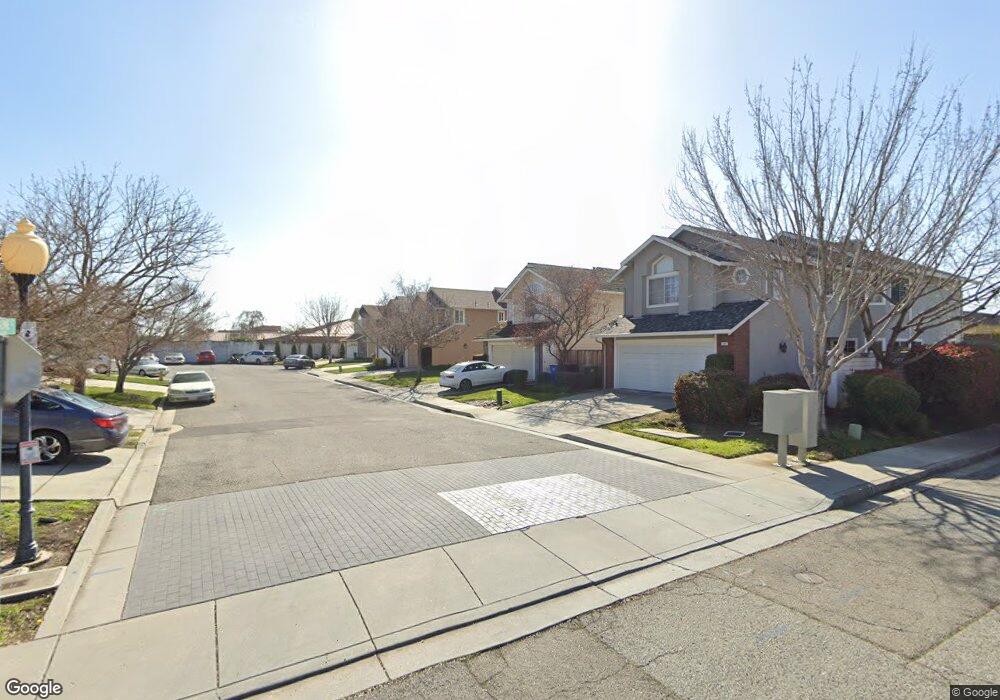

1205 Sassone Ct Milpitas, CA 95035

Estimated Value: $1,736,609 - $2,051,000

3

Beds

3

Baths

1,771

Sq Ft

$1,053/Sq Ft

Est. Value

About This Home

This home is located at 1205 Sassone Ct, Milpitas, CA 95035 and is currently estimated at $1,864,402, approximately $1,052 per square foot. 1205 Sassone Ct is a home located in Santa Clara County with nearby schools including John Sinnott Elementary School, Rancho Milpitas Middle School, and Milpitas High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 26, 2020

Sold by

Kamat Mahesh and Kamath Aruna

Bought by

Kamat Mahesh and Kamath Aruna

Current Estimated Value

Purchase Details

Closed on

Jan 4, 2008

Sold by

Katayama James M and Sun Min Fen

Bought by

Kamat Mahesh and Kamath Aruna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$552,000

Outstanding Balance

$345,517

Interest Rate

6%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$1,518,885

Purchase Details

Closed on

Jun 24, 1994

Sold by

Citicorp Mtg Corp

Bought by

Katayama James M and Sun Min Fen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$216,000

Interest Rate

5.37%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kamat Mahesh | -- | None Available | |

| Kamat Mahesh | $690,000 | First American Title Co | |

| Katayama James M | $245,000 | Stewart Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kamat Mahesh | $552,000 | |

| Previous Owner | Katayama James M | $216,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,344 | $906,315 | $498,474 | $407,841 |

| 2024 | $10,344 | $888,545 | $488,700 | $399,845 |

| 2023 | $10,311 | $871,123 | $479,118 | $392,005 |

| 2022 | $10,267 | $854,043 | $469,724 | $384,319 |

| 2021 | $10,117 | $837,298 | $460,514 | $376,784 |

| 2020 | $10,023 | $828,713 | $455,792 | $372,921 |

| 2019 | $9,909 | $812,464 | $446,855 | $365,609 |

| 2018 | $9,410 | $796,535 | $438,094 | $358,441 |

| 2017 | $9,289 | $780,917 | $429,504 | $351,413 |

| 2016 | $8,836 | $765,606 | $421,083 | $344,523 |

| 2015 | $8,745 | $754,106 | $414,758 | $339,348 |

| 2014 | $8,512 | $739,335 | $406,634 | $332,701 |

Source: Public Records

Map

Nearby Homes

- 1361 Highland Ct

- 997 Courtland Ct

- 1039 Big Bear Ct

- 1598 Grand Teton Dr

- 931 Galindo Ct

- 2085 Ashwood Ln

- 1394 Glacier Dr

- 3388 Landess Ave Unit A

- 3398 Landess Ave Unit D

- 838 Garden St

- 1941 Grosvenor Dr

- 484 Dempsey Rd Unit 186

- 3555 Laurant Way

- 496 Dempsey Rd Unit 199

- 329 Carnegie Dr

- 1912 Vinedale Square

- 2101 Uridias Ranch Rd

- 3488 Prince Phillip Ct

- 2559 Alveswood Cir

- 2006 Terracotta Ct

- 1207 Sassone Ct

- 1203 Sassone Ct

- 1201 Sassone Ct

- 1209 Sassone Ct

- 1204 Sassone Ct

- 1202 Sassone Ct

- 1206 Sassone Ct

- 1200 Sassone Ct

- 1208 Sassone Ct

- 1471 Big Basin Dr

- 1517 Big Basin Dr

- 1210 Sassone Ct

- 1475 Big Basin Dr

- 1513 Big Basin Dr

- 1479 Big Basin Dr

- 1566 Big Basin Dr

- 1509 Big Basin Dr

- 1457 Big Basin Dr

- 1483 Big Basin Dr

- 1453 Big Basin Dr