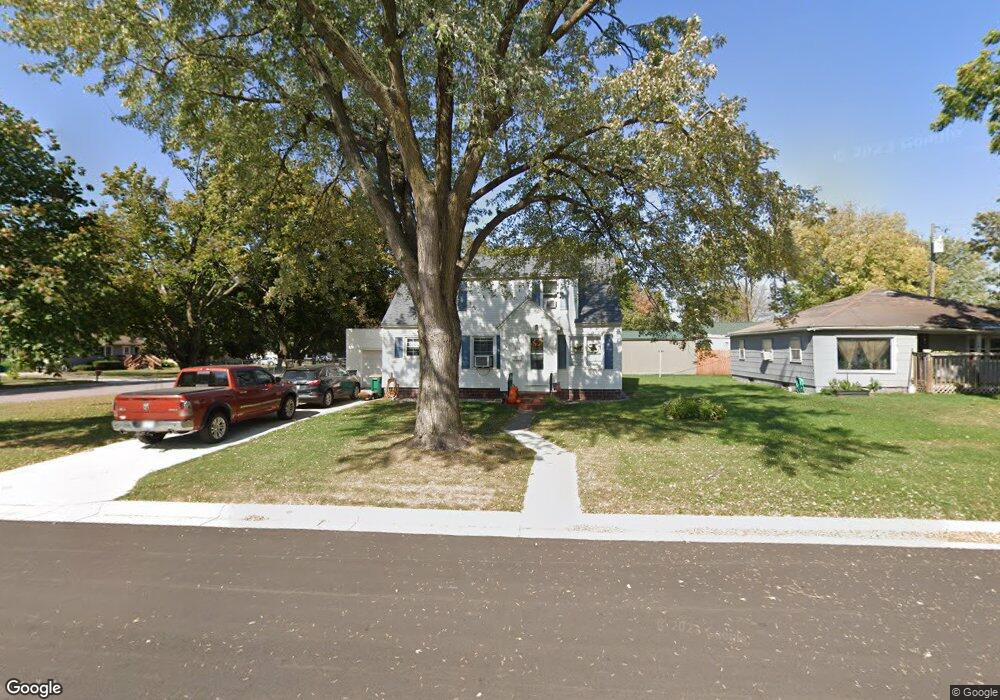

112 W 4th St Sherburn, MN 56171

Estimated Value: $83,000 - $112,000

5

Beds

1

Bath

1,530

Sq Ft

$62/Sq Ft

Est. Value

About This Home

This home is located at 112 W 4th St, Sherburn, MN 56171 and is currently estimated at $95,591, approximately $62 per square foot. 112 W 4th St is a home located in Martin County with nearby schools including Sherburn Elementary School, Trimont Elementary School, and Welcome Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 9, 2020

Sold by

Finke Paula and Finke Michael

Bought by

Skrove Arik J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$57,000

Outstanding Balance

$50,677

Interest Rate

2.67%

Mortgage Type

New Conventional

Estimated Equity

$44,914

Purchase Details

Closed on

Dec 8, 2020

Sold by

Finke Paula and Finke Michael

Bought by

Lutterman Loren and Lutterman Vicki

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$57,000

Outstanding Balance

$50,677

Interest Rate

2.67%

Mortgage Type

New Conventional

Estimated Equity

$44,914

Purchase Details

Closed on

Nov 18, 2005

Sold by

Lutterman Leon Dale and Lutterman Ruth E

Bought by

Lutterman Ruth E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Skrove Arik J | $69,900 | Jenkinson Abstract | |

| Lutterman Loren | $69,900 | Jenkinson Abstract Company | |

| Lutterman Ruth E | -- | None Available | |

| Skrove Arik Arik | $69,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lutterman Loren | $57,000 | |

| Closed | Skrove Arik J | $57,000 | |

| Closed | Skrove Arik J | $67,567 | |

| Closed | Lutterman Loren | $67,567 | |

| Closed | Skrove Arik Arik | $69,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,080 | $91,300 | $6,300 | $85,000 |

| 2024 | $1,690 | $92,400 | $3,600 | $88,800 |

| 2023 | $958 | $77,500 | $2,100 | $75,400 |

| 2022 | $798 | $78,200 | $2,100 | $76,100 |

| 2021 | $902 | $53,200 | $2,100 | $51,100 |

| 2020 | $1,494 | $60,800 | $2,100 | $58,700 |

| 2019 | $1,486 | $51,000 | $2,100 | $48,900 |

| 2018 | $1,498 | $47,200 | $2,100 | $45,100 |

| 2017 | $1,496 | $27,100 | $961 | $26,139 |

| 2016 | $1,544 | $27,100 | $961 | $26,139 |

| 2015 | $810 | $29,200 | $961 | $28,239 |

| 2013 | $978 | $33,000 | $1,560 | $31,440 |

Source: Public Records

Map

Nearby Homes

- 409 N Prairie St

- 102 Ringer Dr

- 211 N Prairie St

- 109 N Main St

- 306 W 2nd St

- 302 N Manyaska St

- 402 W 1st St Unit 420 1st Street West

- 402 W 1st St

- 407 E 2nd St

- 129 S Main St

- 219 Fairmont Ave

- 307 S Main St

- 725 110th St

- 602 Kenzie St

- 110th Street

- TBD Lake Shore Dr

- Xxx Lake Shore Dr

- 801 140th St

- 4 S Fox Lake Dr W

- 4 S Fox Lake Dr E

- 108 W 4th St

- 402 N Prairie St

- 310 N Prairie St

- 406 N Prairie St

- 401 N Prairie St

- 401 N Osborne St

- 315 N Prairie St

- 405 N Prairie St

- 405 N Osborne St

- 308 N Prairie St

- 410 N Prairie St

- 409 409 N Prairie St

- 309 N Osborne St

- 311 N Prairie St

- 304 N Prairie St

- 103 5th St

- 411 N Prairie St

- 305 N Osborne St

- 413 413 N Prairie St

- 307 N Prairie St