Estimated Value: $206,000 - $274,000

3

Beds

2

Baths

1,727

Sq Ft

$145/Sq Ft

Est. Value

About This Home

This home is located at 1106 S Gardenia St, Pharr, TX 78577 and is currently estimated at $251,103, approximately $145 per square foot. 1106 S Gardenia St is a home located in Hidalgo County with nearby schools including Aida C. Escobar Elementary, Kennedy Middle School, and PSJA Southwest Early College High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 15, 2017

Sold by

Avilas Jaime Alberto San Romon

Bought by

Rodriguez Delia and Rodriguez Roberto C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,400

Outstanding Balance

$117,121

Interest Rate

4.3%

Mortgage Type

New Conventional

Estimated Equity

$133,982

Purchase Details

Closed on

Dec 14, 2009

Sold by

Caribella Homes Llc

Bought by

Aviles Jaime Alberto San Roman

Purchase Details

Closed on

Apr 13, 2009

Sold by

Esponjas Development Ltd

Bought by

Caribella Homes Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$105,000

Interest Rate

4.84%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rodriguez Delia | -- | Valley Land Title | |

| Aviles Jaime Alberto San Roman | -- | None Available | |

| Caribella Homes Llc | -- | Sierra Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rodriguez Delia | $140,400 | |

| Previous Owner | Caribella Homes Llc | $105,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,128 | $224,952 | $68,880 | $156,072 |

| 2024 | $6,128 | $228,469 | $68,880 | $159,589 |

| 2023 | $5,709 | $213,023 | $51,660 | $161,363 |

| 2022 | $5,478 | $195,289 | $50,400 | $144,889 |

| 2021 | $4,849 | $169,743 | $50,400 | $119,343 |

| 2020 | $4,947 | $171,010 | $50,400 | $120,610 |

| 2019 | $4,566 | $155,818 | $50,400 | $105,418 |

| 2018 | $4,477 | $151,901 | $50,400 | $101,501 |

| 2017 | $4,298 | $144,605 | $42,000 | $102,605 |

| 2016 | $4,331 | $145,708 | $42,000 | $103,708 |

| 2015 | $4,238 | $146,812 | $42,000 | $104,812 |

Source: Public Records

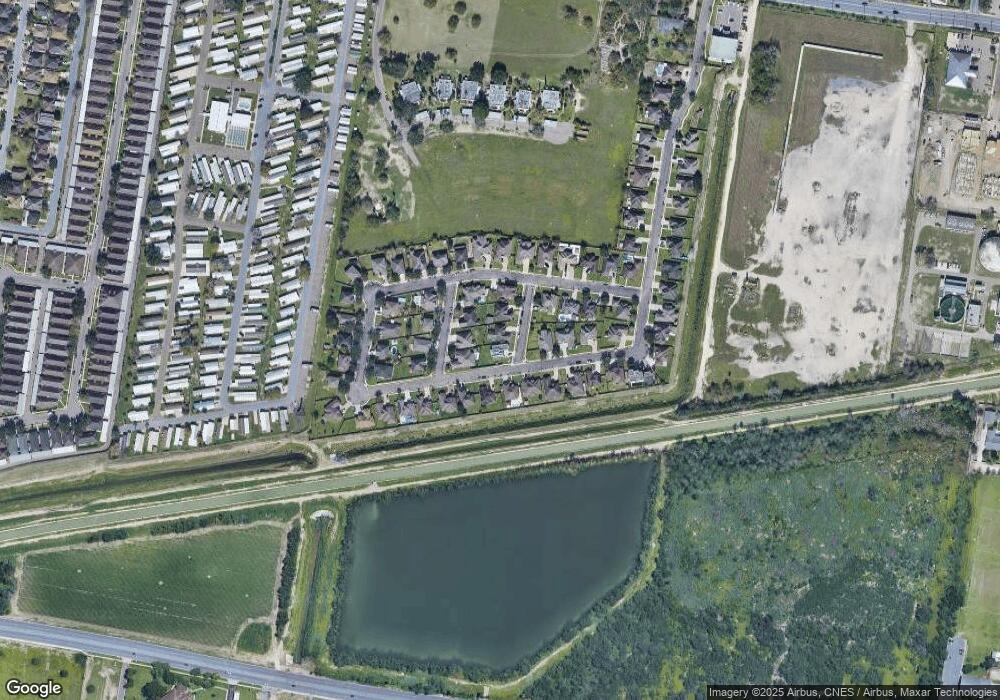

Map

Nearby Homes

- 208 W Palma Vista Dr

- 1511 W Ridge Rd

- 201 W Sam Houston Blvd

- 1007 S Palm Dr

- 907 W Carmel Ave

- 701 S Hibiscus St Unit 12

- 805 W Garrison Dr

- 1422 S Esperanza St

- 903 W Smith Dr

- 504 W Jones Ave

- 502 W Jones Ave

- 318 W Sam Houston Blvd

- 511 W Jackson Ave

- TBD W Jackson Ave

- 1216 S Azalea St

- 804 W Inspiration Dr

- 1503 S Pamplona St

- 301 S Palm Dr

- 109 E McDonald Ave

- 702 W Moore Rd

- 1104 S Gardenia St

- 3005 S Gardenia St

- 3009 S Gardenia St

- 3007 S Gardenia St

- 3003 S Gardenia St

- 1201 S Hibiscus St

- 1105 S Hibiscus St

- 907 W Daffodil Ave

- 1001 W Daffodil Ave

- 1102 S Gardenia St

- 1103 S Hibiscus St

- 904 W Daffodil Ave

- 1003 W Daffodil Ave

- 1003 W Daffodil Ave Unit 21

- 905 W Daffodil Ave

- 1100 S Gardenia St

- 1101 S Hibiscus St

- 903 W Daffodil Ave

- 1005 W Daffodil Ave

- 905 W Helmer St