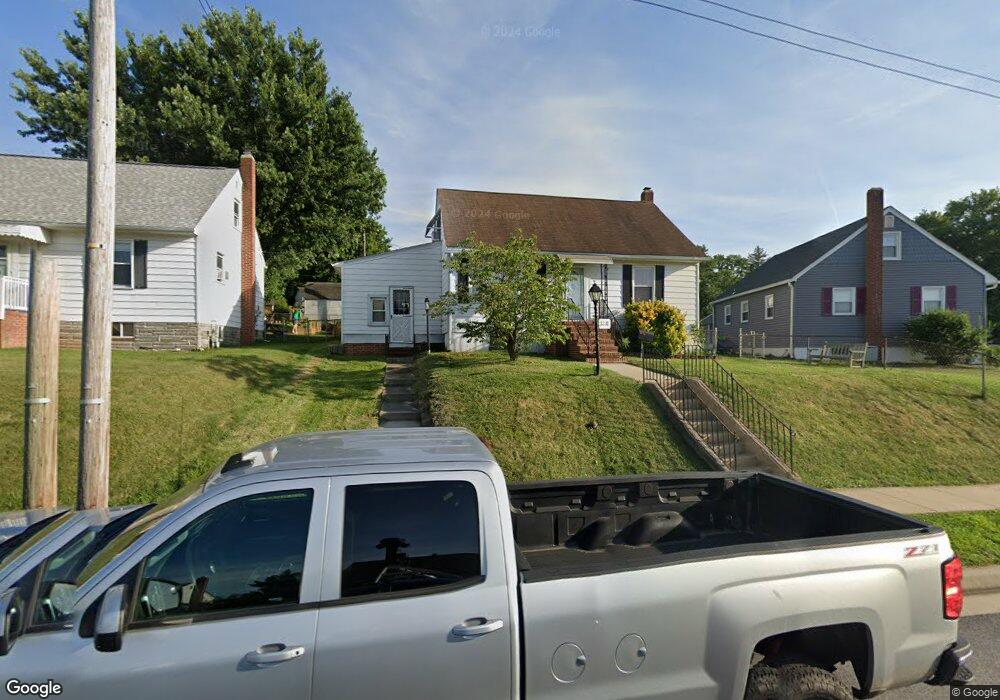

1211 June Rd Halethorpe, MD 21227

Estimated Value: $314,000 - $429,000

--

Bed

2

Baths

1,380

Sq Ft

$261/Sq Ft

Est. Value

About This Home

This home is located at 1211 June Rd, Halethorpe, MD 21227 and is currently estimated at $360,635, approximately $261 per square foot. 1211 June Rd is a home located in Baltimore County with nearby schools including Arbutus Elementary School, Arbutus Middle School, and Lansdowne High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 21, 2007

Sold by

Jimenez Gloria Jean

Bought by

Ortado Matthew T and Ortado Angela B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$201,600

Outstanding Balance

$128,162

Interest Rate

6.65%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$232,473

Purchase Details

Closed on

Sep 12, 2007

Sold by

Jimenez Gloria Jean

Bought by

Ortado Matthew T and Ortado Angela B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$201,600

Outstanding Balance

$128,162

Interest Rate

6.65%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$232,473

Purchase Details

Closed on

Jan 5, 1998

Sold by

Sherwood Albert C

Bought by

Jimenez Gloria Jean and Sherwood Albert Charles

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ortado Matthew T | $252,000 | -- | |

| Ortado Matthew T | $252,000 | -- | |

| Jimenez Gloria Jean | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ortado Matthew T | $201,600 | |

| Closed | Ortado Matthew T | $201,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,058 | $248,633 | -- | -- |

| 2024 | $4,058 | $231,200 | $72,300 | $158,900 |

| 2023 | $1,971 | $221,133 | $0 | $0 |

| 2022 | $3,530 | $211,067 | $0 | $0 |

| 2021 | $3,179 | $201,000 | $72,300 | $128,700 |

| 2020 | $3,348 | $196,533 | $0 | $0 |

| 2019 | $2,328 | $192,067 | $0 | $0 |

| 2018 | $3,030 | $187,600 | $72,300 | $115,300 |

| 2017 | $2,870 | $182,600 | $0 | $0 |

| 2016 | $3,347 | $177,600 | $0 | $0 |

| 2015 | $3,347 | $172,600 | $0 | $0 |

| 2014 | $3,347 | $172,600 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 5523 Council St

- 5536 Gayland Rd

- 1200 Oakland Terrace Rd

- 5522 Ashbourne Rd

- 5530 Willys Ave

- 1243 Linden Ave

- 1263 Birch Ave

- 1246 Elm Rd

- 5502 Osage Ave

- 1014 Elm Rd

- 1312 Poplar Ave

- 1209 Locust Ave

- 5632 Braxfield Rd

- 5613 Chelwynd Rd

- 1242 Vogt Ave

- 1201 Poplar Ave

- 1328 Maple Ave

- 6 Ingate Terrace

- 5605 Oregon Ave

- 5627 Oakland Rd

- 1213 June Rd

- 1209 June Rd

- 5501 Heatherwood Rd

- 1215 June Rd

- 5503 Heatherwood Rd

- 5534 Gayland Rd

- 1212 June Rd

- 5532 Gayland Rd

- 1210 June Rd

- 5505 Heatherwood Rd

- 1214 June Rd

- 1205 June Rd

- 1208 June Rd

- 1216 June Rd

- 1206 June Rd

- 5500 Heatherwood Rd

- 1248 June Rd

- 1203 June Rd

- 5538 Gayland Rd

- 5502 Heatherwood Rd