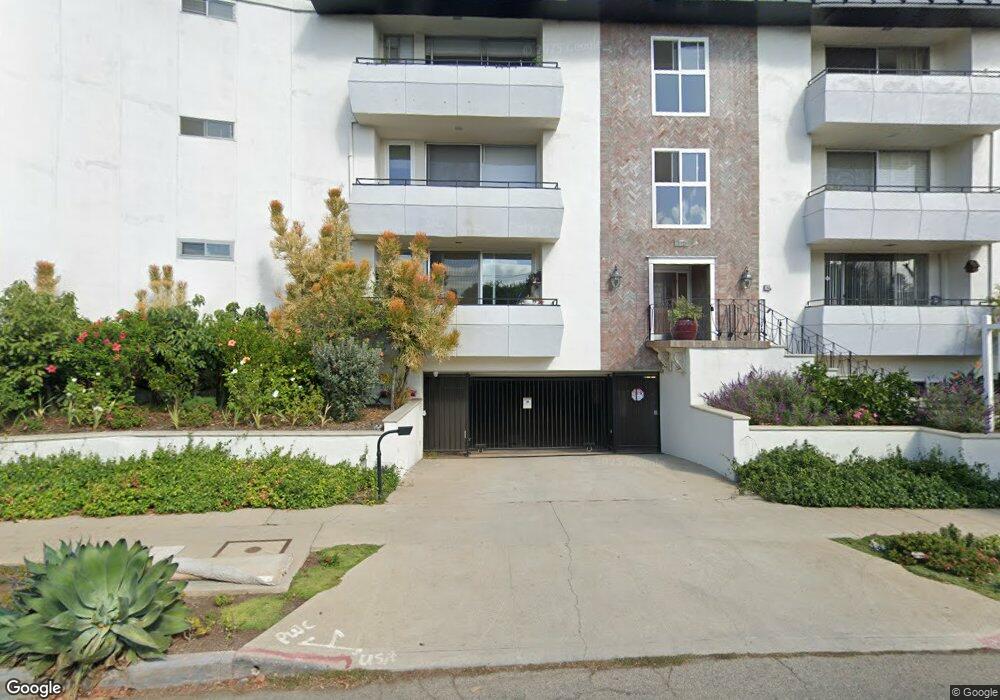

10725 Ohio Ave Unit 305 Los Angeles, CA 90024

Westwood NeighborhoodEstimated Value: $830,383 - $1,051,000

2

Beds

2

Baths

1,178

Sq Ft

$828/Sq Ft

Est. Value

About This Home

This home is located at 10725 Ohio Ave Unit 305, Los Angeles, CA 90024 and is currently estimated at $975,096, approximately $827 per square foot. 10725 Ohio Ave Unit 305 is a home located in Los Angeles County with nearby schools including Fairburn Avenue Elementary, Westwood Charter School, and Ralph Waldo Emerson Community Charter Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 5, 2010

Sold by

Liu Wayne Po Wen

Bought by

Volpert Melissa A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$394,320

Outstanding Balance

$263,280

Interest Rate

5.05%

Mortgage Type

New Conventional

Estimated Equity

$711,816

Purchase Details

Closed on

Oct 4, 2001

Sold by

Niknejad Kourosh

Bought by

Liu Wayne Po Wen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$252,000

Interest Rate

6.73%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Volpert Melissa A | $493,000 | Equity Title Los Angeles | |

| Liu Wayne Po Wen | $315,000 | Equity Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Volpert Melissa A | $394,320 | |

| Previous Owner | Liu Wayne Po Wen | $252,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,543 | $636,232 | $454,491 | $181,741 |

| 2024 | $7,543 | $623,758 | $445,580 | $178,178 |

| 2023 | $7,398 | $611,529 | $436,844 | $174,685 |

| 2022 | $7,053 | $599,539 | $428,279 | $171,260 |

| 2021 | $6,960 | $587,784 | $419,882 | $167,902 |

| 2020 | $7,030 | $581,758 | $415,577 | $166,181 |

| 2019 | $6,748 | $570,352 | $407,429 | $162,923 |

| 2018 | $6,725 | $559,170 | $399,441 | $159,729 |

| 2016 | $6,425 | $537,459 | $383,931 | $153,528 |

| 2015 | $6,330 | $529,386 | $378,164 | $151,222 |

| 2014 | $6,354 | $519,017 | $370,757 | $148,260 |

Source: Public Records

Map

Nearby Homes

- 10725 Ohio Ave Unit PH2

- 10725 Ohio Ave Unit 301

- 10721 Ohio Ave

- 10745 Ohio Ave

- 10735 Rochester Ave

- 10687 Wilkins Ave Unit 1

- 1551 Manning Ave Unit 101

- 10671 Wilkins Ave Unit 5

- 10724 Wilshire Blvd Unit 1001

- 10724 Wilshire Blvd Unit 1209

- 10724 Wilshire Blvd Unit 1501

- 10724 Wilshire Blvd Unit 1402

- 10724 Wilshire Blvd Unit 607

- 10724 Wilshire Blvd Unit 703

- 10724 Wilshire Blvd Unit 1005

- 10633 Kinnard Ave Unit 1

- 10750 Wilshire Blvd Unit 203

- 10660 Wilshire Blvd Unit 609

- 10627 Ashton Ave Unit 103

- 1601 Hilts Ave Unit 3

- 10725 Ohio Ave

- 10725 Ohio Ave Unit 5

- 10725 Ohio Ave Unit PH5

- 10725 Ohio Ave Unit PNTHSE

- 10725 Ohio Ave Unit PNTHSE 2

- 10725 Ohio Ave Unit PNTHSE 3

- 10725 Ohio Ave Unit PH4

- 10725 Ohio Ave Unit PH3

- 10725 Ohio Ave Unit PH1

- 10725 Ohio Ave Unit 205

- 10725 Ohio Ave Unit 204

- 10725 Ohio Ave Unit 203

- 10725 Ohio Ave Unit 202

- 10725 Ohio Ave Unit 201

- 10725 Ohio Ave Unit 15

- 10725 Ohio Ave Unit 304

- 10725 Ohio Ave Unit 303

- 10725 Ohio Ave Unit 302

- 10733 Ohio Ave Unit 1/2

- 10733 Ohio Ave