Estimated Value: $139,000 - $663,000

2

Beds

1

Bath

928

Sq Ft

$469/Sq Ft

Est. Value

About This Home

This home is located at 11370 Twin Cities Rd, Galt, CA 95632 and is currently estimated at $434,975, approximately $468 per square foot. 11370 Twin Cities Rd is a home located in Sacramento County with nearby schools including Arcohe Elementary School and Liberty Ranch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 21, 2021

Sold by

Davigeadono Matthew George and Nlatthewgeorge Davigeadon Livi

Bought by

Davigeadono Matthew and Evans Margarita

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$203,500

Outstanding Balance

$184,244

Interest Rate

2.9%

Mortgage Type

FHA

Estimated Equity

$250,731

Purchase Details

Closed on

Nov 29, 2017

Sold by

Davigeadono Matthew

Bought by

Davigeadono Matthew George

Purchase Details

Closed on

Jun 2, 2011

Sold by

Weir Gene and Bercier Weir Maria

Bought by

Davigeadono Matthew

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$97,600

Interest Rate

4.71%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Aug 15, 2003

Sold by

Weir Gene

Bought by

Weir Gene and Bercier Weir Maria

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Davigeadono Matthew | -- | Title Resource Guarantee | |

| Davigeadono Matthew George | -- | None Available | |

| Davigeadono Matthew | $122,000 | Cornerstone Title Company | |

| Weir Gene | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Davigeadono Matthew | $203,500 | |

| Closed | Davigeadono Matthew | $97,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,622 | $156,287 | $93,517 | $62,770 |

| 2024 | $1,622 | $153,224 | $91,684 | $61,540 |

| 2023 | $1,558 | $150,221 | $89,887 | $60,334 |

| 2022 | $1,487 | $147,276 | $88,125 | $59,151 |

| 2021 | $1,490 | $144,390 | $86,398 | $57,992 |

| 2020 | $4,877 | $142,911 | $85,513 | $57,398 |

| 2019 | $4,841 | $140,110 | $83,837 | $56,273 |

| 2018 | $4,832 | $137,364 | $82,194 | $55,170 |

| 2017 | $4,772 | $134,672 | $80,583 | $54,089 |

| 2016 | $4,750 | $132,032 | $79,003 | $53,029 |

| 2015 | $1,306 | $130,050 | $77,817 | $52,233 |

| 2014 | $1,296 | $127,503 | $76,293 | $51,210 |

Source: Public Records

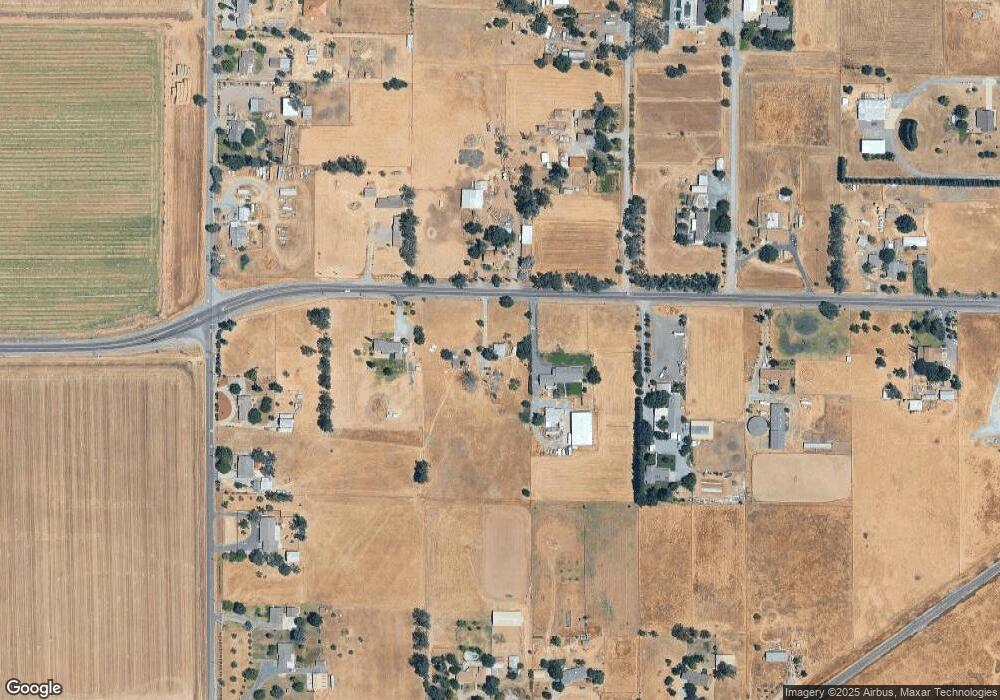

Map

Nearby Homes

- 1525 Mcintyre St

- 1521 Mcintyre St

- 1505 Mcintyre St

- 1489 Mcintyre St

- 1501 Mcintyre St

- 1485 Mcintyre St

- 1509 Mcintyre St

- 1513 Mcintyre St

- 1469 Mcintyre St

- 1465 Mcintyre St

- 1453 Mcintyre St

- 1449 Mcintyre St

- 1541 Billorights Ave

- 1295 Revere Loop

- 1299 Bastion Ave

- 1300 Bastion Ave

- 1540 Billorights Ave

- 1291 Bastion Ave

- 1536 Billorights Ave

- 1532 Billorights Ave

- 11371 Twin Cities Rd

- 11320 Twin Cities Rd

- 11380 Twin Cities Rd

- 11325 Twin Cities Rd

- 11400 Twin Cities Rd

- 11417 Twin Cities Rd

- 11383 Twin Cities Rd

- 12815 Cherokee Ln

- 12835 Cherokee Ln

- 12795 Cherokee Ln

- 11420 Twin Cities Rd

- 12857 Cherokee Ln

- 11435 Twin Cities Rd

- 11341 Twin Cities Rd

- 12893 Cherokee Ln

- 12895 Cherokee Ln

- 12771 Cherokee Ln

- 11391 Twin Cities Rd

- 12891 Cherokee Ln

- 12897 Cherokee Ln