 1103

- 1070 Green St Unit 601

- 1070 Green St Unit 503

- 1070 Green St Unit 502

- 1070 Green St Unit 501