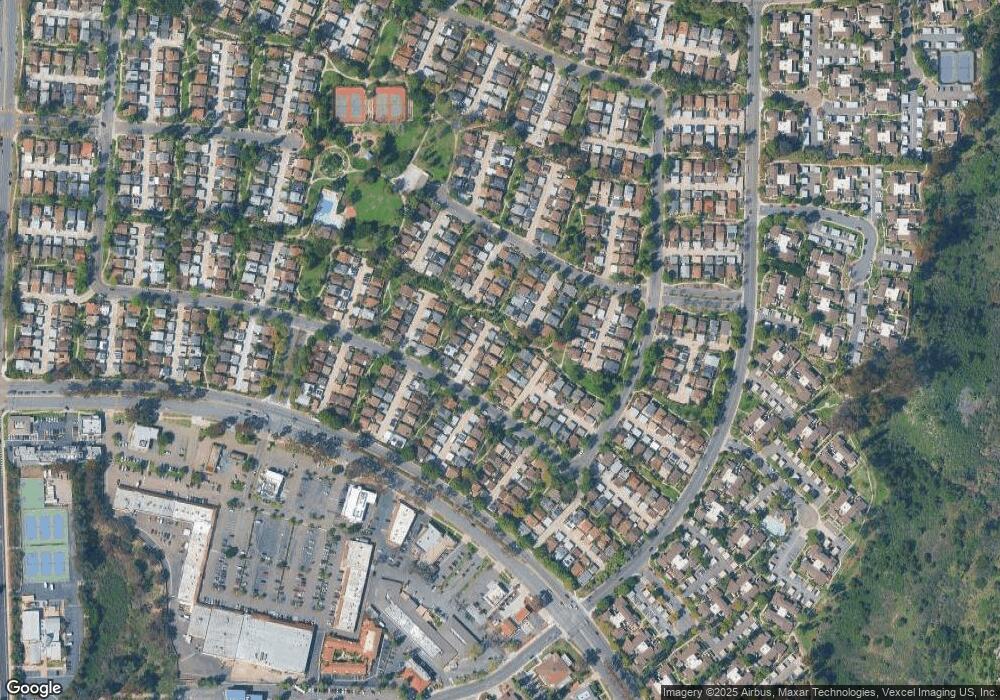

10758 Escobar Dr San Diego, CA 92124

Tierrasanta NeighborhoodEstimated Value: $943,941 - $1,111,000

3

Beds

2

Baths

1,529

Sq Ft

$660/Sq Ft

Est. Value

About This Home

This home is located at 10758 Escobar Dr, San Diego, CA 92124 and is currently estimated at $1,008,485, approximately $659 per square foot. 10758 Escobar Dr is a home located in San Diego County with nearby schools including Tierrasanta Elementary, Farb Middle School, and De Portola Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 20, 2015

Sold by

Palguta Sandra L

Bought by

Lacava Philip S

Current Estimated Value

Purchase Details

Closed on

Jul 15, 2004

Sold by

Gilkerson Larry

Bought by

Gilkerson Sharon

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$475,000

Interest Rate

6.29%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Jun 30, 2004

Sold by

Sande Eleanor N

Bought by

Martinez Lee Q and Gilkerson Sharon

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$475,000

Interest Rate

6.29%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Feb 26, 2002

Sold by

Sande Eleanor N

Bought by

Sande Eleanor N

Purchase Details

Closed on

Dec 30, 1999

Sold by

Sande Elden M

Bought by

Sande Eleanor N

Purchase Details

Closed on

Aug 26, 1999

Sold by

Sande E M

Bought by

Sande Elden M

Purchase Details

Closed on

Aug 6, 1999

Sold by

Sande E M Family Trust 02-08-79 and Elden M

Bought by

Sande Elden M and Sande Eleanor N

Purchase Details

Closed on

Nov 15, 1993

Sold by

Sande E M and Sande E

Bought by

Sande Elden M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lacava Philip S | -- | None Available | |

| Gilkerson Sharon | -- | Fidelity National Title Co | |

| Martinez Lee Q | -- | Fidelity National Title Co | |

| Martinez Lee Q | $500,000 | Fidelity National Title Co | |

| Sande Eleanor N | -- | -- | |

| Sande Eleanor N | -- | -- | |

| Sande Elden M | -- | -- | |

| Sande Elden M | -- | -- | |

| Sande Elden M | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Martinez Lee Q | $475,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,526 | $696,907 | $557,527 | $139,380 |

| 2024 | $8,526 | $683,244 | $546,596 | $136,648 |

| 2023 | $8,336 | $669,848 | $535,879 | $133,969 |

| 2022 | $8,110 | $656,715 | $525,372 | $131,343 |

| 2021 | $7,017 | $560,000 | $398,000 | $162,000 |

| 2020 | $7,002 | $560,000 | $398,000 | $162,000 |

| 2019 | $7,013 | $560,000 | $398,000 | $162,000 |

| 2018 | $6,571 | $550,000 | $391,000 | $159,000 |

| 2017 | $5,956 | $500,000 | $356,000 | $144,000 |

| 2016 | $5,447 | $455,000 | $324,000 | $131,000 |

| 2015 | $5,094 | $425,000 | $303,000 | $122,000 |

| 2014 | $5,054 | $420,000 | $300,000 | $120,000 |

Source: Public Records

Map

Nearby Homes

- 10748 Escobar Dr

- 10716 Escobar Dr

- 5137 Abuela Dr

- 10706 Esmeraldas Dr Unit 6

- 10690 Esmeraldas Dr

- 10617 Escobar Dr Unit 4

- 10812 Lamentin Ct Unit 312

- 10828 Lamentin Ct Unit 313

- 5059 La Cuenta Dr

- 10889 Lamentin Ct

- 10852 Carbet Place

- 10834 Caravelle Place

- 10853 Valldemosa Ln

- 6140 Calle Mariselda Unit 102

- 4375 Calle de Vida

- 5367 Outlook Point

- 10908 Avenida Playa Veracruz

- 10437 Hermanos Rd

- 6161 Calle Mariselda Unit 408

- 10976 Pallon Way

- 10760 Escobar Dr

- 10756 Escobar Dr

- 10762 Escobar Dr

- 10752 Escobar Dr

- 10750 Escobar Dr

- 10754 Escobar Dr

- 10772 Escobar Dr

- 10764 Escobar Dr

- 10770 Escobar Dr

- 10774 Escobar Dr

- 10759 Cariuto Ct

- 10768 Escobar Dr

- 10746 Escobar Dr

- 10766 Escobar Dr

- 10741 Cariuto Ct

- 10757 Cariuto Ct

- 10761 Cariuto Ct

- 10743 Cariuto Ct

- 5016 Abuela Dr

- 10763 Cariuto Ct