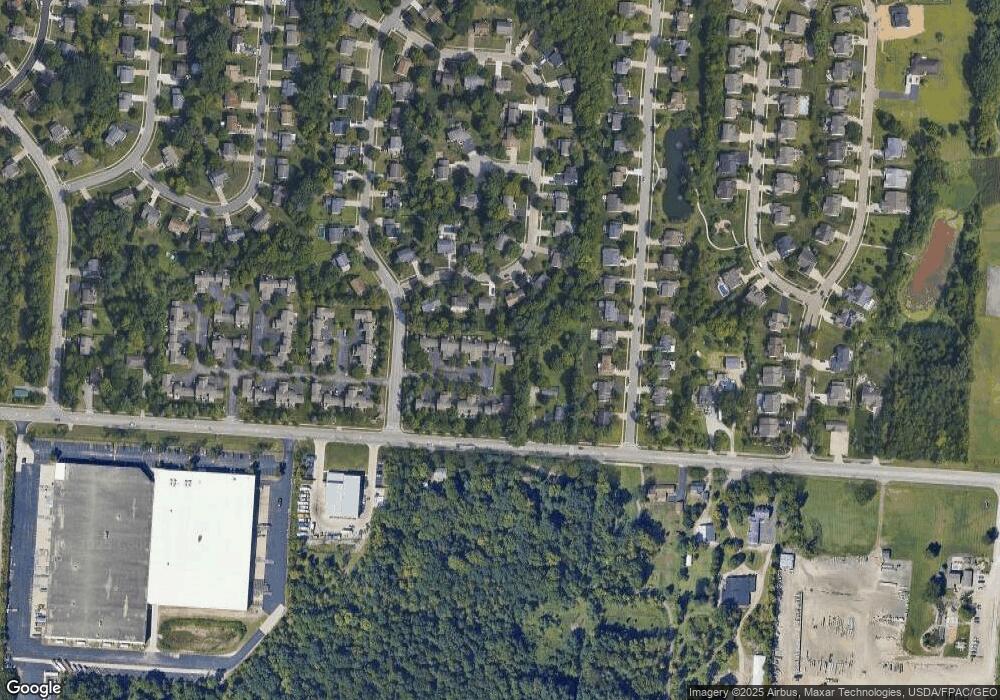

1082 Cypress Ln Unit 127 Columbus, OH 43230

Rathburn Woods NeighborhoodEstimated Value: $307,000 - $362,000

3

Beds

3

Baths

1,700

Sq Ft

$191/Sq Ft

Est. Value

About This Home

This home is located at 1082 Cypress Ln Unit 127, Columbus, OH 43230 and is currently estimated at $324,192, approximately $190 per square foot. 1082 Cypress Ln Unit 127 is a home located in Franklin County with nearby schools including Lincoln Elementary School, Gahanna South Middle School, and Lincoln High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 14, 2011

Sold by

Davis Jennifer M and Davis Santino M

Bought by

Davis Jennifer M and Davis Santino M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,972

Outstanding Balance

$87,816

Interest Rate

4.93%

Mortgage Type

FHA

Estimated Equity

$236,376

Purchase Details

Closed on

Aug 30, 2000

Sold by

Mclaren James R and Mclaren Bonnie J

Bought by

Emerich Jennifer M and Davis Santino M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$129,450

Interest Rate

8.15%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 23, 1998

Sold by

Davidson Phillips Inc

Bought by

Mclaren James R and Mclaren Bonnie J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,700

Interest Rate

4.75%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Davis Jennifer M | -- | None Available | |

| Emerich Jennifer M | $133,500 | -- | |

| Mclaren James R | $138,400 | Steward Title Agency Of Colu |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Davis Jennifer M | $126,972 | |

| Closed | Emerich Jennifer M | $129,450 | |

| Previous Owner | Mclaren James R | $110,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,452 | $92,540 | $15,050 | $77,490 |

| 2023 | $5,383 | $92,540 | $15,050 | $77,490 |

| 2022 | $4,778 | $63,980 | $8,750 | $55,230 |

| 2021 | $4,621 | $63,980 | $8,750 | $55,230 |

| 2020 | $4,582 | $63,980 | $8,750 | $55,230 |

| 2019 | $3,673 | $51,170 | $7,000 | $44,170 |

| 2018 | $3,419 | $51,170 | $7,000 | $44,170 |

| 2017 | $3,280 | $51,170 | $7,000 | $44,170 |

| 2016 | $3,190 | $44,100 | $6,930 | $37,170 |

| 2015 | $3,192 | $44,100 | $6,930 | $37,170 |

| 2014 | $3,168 | $44,100 | $6,930 | $37,170 |

| 2013 | $1,655 | $46,410 | $7,280 | $39,130 |

Source: Public Records

Map

Nearby Homes

- 1252 Rice Ave

- 349 Helmbright Dr

- 875 Taylor Station Rd

- 970 Claycraft Rd

- 249 Farm Creek Dr

- 1391 Windrush Cir

- 555 Chadwood Dr

- 745 Fleetrun Ave

- 107 Kinder Place

- 6162 Stockton Trail Way

- 6343 Hoffman Trace Dr

- 5986 Stratton Place

- 3005 Souder Dr

- 6924 Shady Rock Ln

- 6972 Shady Rock Ln

- 6913 Onyxbluff Ln

- 321 Flint Ridge Dr

- 3264 Mann Rd

- 488 Three Oaks Ct Unit 488

- 148 Sierra Dr

- 1084 Cypress Ln Unit 128

- 1076 Cypress Ln Unit 126

- 1076 Cypress Ln Unit 6

- 1074 Cypress Ln

- 1072 Cypress Ln Unit 124

- 534 Whitson Dr

- 532 Whitson Dr

- 1068 Cypress Ln Unit 123

- 536 Whitson Dr

- 1066 Cypress Ln Unit 122

- 1083 Cypress Ln Unit 138

- 1073 Cypress Ln Unit 135

- 1081 Cypress Ln

- 1075 Cypress Ln Unit 136

- 1060 Cypress Ln Unit 121

- 1071 Cypress Ln Unit 134

- 1067 Cypress Ln Unit 133

- 528 Whitson Dr

- 538 Whitson Dr

- 1065 Cypress Ln