114 Oliva Ct Unit D Novato, CA 94947

San Marin NeighborhoodEstimated Value: $548,750 - $849,000

3

Beds

2

Baths

1,288

Sq Ft

$495/Sq Ft

Est. Value

About This Home

This home is located at 114 Oliva Ct Unit D, Novato, CA 94947 and is currently estimated at $636,938, approximately $494 per square foot. 114 Oliva Ct Unit D is a home located in Marin County with nearby schools including San Ramon Elementary School, Sinaloa Middle School, and San Marin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 15, 2015

Sold by

Kyle Caresse S

Bought by

Kyle Caresse S

Current Estimated Value

Purchase Details

Closed on

Mar 29, 2002

Sold by

Kyle Gerald Richard and Kyle Caresse Sims

Bought by

Kyle Gerald Richard and Kyle Caresse Sims

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$141,600

Outstanding Balance

$58,574

Interest Rate

6.78%

Estimated Equity

$578,364

Purchase Details

Closed on

Mar 8, 2001

Sold by

Kyle Caresse S

Bought by

Kyle Caresse S and Kyle Gerald R

Purchase Details

Closed on

Jan 16, 2001

Sold by

Kyle Caresse Sims

Bought by

Kyle Gereld Richard and Kyle Caresse Sims

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kyle Caresse S | -- | None Available | |

| Kyle Gerald Richard | -- | Gateway Title Company | |

| Kyle Caresse S | -- | -- | |

| Kyle Caresse S | -- | -- | |

| Kyle Gereld Richard | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kyle Gerald Richard | $141,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,065 | $188,883 | $56,870 | $132,013 |

| 2024 | $3,065 | $185,179 | $55,755 | $129,424 |

| 2023 | $3,000 | $181,549 | $54,662 | $126,887 |

| 2022 | $2,922 | $177,982 | $53,585 | $124,397 |

| 2021 | $2,914 | $174,492 | $52,534 | $121,958 |

| 2020 | $2,876 | $172,704 | $51,996 | $120,708 |

| 2019 | $2,698 | $169,318 | $50,976 | $118,342 |

| 2018 | $2,647 | $165,999 | $49,977 | $116,022 |

| 2017 | $2,589 | $162,744 | $48,997 | $113,747 |

| 2016 | $2,413 | $159,554 | $48,037 | $111,517 |

| 2015 | $2,363 | $157,157 | $47,315 | $109,842 |

| 2014 | $2,625 | $154,079 | $46,388 | $107,691 |

Source: Public Records

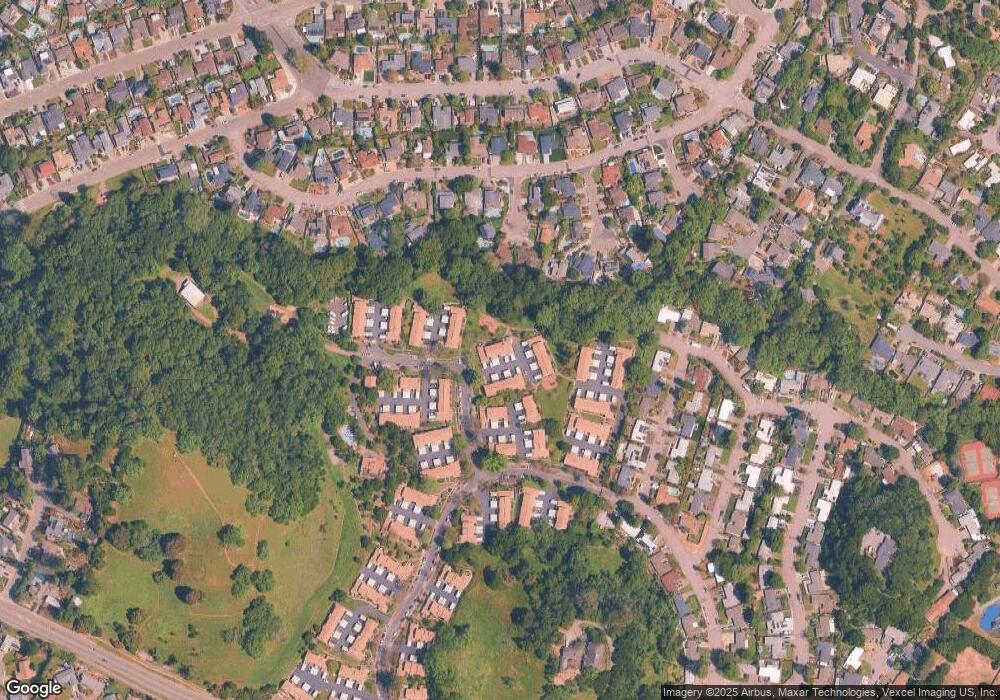

Map

Nearby Homes

- 11 Katlas Ct

- 2108 Feliz Dr

- 105 Holstrom Cir

- 2094 Center Rd

- 998 Simmons Ln

- 90 San Benito Way

- 85 San Carlos Way

- 7 Laurie Ct

- 840 Wilmac Ave

- 70 San Carlos Way

- 765 Sun Ln

- 36 Andreas Ct

- 846 Wilmac Ave

- 13 Margory Ct

- 7 Illes Ct

- 1 San Marin Dr

- 14 Saint Paul Cir

- 1830 Marion Ave

- 2009 Hawthorne Terrace

- 16 Marion Ct

- 114 Oliva Ct Unit E

- 114 Oliva Ct

- 114 Oliva Ct Unit C

- 114 Oliva Ct Unit B

- 114 Oliva Ct Unit A

- 110 Oliva Ct Unit E

- 110 Oliva Ct Unit A

- 110 Oliva Ct Unit B

- 110 Oliva Ct Unit C

- 110 Oliva Ct Unit D

- 110 Oliva Ct

- 110 Oliva Ct Unit F

- 112 Oliva Ct Unit A

- 112 Oliva Ct Unit B

- 112 Oliva Ct Unit C

- 112 Oliva Ct Unit D

- 112 Oliva Ct

- 112 Oliva Ct Unit F

- 116A Oliva Ct

- 116 Oliva Ct Unit A