1211 E Sedona Dr Unit 133 Orange, CA 92866

Estimated Value: $1,079,549 - $1,403,000

3

Beds

2

Baths

1,996

Sq Ft

$590/Sq Ft

Est. Value

About This Home

This home is located at 1211 E Sedona Dr Unit 133, Orange, CA 92866 and is currently estimated at $1,178,137, approximately $590 per square foot. 1211 E Sedona Dr Unit 133 is a home located in Orange County with nearby schools including Palmyra GATE Magnet, Yorba Middle School, and Orange High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 18, 2017

Sold by

Ignacio Edsel C and Ignacio Rodney C

Bought by

Ignacio Edsel C and Ignacio Hoang

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$520,000

Outstanding Balance

$433,780

Interest Rate

4.3%

Mortgage Type

New Conventional

Estimated Equity

$744,357

Purchase Details

Closed on

Dec 5, 2006

Sold by

Stelzner William J and Stelzner Isabelita A

Bought by

Ignacio Edsel C and Ignacio Rodney C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$516,000

Interest Rate

5.5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 5, 1997

Sold by

Van Daele/Orange Ltd

Bought by

Stelzner William J and Stelzner Isabelita A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$197,800

Interest Rate

7.86%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ignacio Edsel C | -- | Wfg Title Company | |

| Ignacio Edsel C | $645,000 | None Available | |

| Stelzner William J | $208,500 | Continental Lawyers Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ignacio Edsel C | $520,000 | |

| Closed | Ignacio Edsel C | $516,000 | |

| Previous Owner | Stelzner William J | $197,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,995 | $809,262 | $553,175 | $256,087 |

| 2024 | $8,995 | $793,395 | $542,329 | $251,066 |

| 2023 | $8,803 | $777,839 | $531,695 | $246,144 |

| 2022 | $8,638 | $762,588 | $521,270 | $241,318 |

| 2021 | $8,403 | $747,636 | $511,049 | $236,587 |

| 2020 | $8,003 | $709,000 | $495,890 | $213,110 |

| 2019 | $8,050 | $709,000 | $495,890 | $213,110 |

| 2018 | $7,868 | $638,500 | $434,548 | $203,952 |

| 2017 | $7,656 | $627,000 | $410,552 | $216,448 |

| 2016 | $7,635 | $627,000 | $410,552 | $216,448 |

| 2015 | $7,630 | $627,000 | $410,552 | $216,448 |

| 2014 | $6,862 | $536,702 | $320,254 | $216,448 |

Source: Public Records

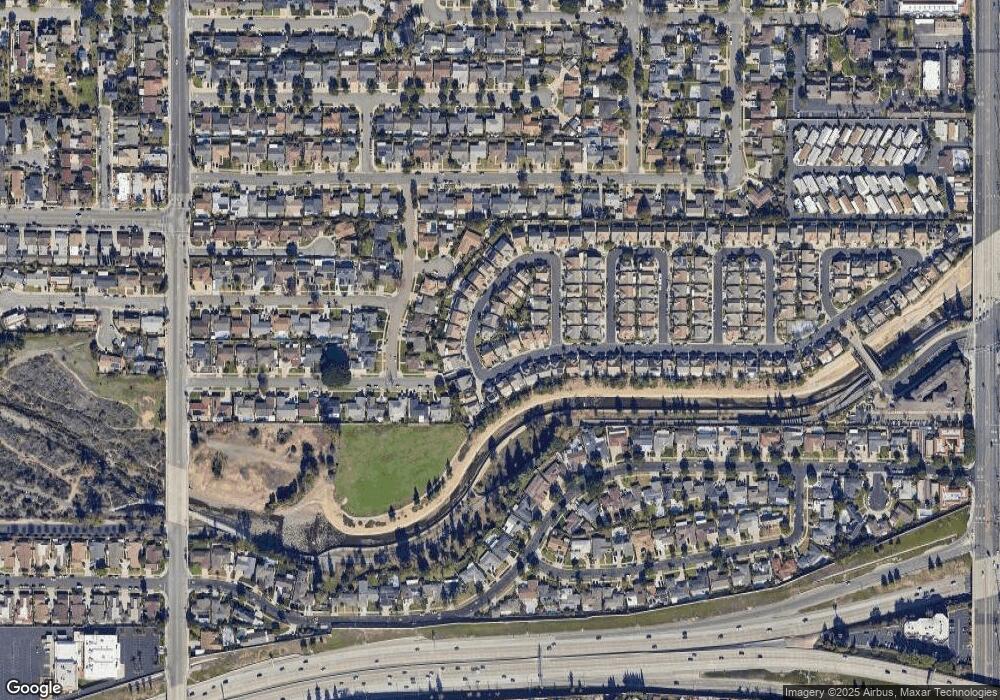

Map

Nearby Homes

- 1024 E Tularosa Ave

- 906 E Chalynn Ave

- 360 S Greengrove Dr

- 707 E Tularosa Ave

- 1916 1920 E Kirkwood

- 447 S Shaffer St

- 2718 N Wright St

- 2602 N Tustin Ave Unit D

- 528 E Palmyra Ave

- 2608 N Tustin Ave

- 1331 E Century Dr

- 547 E Washington Ave

- 354 E Culver Ave

- 2516 N Tustin Ave Unit A

- 2518 N Tustin Ave Unit E

- 2514 N Tustin Ave Unit 71

- 2544 Forest Lake Unit 20

- 313 E Palmyra Ave

- 1609 E Canyon Lake Ave Unit 137

- 1529 E Canyon Lake Ave Unit 140

- 1217 E Sedona Dr Unit 132

- 1203 E Sedona Dr Unit 134

- 1146 E Sunflower Cir

- 1150 E Sunflower Cir Unit 121

- 1223 E Sedona Dr

- 1210 E Sunflower Cir

- 1216 E Sedona Dr Unit 137

- 1212 E Sedona Dr

- 1224 E Sedona Dr Unit 138

- 1233 E Sedona Dr Unit 130

- 1141 E Sunflower Cir Unit 115

- 1137 E Sunflower Cir

- 1202 E Sedona Dr

- 1145 E Sunflower Cir Unit 114

- 1149 E Sunflower Cir Unit 113

- 548 S Evergreen Ln Unit 129

- 1212 E Sunflower Cir

- 1138 E Sedona Dr

- 1232 E Sedona Dr Unit 139

- 1205 E Sunflower Cir Unit 112