10943 Clairmnt ms Blvd Unit 386 San Diego, CA 92124

Tierrasanta NeighborhoodEstimated Value: $636,000 - $698,000

3

Beds

2

Baths

1,250

Sq Ft

$531/Sq Ft

Est. Value

About This Home

This home is located at 10943 Clairmnt ms Blvd Unit 386, San Diego, CA 92124 and is currently estimated at $663,553, approximately $530 per square foot. 10943 Clairmnt ms Blvd Unit 386 is a home located in San Diego County with nearby schools including Tierrasanta Elementary, De Portola Middle School, and Farb Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 6, 2018

Sold by

Hagood Heidi

Bought by

Iniguez Castro Jorge A Cordero and Iniguez Cordero Mercedes D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$215,000

Outstanding Balance

$189,049

Interest Rate

4.8%

Mortgage Type

New Conventional

Estimated Equity

$474,504

Purchase Details

Closed on

Jan 8, 2016

Sold by

Rebolloso Deborah J

Bought by

Hagood Heidi

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$304,200

Interest Rate

3.64%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 18, 2010

Sold by

Esposito Phyllis

Bought by

Esposito Phyllis and Rebolloso Deborah J

Purchase Details

Closed on

Jun 21, 2001

Sold by

Boccia Gaetano C and Boccia Patricia

Bought by

Esposito Phyllis

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,000

Interest Rate

7.26%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 12, 1991

Purchase Details

Closed on

May 8, 1986

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Iniguez Castro Jorge A Cordero | $415,000 | Corinthian Title Company | |

| Hagood Heidi | $338,000 | Chicago Title Company | |

| Esposito Phyllis | -- | None Available | |

| Esposito Phyllis | $216,000 | Equity Title | |

| -- | $125,000 | -- | |

| -- | $86,100 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Iniguez Castro Jorge A Cordero | $215,000 | |

| Previous Owner | Hagood Heidi | $304,200 | |

| Previous Owner | Esposito Phyllis | $119,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,590 | $462,933 | $166,652 | $296,281 |

| 2024 | $5,590 | $453,857 | $163,385 | $290,472 |

| 2023 | $5,463 | $444,959 | $160,182 | $284,777 |

| 2022 | $5,314 | $436,236 | $157,042 | $279,194 |

| 2021 | $5,273 | $427,683 | $153,963 | $273,720 |

| 2020 | $5,208 | $423,299 | $152,385 | $270,914 |

| 2019 | $5,114 | $415,000 | $149,398 | $265,602 |

| 2018 | $4,215 | $351,653 | $126,593 | $225,060 |

| 2017 | $80 | $344,759 | $124,111 | $220,648 |

| 2016 | $3,289 | $273,284 | $98,381 | $174,903 |

| 2015 | $3,241 | $269,180 | $96,904 | $172,276 |

| 2014 | $3,108 | $263,908 | $95,006 | $168,902 |

Source: Public Records

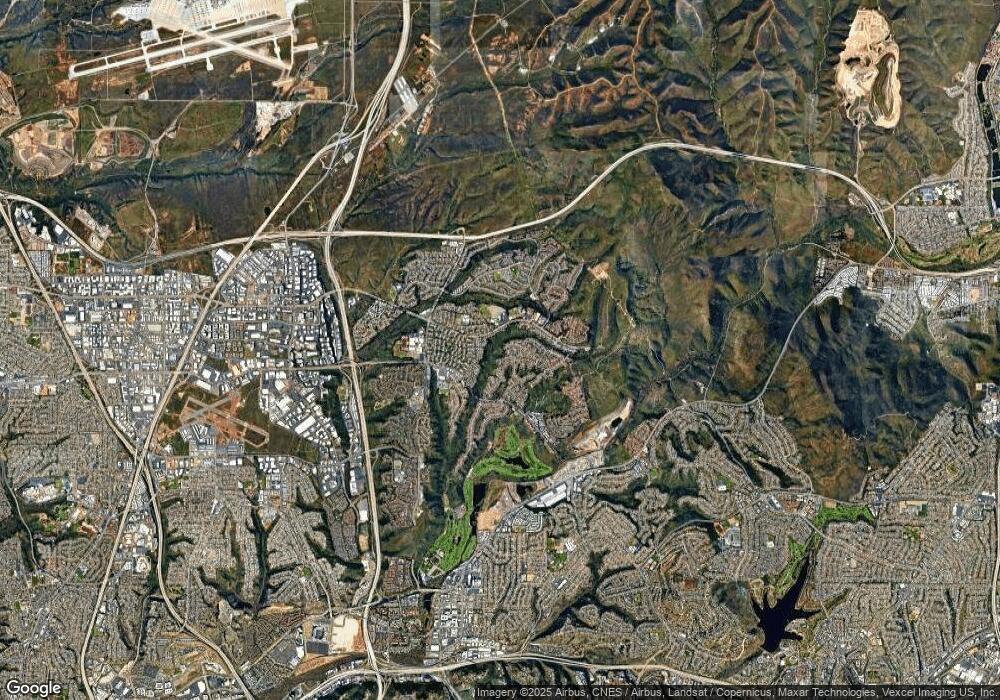

Map

Nearby Homes

- 10889 Lamentin Ct

- 10828 Lamentin Ct Unit 313

- 10834 Caravelle Place

- 10812 Lamentin Ct Unit 312

- 5137 Abuela Dr

- 10706 Esmeraldas Dr Unit 6

- 4375 Calle de Vida

- 10690 Esmeraldas Dr

- 5059 La Cuenta Dr

- 10748 Escobar Dr

- 10852 Carbet Place

- 10716 Escobar Dr

- 10908 Avenida Playa Veracruz

- 4989 Corte Playa Encino

- 6140 Calle Mariselda Unit 102

- 5238 Camino Playa Malaga

- 10617 Escobar Dr Unit 4

- 6161 Calle Mariselda Unit 408

- 4755 Mayita Way

- 10853 Valldemosa Ln

- 10955 Clairemont Mesa Blvd

- 10929 Clairmnt ms Blvd Unit 381

- 10927 Clairmnt ms Blvd Unit 380

- 10955 Clairmnt ms Blvd

- 10951 Clairmnt ms Blvd Unit 390

- 10947 Clairmnt ms Blvd

- 10945 Clairmnt ms Blvd Unit 387

- 5285 Marig San Diego

- 0 Clairemont Mesa Blvd Unit 130035458

- 0 Clairemont Mesa Blvd Unit 200046866

- 0 Clairemont Mesa Blvd Unit 200012571

- 10953 Clairemont Mesa Blvd

- 10953 Clairmnt ms Blvd

- 10941 Clairemont Mesa Blvd

- 10943 Clairemont Mesa Blvd

- 10931 Clairemont Mesa Blvd

- 10929 Clairemont Mesa Blvd

- 10927 Clairemont Mesa Blvd

- 10925 Clairemont Mesa Blvd

- 10949 Clairemont Mesa Blvd