1127 Moreno Way Placentia, CA 92870

Estimated Value: $935,784 - $1,088,000

4

Beds

3

Baths

1,807

Sq Ft

$558/Sq Ft

Est. Value

About This Home

This home is located at 1127 Moreno Way, Placentia, CA 92870 and is currently estimated at $1,008,446, approximately $558 per square foot. 1127 Moreno Way is a home located in Orange County with nearby schools including John O. Tynes Elementary School, Kraemer Middle School, and Valencia High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 3, 2010

Sold by

Debest Peter H and De Best Jennifer M

Bought by

Debest Peter H and Debest Jennifer M

Current Estimated Value

Purchase Details

Closed on

Feb 28, 2006

Sold by

Debest Peter

Bought by

Debest Peter H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$416,000

Outstanding Balance

$233,296

Interest Rate

6.04%

Mortgage Type

New Conventional

Estimated Equity

$775,150

Purchase Details

Closed on

Oct 24, 2001

Sold by

Debest Jennifer Michelle

Bought by

Debest Pete

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$244,000

Interest Rate

6.87%

Purchase Details

Closed on

Oct 8, 2001

Sold by

Wolfe Roy Louis

Bought by

Debest Pete

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$244,000

Interest Rate

6.87%

Purchase Details

Closed on

Jun 21, 2000

Sold by

Sarte Antonio G and Sarte Deizel P

Bought by

Wolfe Roy Louis

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$270,750

Interest Rate

8.19%

Purchase Details

Closed on

Feb 27, 1997

Sold by

Haseko Townhomes Inc

Bought by

Sarte Antonio G and Sarte Deizel P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$186,400

Interest Rate

7.9%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Debest Peter H | -- | None Available | |

| Debest Peter H | -- | None Available | |

| Debest Peter H | -- | Fidelity National Title | |

| Debest Pete | -- | Orange Coast Title Company | |

| Debest Pete | $305,000 | -- | |

| Wolfe Roy Louis | $285,000 | Commonwealth Land Title Co | |

| Sarte Antonio G | $196,500 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Debest Peter H | $416,000 | |

| Closed | Debest Pete | $244,000 | |

| Previous Owner | Wolfe Roy Louis | $270,750 | |

| Previous Owner | Sarte Antonio G | $186,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,712 | $450,567 | $250,556 | $200,011 |

| 2024 | $5,712 | $441,733 | $245,643 | $196,090 |

| 2023 | $5,587 | $433,072 | $240,826 | $192,246 |

| 2022 | $5,495 | $424,581 | $236,104 | $188,477 |

| 2021 | $5,358 | $416,256 | $231,474 | $184,782 |

| 2020 | $5,373 | $411,988 | $229,100 | $182,888 |

| 2019 | $5,162 | $403,910 | $224,608 | $179,302 |

| 2018 | $5,097 | $395,991 | $220,204 | $175,787 |

| 2017 | $5,013 | $388,227 | $215,886 | $172,341 |

| 2016 | $4,916 | $380,615 | $211,653 | $168,962 |

| 2015 | $4,854 | $374,898 | $208,473 | $166,425 |

| 2014 | $4,724 | $367,555 | $204,390 | $163,165 |

Source: Public Records

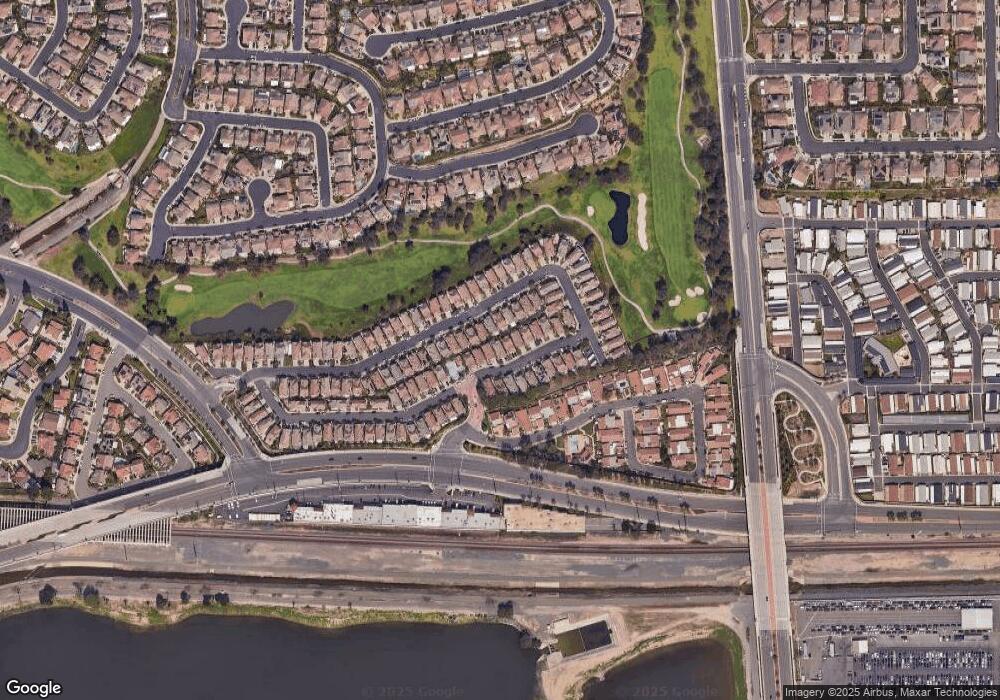

Map

Nearby Homes

- 1171 Curie Ln

- 1037 Davis Way

- 327 Tomko Way

- 1203 Castner Dr

- 420 Augusta Ln

- 1259 E Providence Loop

- 988 Spyglass Place

- Lyda Plan at Vista Rose

- Elina Plan at Vista Rose

- Gallica Plan at Vista Rose

- Prairie Plan at Vista Rose

- 583 Patten Ave

- 918 Doral Ct

- 615 Jensen Place

- 625 Patten Ave

- 582 Mcfadden St

- 651 Ziegler Way

- 653 Patten Ave

- 707 Olivier Dr

- 709 Olivier Dr

- 1133 Moreno Way

- 1121 Moreno Way

- 1139 Moreno Way Unit 116

- 1115 Moreno Way Unit 120

- 1136 Davis Way Unit 101

- 1142 Davis Way

- 1148 Davis Way Unit 103

- 1130 Davis Way

- 1145 Moreno Way

- 1154 Davis Way

- 1122 Moreno Way

- 1124 Davis Way

- 1116 Moreno Way

- 1110 Moreno Way

- 1151 Moreno Way

- 1128 Moreno Way Unit 54

- 1160 Davis Way Unit 105

- 1134 Moreno Way Unit 53

- 1140 E Moreno Way

- 1118 Davis Way