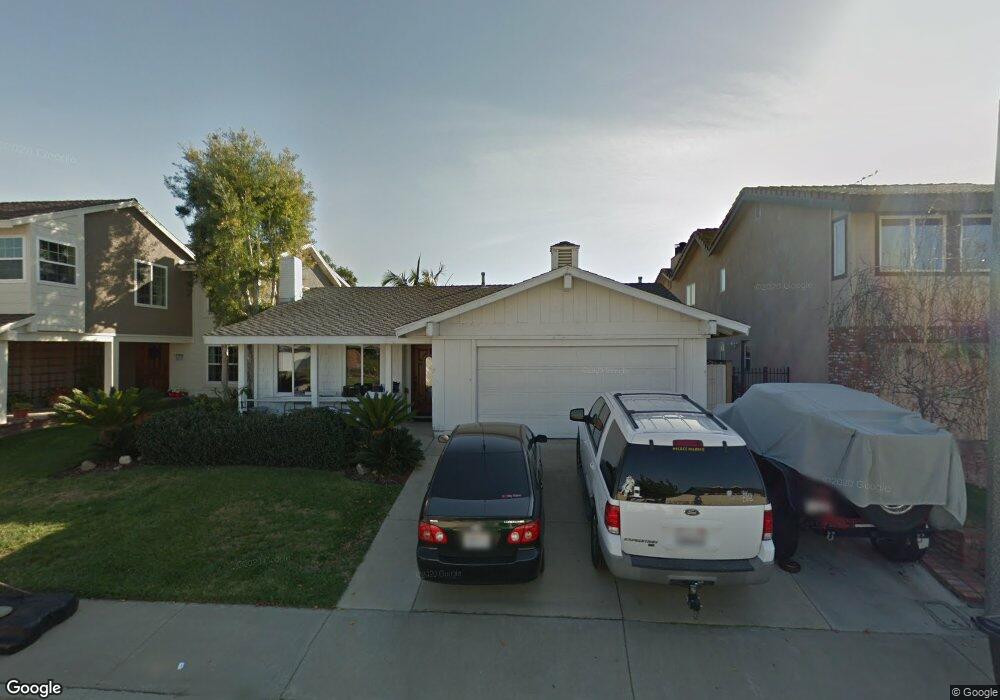

10810 San Leon Ave Fountain Valley, CA 92708

Estimated Value: $1,130,909 - $1,364,000

4

Beds

2

Baths

1,536

Sq Ft

$822/Sq Ft

Est. Value

About This Home

This home is located at 10810 San Leon Ave, Fountain Valley, CA 92708 and is currently estimated at $1,262,227, approximately $821 per square foot. 10810 San Leon Ave is a home located in Orange County with nearby schools including Cox (James H.) Elementary School, Masuda (Kazuo) Middle School, and Fountain Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 8, 2012

Sold by

Stoner Monty G and Stoner Denise L

Bought by

Stoner Monty G and Stoner Denise L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,000

Outstanding Balance

$274,172

Interest Rate

3.9%

Mortgage Type

New Conventional

Estimated Equity

$988,055

Purchase Details

Closed on

Sep 6, 1996

Sold by

Livesey James R and Livesey Deanne

Bought by

Stoner Lamont G and Stoner Denise L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$198,550

Interest Rate

8.37%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stoner Monty G | -- | Fidelity Title | |

| Stoner Lamont G | $209,000 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Stoner Monty G | $400,000 | |

| Closed | Stoner Lamont G | $198,550 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,988 | $340,385 | $214,126 | $126,259 |

| 2024 | $3,988 | $333,711 | $209,927 | $123,784 |

| 2023 | $3,893 | $327,168 | $205,811 | $121,357 |

| 2022 | $3,834 | $320,753 | $201,775 | $118,978 |

| 2021 | $3,762 | $314,464 | $197,818 | $116,646 |

| 2020 | $3,739 | $311,240 | $195,790 | $115,450 |

| 2019 | $3,666 | $305,138 | $191,951 | $113,187 |

| 2018 | $3,597 | $299,155 | $188,187 | $110,968 |

| 2017 | $3,541 | $293,290 | $184,497 | $108,793 |

| 2016 | $3,394 | $287,540 | $180,880 | $106,660 |

| 2015 | $3,342 | $283,221 | $178,163 | $105,058 |

| 2014 | $3,277 | $277,674 | $174,673 | $103,001 |

Source: Public Records

Map

Nearby Homes

- 10900 La Flor Ave

- 10519 La Rosa Cir

- 10430 La Cebra Ave

- 17401 Hood Ct

- 17288 San Lorenzo Cir

- 10452 Circulo de Juarez

- 18189 Muir Woods Ct

- 10231 Bunting Ave

- 10322 Avenida Cinco de Mayo

- 17077 Los Modelos St

- 10200 Peregrine Cir

- 17071 Ward St

- 3295 Iowa St

- 1722 New Hampshire Dr

- 17333 Brookhurst St Unit B7

- 17333 Brookhurst St Unit D6

- 17168 Newhope St Unit 222

- 17200 Newhope St Unit 109

- 17200 Newhope St Unit 217

- 11620 Warner Ave Unit 624

- 10820 San Leon Ave

- 10800 San Leon Ave

- 10830 San Leon Ave

- 10790 San Leon Ave

- 17825 San Maiz St

- 17824 San Miniso Cir

- 10840 San Leon Ave

- 10817 Goldeneye Ave

- 10829 Goldeneye Ave

- 10805 Goldeneye Ave

- 17815 San Maiz St

- 17814 San Miniso Cir

- 10780 San Leon Ave

- 10850 San Leon Ave

- 10839 Goldeneye Ave

- 17824 San Maiz St

- 10801 Goldeneye Ave

- 10849 Goldeneye Ave

- 17805 San Maiz St

- 10860 San Leon Ave