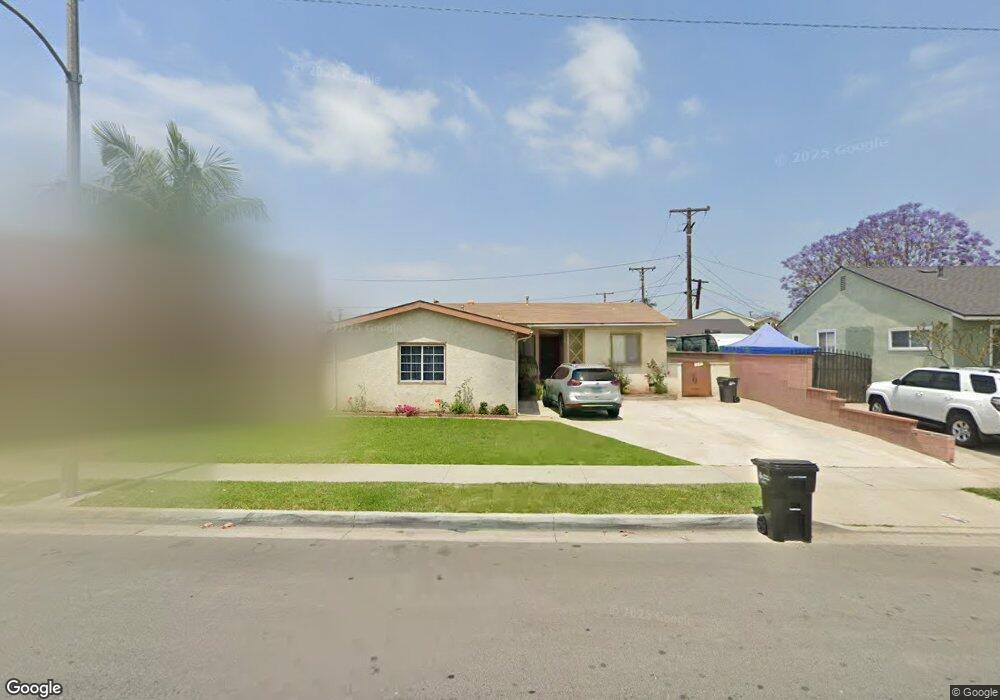

1109 Carob Way Montebello, CA 90640

Estimated Value: $702,000 - $795,262

3

Beds

2

Baths

1,285

Sq Ft

$581/Sq Ft

Est. Value

About This Home

This home is located at 1109 Carob Way, Montebello, CA 90640 and is currently estimated at $747,066, approximately $581 per square foot. 1109 Carob Way is a home located in Los Angeles County with nearby schools including Greenwood Elementary School, La Merced Intermediate School, and Montebello High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 7, 2018

Sold by

Bernal Daniel

Bought by

Martinez Eloise

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$464,432

Outstanding Balance

$396,748

Interest Rate

4.25%

Mortgage Type

FHA

Estimated Equity

$350,318

Purchase Details

Closed on

Apr 26, 2010

Sold by

Pursell Cecilia and The Vigil Family Grantor Trust

Bought by

Bernal Daniel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$328,932

Interest Rate

4.75%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 30, 2009

Sold by

Vigil Frances F

Bought by

Pursell Cecilia and The Vigil Family Grantor Trust

Purchase Details

Closed on

May 18, 1998

Sold by

Ramos Rudolph

Bought by

Ramos Rudolph and Rudolph Ramos Living Trust

Purchase Details

Closed on

Jan 23, 1997

Sold by

Ramos Rudolph and Ramos Elizabeth

Bought by

Ramos Rudolph

Purchase Details

Closed on

Jun 9, 1994

Sold by

Vigil Frances F

Bought by

Vigil Frances F

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Martinez Eloise | $473,000 | Lawyers Title | |

| Bernal Daniel | $335,000 | Cctn | |

| Pursell Cecilia | -- | None Available | |

| Vigil Frances F | -- | None Available | |

| Ramos Rudolph | -- | -- | |

| Ramos Rudolph | -- | -- | |

| Vigil Frances F | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Martinez Eloise | $464,432 | |

| Previous Owner | Bernal Daniel | $328,932 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,958 | $538,187 | $405,406 | $132,781 |

| 2024 | $7,958 | $527,635 | $397,457 | $130,178 |

| 2023 | $7,937 | $517,290 | $389,664 | $127,626 |

| 2022 | $7,670 | $507,148 | $382,024 | $125,124 |

| 2021 | $7,403 | $497,205 | $374,534 | $122,671 |

| 2019 | $7,085 | $482,460 | $363,426 | $119,034 |

| 2018 | $5,872 | $380,039 | $221,670 | $158,369 |

| 2016 | $5,627 | $365,283 | $213,063 | $152,220 |

| 2015 | $5,330 | $359,797 | $209,863 | $149,934 |

| 2014 | $5,260 | $352,750 | $205,753 | $146,997 |

Source: Public Records

Map

Nearby Homes

- 740 Albee St

- 730 Frankel Ave Unit B9

- 524 Washington Blvd

- 1109 S Spruce St

- 932 S Montebello Blvd

- 1032 S Greenwood Ave

- 919 Carob Way

- 965 Acacia Ln

- 912 Jacmar Dr

- 757 S 4th St

- 859 W Carmelita Ave

- 6733 Candace Ave

- 637 Carmelita Place

- 552 S 6th St

- 816 W Mines Ave

- 522 S 5th St

- 862 W Mines Ave

- 630 S Maple Ave Unit 44

- 630 S Maple Ave Unit 7

- 1118 Calle Montana