12 Bayview Dr Buena Park, CA 90621

Estimated Value: $1,165,543 - $1,312,000

4

Beds

3

Baths

1,977

Sq Ft

$641/Sq Ft

Est. Value

About This Home

This home is located at 12 Bayview Dr, Buena Park, CA 90621 and is currently estimated at $1,267,136, approximately $640 per square foot. 12 Bayview Dr is a home located in Orange County with nearby schools including Charles G. Emery Elementary School, Buena Park Junior High School, and Buena Park High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 21, 2002

Sold by

Egana Philips John and Egana Clarissa T

Bought by

Egana Philips John and Egana Clarissa T

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$288,750

Outstanding Balance

$118,240

Interest Rate

6.78%

Mortgage Type

Stand Alone First

Estimated Equity

$1,148,896

Purchase Details

Closed on

Jan 11, 2000

Sold by

Catellus Residential Group Inc

Bought by

Egana Philips John and Tibayan Clarissa Maniego

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$277,200

Interest Rate

8.06%

Mortgage Type

Stand Alone First

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Egana Philips John | -- | American Title Co | |

| Egana Philips John | $308,000 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Egana Philips John | $288,750 | |

| Closed | Egana Philips John | $277,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,332 | $473,377 | $158,219 | $315,158 |

| 2024 | $5,332 | $464,096 | $155,117 | $308,979 |

| 2023 | $5,222 | $454,997 | $152,076 | $302,921 |

| 2022 | $5,137 | $446,076 | $149,094 | $296,982 |

| 2021 | $5,098 | $437,330 | $146,171 | $291,159 |

| 2020 | $5,034 | $432,846 | $144,672 | $288,174 |

| 2019 | $4,913 | $424,359 | $141,835 | $282,524 |

| 2018 | $4,818 | $416,039 | $139,054 | $276,985 |

| 2017 | $4,748 | $407,882 | $136,328 | $271,554 |

| 2016 | $4,653 | $399,885 | $133,655 | $266,230 |

| 2015 | $4,451 | $393,879 | $131,648 | $262,231 |

| 2014 | $4,435 | $386,164 | $129,069 | $257,095 |

Source: Public Records

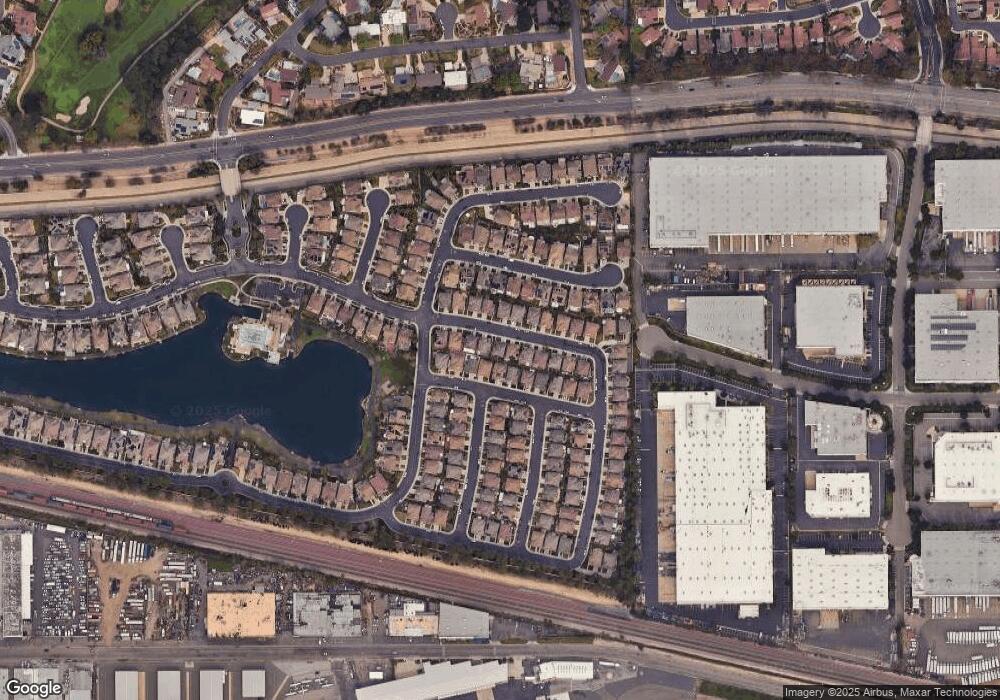

Map

Nearby Homes

- 6 Tidewater Cove

- 86 Lakeside Dr

- 900 Ashton Place

- 5471 Jonesboro Way

- 9 Coveside Ct

- 109 S Vermont Ave

- 11 Travis Rd

- 52 Preston Ln

- 2410 Plaza de Vista

- 134 S Pritchard Ave

- 3604 W Valencia Dr

- 3620 W West Ave

- 3750 Franklin Ave

- 1108 Jewett Dr Unit 23

- 2521 W Ash Ave

- 5588 Cajon Ave

- 5412 Arrowhead Ave

- 5468 Cajon Ave

- 433 435 N Basque

- 2164 Silva Dr