11432 Peed Dead End Rd Raleigh, NC 27614

Falls Lake NeighborhoodEstimated Value: $711,982 - $816,000

3

Beds

4

Baths

2,378

Sq Ft

$322/Sq Ft

Est. Value

About This Home

This home is located at 11432 Peed Dead End Rd, Raleigh, NC 27614 and is currently estimated at $765,246, approximately $321 per square foot. 11432 Peed Dead End Rd is a home located in Wake County with nearby schools including Pleasant Union Elementary School, West Millbrook Middle School, and Millbrook High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 25, 2020

Sold by

Art Builders Llc

Bought by

Cleary Paul Richard

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$367,500

Outstanding Balance

$327,768

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$437,478

Purchase Details

Closed on

Sep 23, 2005

Sold by

Patterson Robert M and Patterson Sandra L

Bought by

Salazar Marco A and Salazar Maria Magdalena

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$214,000

Interest Rate

5.77%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cleary Paul Richard | $490,000 | None Available | |

| Salazar Marco A | $268,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cleary Paul Richard | $367,500 | |

| Previous Owner | Salazar Marco A | $214,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,958 | $615,633 | $215,000 | $400,633 |

| 2024 | $3,843 | $615,633 | $215,000 | $400,633 |

| 2023 | $3,037 | $386,923 | $160,000 | $226,923 |

| 2022 | $2,814 | $386,923 | $160,000 | $226,923 |

| 2021 | $2,739 | $386,923 | $160,000 | $226,923 |

| 2020 | $2,694 | $386,923 | $160,000 | $226,923 |

| 2019 | $2,618 | $318,133 | $144,000 | $174,133 |

| 2018 | $2,407 | $318,133 | $144,000 | $174,133 |

| 2017 | $2,282 | $318,133 | $144,000 | $174,133 |

| 2016 | $2,236 | $318,133 | $144,000 | $174,133 |

| 2015 | $1,943 | $276,916 | $104,400 | $172,516 |

| 2014 | $1,842 | $276,916 | $104,400 | $172,516 |

Source: Public Records

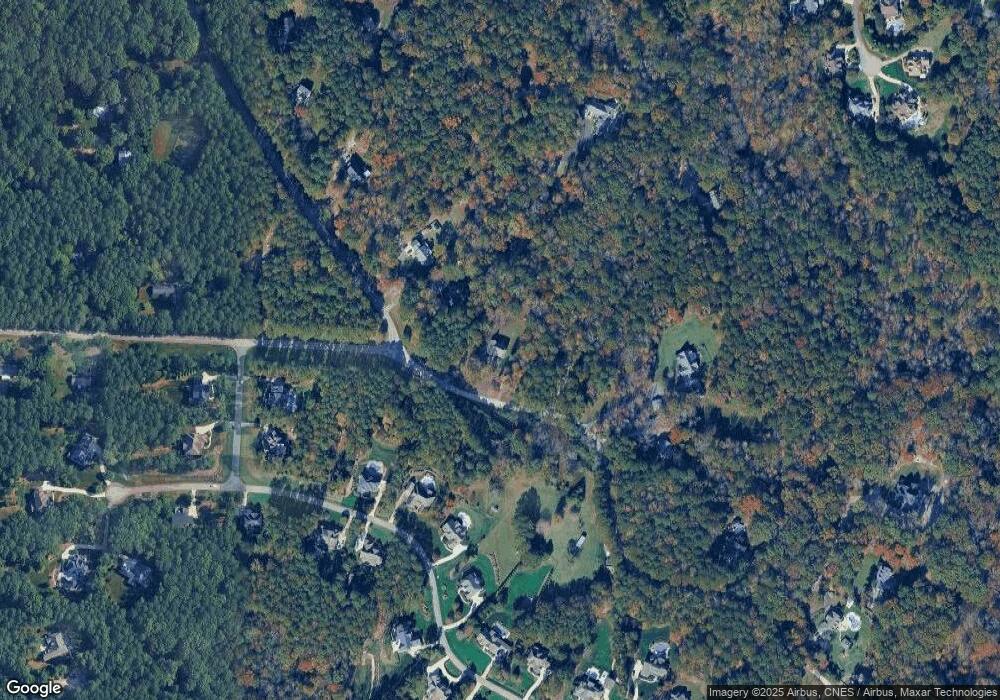

Map

Nearby Homes

- 11820 Peed Rd

- 1062 Tacketts Pond Dr

- 1097 Tacketts Pond Dr

- 1116 Tacketts Pond Dr

- 7108 Millstone Ridge Ct

- 1128 Tacketts Pond Dr

- 7201 Summer Tanager Trail

- 1513 Rock Dove Way

- 6816 Cool Pond Rd

- 6832 Cool Pond Rd

- 6508 Sanctuary Falls Dr

- 7112 Camp Side Ct

- 12420 Creedmoor Rd

- 1404 Song Bird Crest Way

- 7429 Summer Tanager Trail

- 7441 Summer Tanager Trail

- 1404 Barony Lake Way

- 7500 Rusty Spur Ln

- 7000 Rosewood Park Ct

- 3028 Mount Vernon Church Rd

- 12000 Peed Rd

- 1020 Margarets Ln Unit 38

- 1024 Margarets Ln Unit 39

- 12004 Peed Rd

- 1028 Margarets Ln Unit 40

- 1028 Margarets Ln

- 1016 Margarets Ln Unit 37

- 7004 Bartons Grove Place

- 7004 Bartons Grove Place Unit 42

- 11416 Peed Dead End Rd

- 11404 Peed Dead End Rd

- 7000 Bartons Grove Place

- 7000 Bartons Grove Place Unit 41

- 12020 Peed Rd

- 1012 Margarets Ln Unit 36

- 1000 Margarets Ln Unit 34

- 12008 Peed Rd

- 12012 Peed Rd

- 11932 Peed Rd

- 11428 Peed Dead End Rd