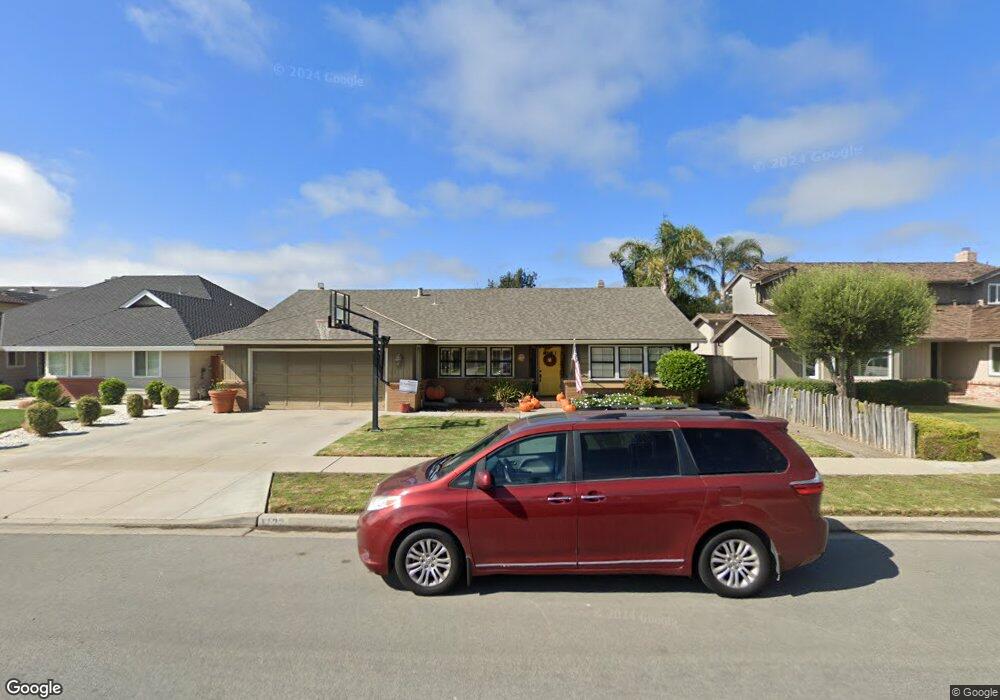

1122 Orinda Way Unit 2 Salinas, CA 93901

South Salinas NeighborhoodEstimated Value: $862,005 - $958,000

3

Beds

2

Baths

2,028

Sq Ft

$447/Sq Ft

Est. Value

About This Home

This home is located at 1122 Orinda Way Unit 2, Salinas, CA 93901 and is currently estimated at $905,751, approximately $446 per square foot. 1122 Orinda Way Unit 2 is a home located in Monterey County with nearby schools including University Park Elementary School, Mission Park Elementary School, and Lincoln Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 11, 2000

Sold by

Maker Stephanie R

Bought by

Maker Wyatt P

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$314,400

Outstanding Balance

$110,668

Interest Rate

8%

Estimated Equity

$795,083

Purchase Details

Closed on

May 18, 1999

Sold by

Sites Daniel K and Sites Jennifer L

Bought by

Sites Daniel K and Sites Jennifer L

Purchase Details

Closed on

Mar 5, 1998

Sold by

Sites Jennifer L

Bought by

Sites Dennis K and Sites Jennifer L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,000

Interest Rate

7.11%

Purchase Details

Closed on

Sep 11, 1996

Sold by

Pattee Ranch Associates

Bought by

Sites Dennis J and Sites Millicent J

Purchase Details

Closed on

Feb 1, 1996

Sold by

Adams Rick T and Adams Amy B

Bought by

Sites Dennis J and Sites Millicent J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Maker Wyatt P | -- | Old Republic Title Company | |

| Maker Wyatt P | $393,000 | Old Republic Title Company | |

| Sites Daniel K | -- | -- | |

| Sites Dennis K | -- | -- | |

| Sites Jennifer L | -- | Old Republic Title Company | |

| Sites Jennifer L | $260,000 | Old Republic Title Company | |

| Sites Dennis J | $257,000 | Chicago Title | |

| Sites Dennis J | $124,000 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Maker Wyatt P | $314,400 | |

| Previous Owner | Sites Jennifer L | $135,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,461 | $592,195 | $158,215 | $433,980 |

| 2024 | $7,461 | $580,584 | $155,113 | $425,471 |

| 2023 | $7,133 | $569,201 | $152,072 | $417,129 |

| 2022 | $6,770 | $558,041 | $149,091 | $408,950 |

| 2021 | $6,428 | $547,100 | $146,168 | $400,932 |

| 2020 | $6,268 | $541,491 | $144,670 | $396,821 |

| 2019 | $6,189 | $530,875 | $141,834 | $389,041 |

| 2018 | $6,082 | $520,466 | $139,053 | $381,413 |

| 2017 | $6,051 | $510,262 | $136,327 | $373,935 |

| 2016 | $5,890 | $500,257 | $133,654 | $366,603 |

| 2015 | $5,497 | $471,000 | $126,000 | $345,000 |

| 2014 | $4,299 | $388,000 | $104,000 | $284,000 |

Source: Public Records

Map

Nearby Homes

- 785 Ambrose Dr

- 786 Bellarmine Dr

- 961 Loyola Dr

- 877 San Simeon Dr

- 1111 Santa fe Way

- 807 University Ave

- 981 Sierra Madre Dr

- 1223 La Canada Way

- 426 Palma Dr

- 1101 Greenwood Place

- 840 Archer St

- 435 Shelley Way

- 318 La Jolla Cir

- 307 De la Vina Way

- 1310 Primavera St Unit 118

- 330 Woodside Dr Unit 104

- 527 Park St

- 844 Capistrano Dr

- 315 3151/2 Archer St

- 929 Capistrano Dr

- 1118 Orinda Way

- 1126 Orinda Way

- 1113 Palo Alto Way

- 1114 Orinda Way

- 1128 Orinda Way

- 1109 Palo Alto Way

- 1125 Orinda Way

- 1121 Orinda Way

- 1129 Orinda Way

- 1125 Palo Alto Way

- 1117 Orinda Way

- 1110 Orinda Way

- 1195 Loyola Dr

- 1105 Palo Alto Way

- 1131 Orinda Way

- 1113 Orinda Way

- 1129 Palo Alto Way

- 1114 Palo Alto Way

- 1136 Kentfield Dr

- 1134 Kentfield Dr