114 Henning Ct Unit 24 Los Gatos, CA 95032

West Los Gatos NeighborhoodEstimated Value: $1,595,131 - $1,679,000

3

Beds

3

Baths

1,842

Sq Ft

$891/Sq Ft

Est. Value

About This Home

This home is located at 114 Henning Ct Unit 24, Los Gatos, CA 95032 and is currently estimated at $1,640,783, approximately $890 per square foot. 114 Henning Ct Unit 24 is a home located in Santa Clara County with nearby schools including Daves Avenue Elementary School, Loma Prieta Elementary School, and Raymond J. Fisher Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 16, 2016

Sold by

Vanroy Mary Elizabeth and Van Roy Craig Ronald

Bought by

Vanroy Craig Ronald and Van Roy Mary Elizabeth

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$498,000

Outstanding Balance

$363,557

Interest Rate

3.41%

Mortgage Type

New Conventional

Estimated Equity

$1,277,226

Purchase Details

Closed on

Jun 12, 2007

Sold by

Johnson Christen Anne

Bought by

Vanroy Mary E and Van Roy Craig R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$633,600

Interest Rate

6.21%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 29, 2000

Sold by

Souza Wilbert J and Souza Patricia R

Bought by

Johnson Christen Anne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$138,000

Interest Rate

8.37%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 10, 1993

Sold by

Souza Wilbert J and Souza Patricia R

Bought by

The Santa Clara County Traffic Authority

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vanroy Craig Ronald | -- | Wfg National Title Ins Co | |

| Vanroy Mary E | $792,000 | First American Title Company | |

| Johnson Christen Anne | $560,000 | Chicago Title Co | |

| The Santa Clara County Traffic Authority | -- | First American Title Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vanroy Craig Ronald | $498,000 | |

| Closed | Vanroy Mary E | $633,600 | |

| Previous Owner | Johnson Christen Anne | $138,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,883 | $1,061,098 | $795,828 | $265,270 |

| 2024 | $12,883 | $1,040,293 | $780,224 | $260,069 |

| 2023 | $12,622 | $1,019,896 | $764,926 | $254,970 |

| 2022 | $12,540 | $999,899 | $749,928 | $249,971 |

| 2021 | $12,301 | $980,294 | $735,224 | $245,070 |

| 2020 | $12,075 | $970,244 | $727,686 | $242,558 |

| 2019 | $11,901 | $951,220 | $713,418 | $237,802 |

| 2018 | $11,727 | $932,570 | $699,430 | $233,140 |

| 2017 | $11,686 | $914,285 | $685,716 | $228,569 |

| 2016 | $11,371 | $896,359 | $672,271 | $224,088 |

| 2015 | $11,284 | $882,895 | $662,173 | $220,722 |

| 2014 | $10,306 | $799,000 | $599,300 | $199,700 |

Source: Public Records

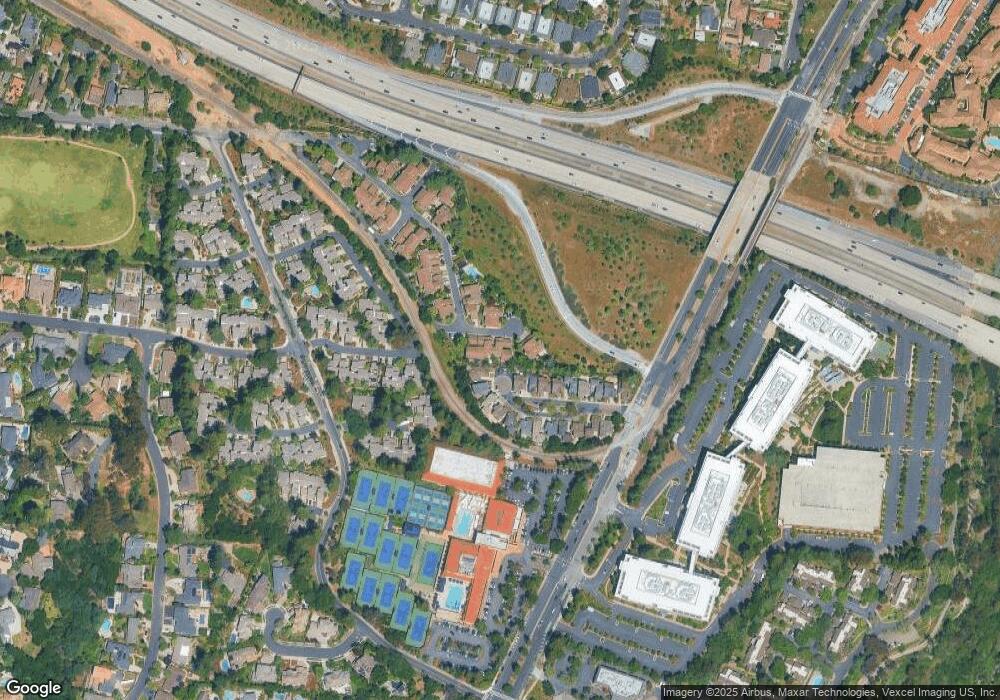

Map

Nearby Homes

- 207 Palmer Dr

- 14685 Oka Rd Unit 28

- 14145 Capri Dr

- 112 Mozart Ave

- 14225 Lora Dr Unit 56

- 14225 Lora Dr Unit 90

- 14225 Lora Dr Unit 70

- 101 Peach Willow Ct

- 16293 Gellatt Ct

- 1170 Steinway Ave

- 15021 Briggs Ct

- 209 Nob Hill Way

- 615 Chapman Dr

- 107 Naramore Ln

- 16157 E Mozart Ave

- 1097-1099 W Hacienda Ave

- 1162 Capri Dr

- 1152 Capri Dr

- 403 Montclair Rd

- 14566 S Bascom Ave

- 110 Henning Ct Unit 25

- 116 Henning Ct

- 112 Henning Ct

- 118 Henning Ct Unit 22

- 120 Henning Ct Unit 21

- 122 Henning Ct

- 199 Smith Ranch Ct

- 108 Henning Ct Unit 26

- 105 Henning Ct

- 106 Henning Ct Unit 27

- 188 Smith Ranch Ct

- 103 Henning Ct

- 195 Smith Ranch Ct

- 186 Smith Ranch Ct

- 224 Palmer Dr

- 193 Smith Ranch Ct

- 178 Smith Ranch Ct

- 220 Palmer Dr Unit 32

- 189 Smith Ranch Ct

- 223 Palmer Dr Unit 20